I’m expecting to see more choppy, back-and-forth action in the stock market.

So instead of putting my focus on individual names, I’m watching the major indexes a lot closer.

Why?

Because right now…

It seems like every stock is reacting to the macro headlines.

If you want to figure out if you should be “buying the dip” or “selling the rip,” then keep your eyes on what the major indexes are doing…

Which ones do I care about the most this week?

Read on to learn what I’m watching and why…

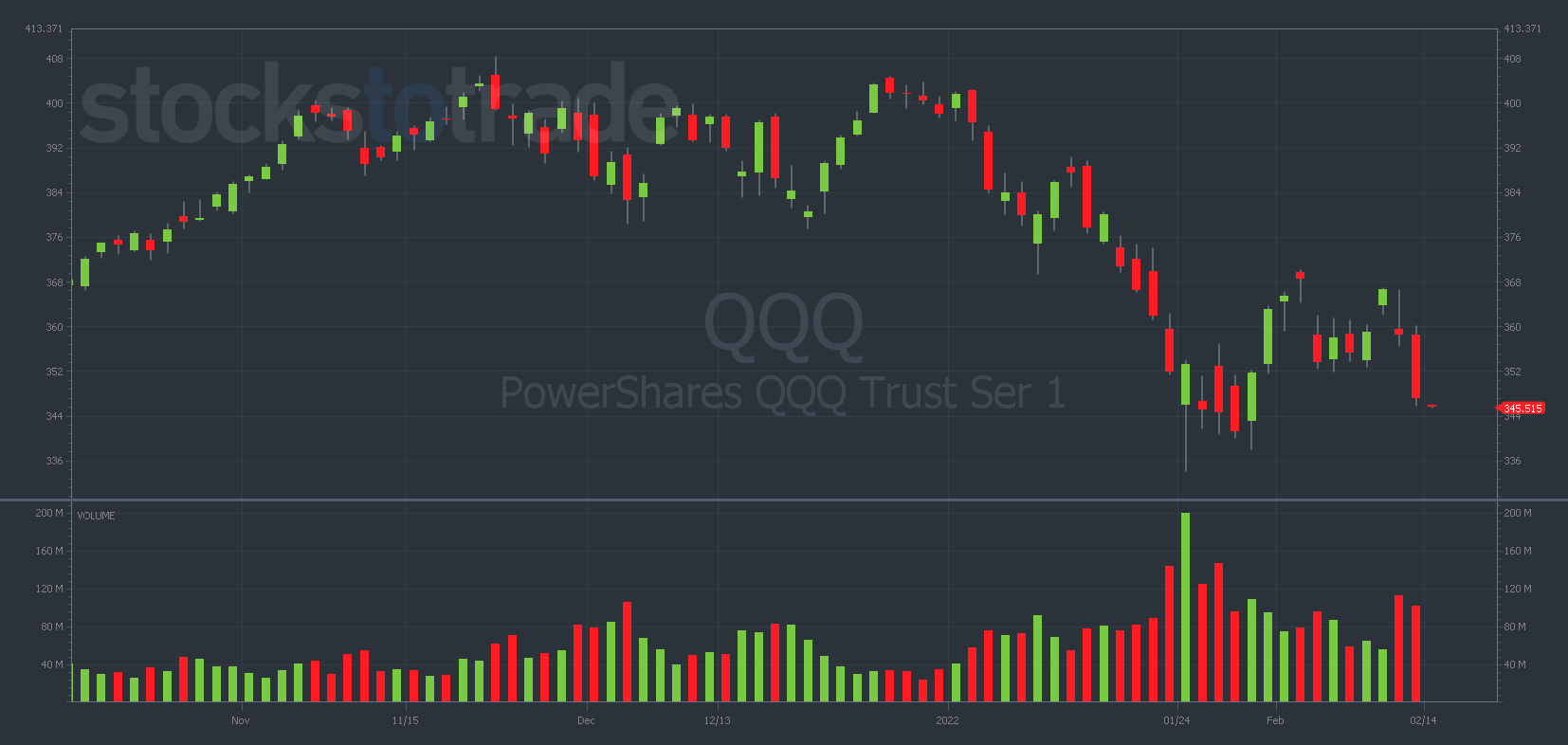

Invesco QQQ Trust (NASDAQ: QQQ)

All eyes are on the major indexes after last week’s inflation and Russia-Ukraine invasion headlines.

It seems like the news can’t get much worse for the stock market. And I start to get nervous about buying puts in such an endlessly bearish environment.

Why? Because after such an extended period of selling, there’s a ton of money on the sidelines ready to buy assets.

One piece of really positive news could send the markets soaring. Think about it…

If this Russia-Ukraine tension sputters out — or we start to see some relief from inflation — the markets could spur into a violent rally.

That being said, the technicals look terrible on the indexes right now.

Last week, I was watching QQQ’s support at $353, which failed on Friday. It just keeps taking out the lows.

Additionally, we’re not seeing bounces in decimated growth stocks like Netflix Inc. (NASDAQ: NFLX) and Meta Platforms, Inc. (NASDAQ: FB).

You’d think these beaten-down tech giants would be bouncing after such huge drops, but they aren’t. And that’s an internally bearish signal for QQQ.

While my gut thinks a shocking rally is possible at some point soon, the technicals indicate the opposite.

Right now, the QQQ chart is signaling further pain. We can’t ignore this.

