Last week, I talked about a trade I made on a particular cannabis stock.

It didn’t work out as I had planned as I cut the trade near breakeven…

But this week, I re-entered the trade and closed out a massive, $20,000 win overnight.

Why did I have the conviction to trade this name again? What did I learn from these two trades? And how can you identify similar setups in your own trading?

Keep reading and I’ll show you…

The Catalyst That Led Me To This Trade

First, let’s do a quick refresher for anyone who’s missed my general thesis on cannabis stocks…

Two weeks ago, the Department of Health and Human Services this week recommended that marijuana be moved from Schedule I (the category reserved for the most dangerous drugs) to Schedule III (a category for certain prescription drugs).

If this reclassification gets finalized, it would be extremely bullish for weed stocks.

And we’re already seeing the initial market reaction to this potential catalyst…

The AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS) has nearly doubled from $4.85 to $9 in ten trading days…

MSOS 3-month daily chart — courtesy of StocksToTrade.com

However, there are more hurdles to clear first…

Although this is positive news for cannabis companies, nothing has actually changed yet. It’s still up to the Drug Enforcement Administration (DEA) to make the final decision, which could take months.

That said, considering how beaten-down weed stocks were, I thought there was significant upside on the charts leading into last week.

One stock, in particular, had me buying calls for a breakout…

Why I Bought CGC Calls

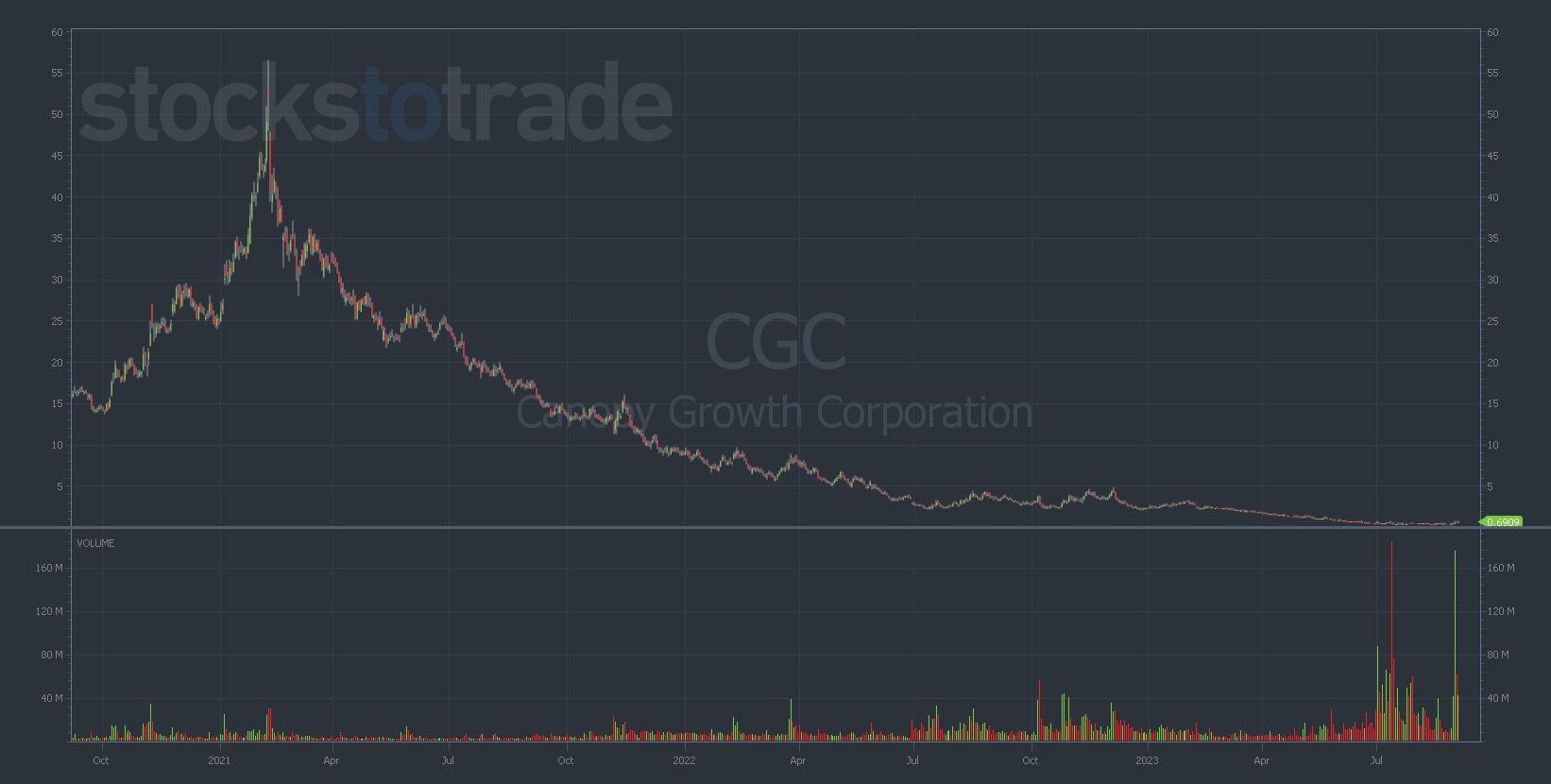

From 2018 to 2021, Canopy Growth Corporation (NASDAQ: CGC) was seen as one of the most promising stocks in the weed game.

Once trading as high as $51, CGC has been the poster child for weed stock destruction over the past few years.

Last week, it was trading for 67 cents…

CGC 3-year daily chart from September 6 — courtesy of StocksToTrade.com

And with the possibility of cannabis being reclassified as a less dangerous drug by the government, I thought this stock could move higher in the near term.

So, on Wednesday, September 6 … I bought CGC 9/8/2023 $1 Calls for $0.03.