Key Levels: $345 (support) and $367 (resistance)

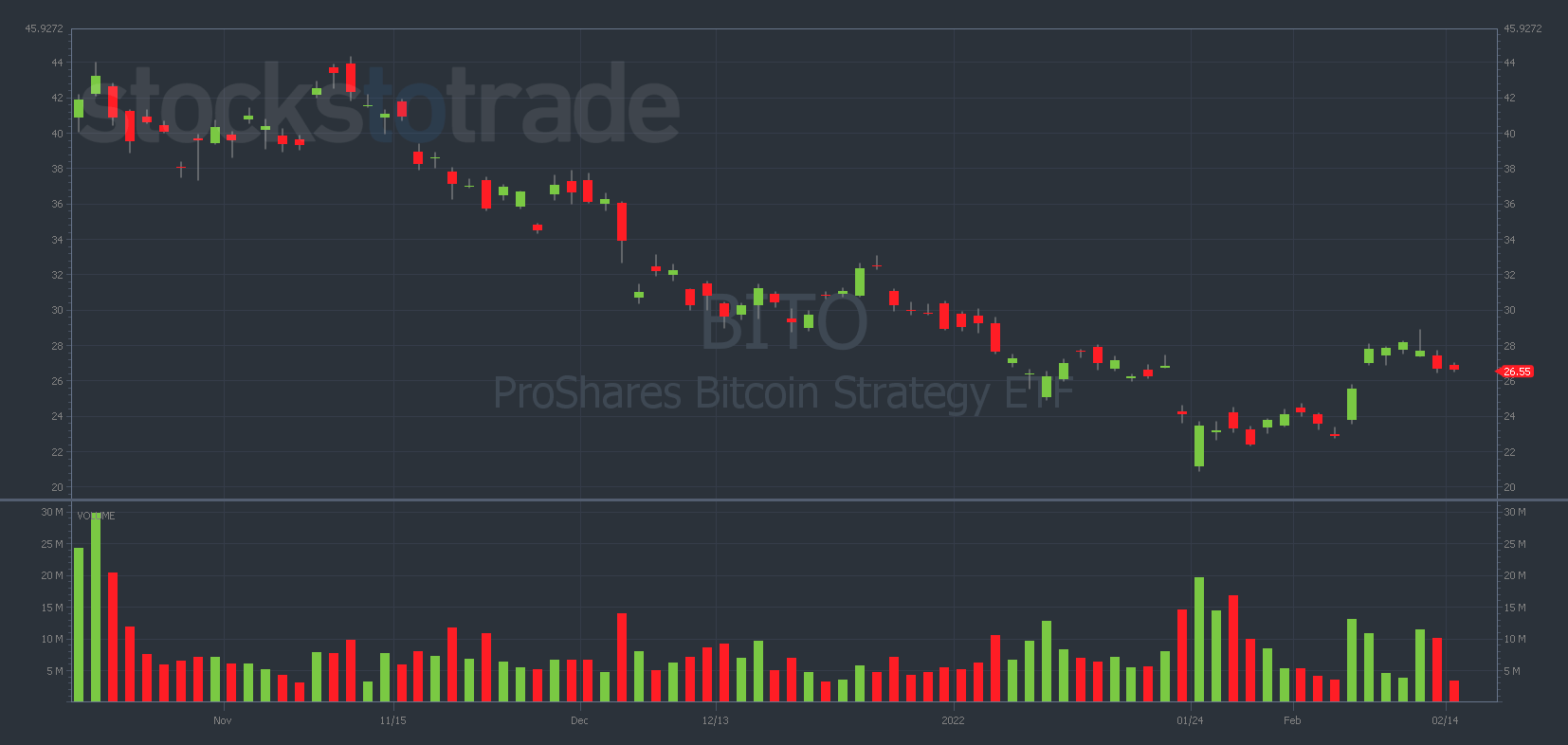

ProShares Bitcoin Strategy ETF (NYSE: BITO)

Anyone who’s been following my alerts will know that I’ve been consistently trading BITO options in order to catch downside moves on bitcoin (BTC).

The BTC chart moves in waves. After getting utterly destroyed in November, December, and January — we’ve seen the crypto markets attempt to inch higher over the past three weeks.

Until last Thursday, when we got a nice first red day on the BITO chart after a multi-day relief rally.

Remember: The first red day is my favorite time to buy puts.

On Thursday morning, I alerted my purchase of BITO 2/18/2022 $27 puts for 57 cents.

I sold the puts the next day, on Friday morning, for 78 cents — a gain of 36%. But I sold too early…

A few hours later, BITO cratered lower and the puts were trading as high as $1 — a potential gain of nearly 100%!

Several Evolvers banked hard on this trade. Congrats to anyone who held the puts through that mid-morning plummet!

Now, I’m watching the crucial level at $27.

$27 was support last week, but after BITO lost that level, it seems to be acting as resistance now.

This was too bearish for me to ignore…

When BITO re-failed at $27, I alerted my purchase of 2/18/2022 $26 puts for 61 cents.

I’ll look to close these contracts out somewhere under $25.

Key Level: $27

Final Thoughts

The news, the technicals, the sentiment — it’s all terrible right now.

But be careful when everyone around you is screaming bearish.

Watch the indexes for indications of how to trade your strategy this week.

And whatever you do — trade this wild market with the utmost caution.