This was a very small bet, expiring that Friday.

But by the following day, I wasn’t impressed with the immediate momentum and ended up cutting the position.

That said, I wasn’t done with CGC yet. I thought my first trade was too early, but I was looking for a point to re-enter.

And sure enough, that opportunity rolled around last Thursday, September 7.

Just one short day after cutting my $1 strike contracts, I saw the momentum increasing and bought 1000 CGC 9/8/2023 $0.50 Calls for $0.23 — an upfront bet of $23,000.

I moved my strike down by $0.50 to increase the delta on my trade (and lower the implied volatility on my contracts).

This turned out to be a great decision…

I was more comfortable holding onto the contracts overnight by choosing a strike that was slightly in the money (ITM).

But I didn’t have to wait long for this trade to play out…

The next day, Friday, September 8, CGC opened 20% higher and I sold my contracts for $0.43 — an 86% gain of $20,000 … overnight!

4 Big Takeaways from My $20,000 Win

So, why did this trade work out so well? What aspects of this play can we look to identify in future setups? And what did I learn from making this move?

Here are my four big takeaways from my massive CGC win:

- CGC is a former runner. A lot of traders remember the days when this stock was going parabolic. This was a major factor in my decision to buy calls. REMEMBER: A former runner can always run again.

- There was a strong news catalyst. The potential for cannabis to be reclassified as a Schedule III drug is very positive news for the sector. I wouldn’t have made this trade if the momentum from this catalyst wasn’t as strong as it was.

- My strategy can work with lower-priced stocks. I don’t usually trade options on sub-$1 stocks, which made this trade somewhat unique for me. That said, the success of this trade leads me to believe that my strategy can work on lower-priced stocks as well.

- There’s still plenty of momentum in the market. The fact that overextended stocks like CGC and Carvana Inc. (NASDAQ: CVNA) have been so strong recently tells me that there’s still plenty of momentum in the market to boost speculative names. The market is still very willing to drum up big short squeezes.

Now, I have to be honest here…

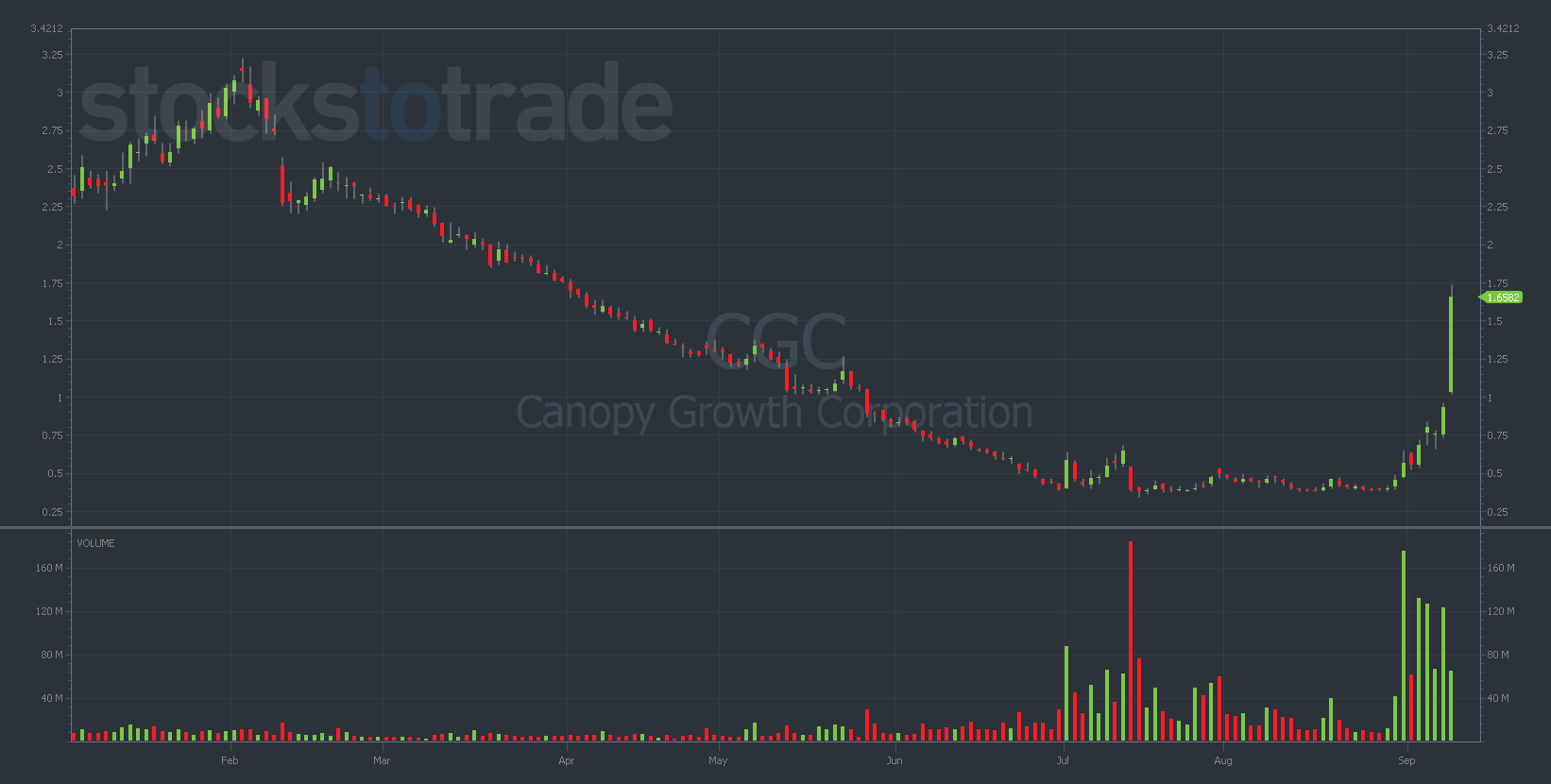

As I’m writing this on Monday, I’m watching CGC surge 80% on the day…

CGC YTD daily chart — courtesy of StocksToTrade.com

Had I held my contracts into Monday, I’d be up an additional $80,000!

Is this annoying? Of course.

If you’re going long in a crazy momentum trade, holding a small % of your contracts for a potential grand slam is ideal.

That said, it would’ve been hard to make that call on Friday. I had to choose between holding a runner and booking profits quickly, and I erred on the side of caution.

I don’t regret my decision to book profits, but I do wish I held onto a few of my contracts for one extra trading day.

Ultimately, booking profits is always the safer bet over holding a runner. But only you can decide when it feels right to employ each strategy.

REMEMBER: Making decisions that feel right to you will help you become the best trader you can be.

And speaking of becoming the best trader you can be…

Are You Ready To Level Up Your Trading Game?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!

Are you familiar with this trading “loophole?”

Are you familiar with the “loophole” that helps small accounts grow exponentially?

No, it doesn’t have anything to do with penny stocks or crypto…

And this strategy works regardless of whether the markets are up OR down…

This little-known options “loophole” is something you can use to grow your trading account right now…