Just as the bulls thought the bear market was behind them, the selloff resumed this week.

It goes without saying that this is a tough market to trade.

We’re in a new era. It’s not like the past several years (when interest rates were near zero and momentum stocks were flying)…

Now, macroeconomics and monetary policy run the market and Federal Reserve Chairman Jerome Powell is the most powerful person in the financial world.

Even for me — a multi-millionaire trader with 10+ years of experience — it’s not easy to adjust to such a foreign trading environment.

That said, one thing is clear to me … there are some serious red flags for bulls right now.

The time for dip-buying is over. (I’d be scared to be long anything right now!)

But whether you’re buying puts or calls, you need to be aware of these bearish signals.

In this market, one false move could cause irreparable damage to your account.

Keep reading and I’ll point them out to you. That way, you can work on identifying red flags on your own.

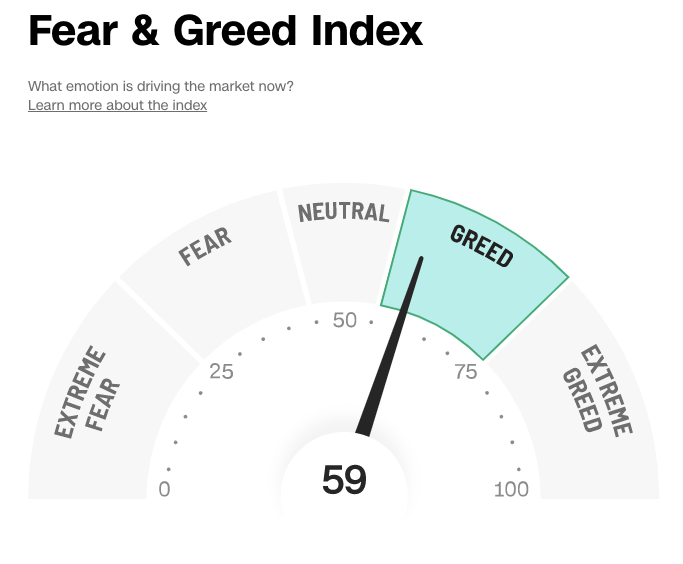

Fear and Greed? Mostly Greed…

First, it’s important to note that there’s a lot of greed in the market right now…

The CNN Business Fear & Greed Index is a widely-tracked metric for assessing how greedy (or fearful) the market is at any given time.

It’s calculated by combining market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand.

And currently, the index is firmly on the “greed” side…

What does greed do in financial markets? It causes stocks to get overextended.

In this context, the bear market rally we’ve seen over the past two months isn’t so surprising.

On the other hand, fear has the opposite effect … driving prices downward.

Considering all of the negatives in the market right now, I think we could see some more fear coming out of traders very soon.

But aside from trader sentiment, the components of the major indexes are sending hints as well..

Big Tech? Failing to Bounce…

When I’m evaluating where an index might be headed, the first thing I do is look at the biggest names in the fund.

And right now, the leaders of the S&P 500 ETF Trust (NYSEARCA: SPY) are looking especially bearish…

Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), and Tesla Inc. (NASDAQ: TSLA) have all traded lower five days in a row.

When the big boys are failing to bounce, that’s a huge red flag to me. But why?

Because if the SPY is gonna resume the uptrend that started in October, these names will need to lead it.

But that’s not what we’re seeing currently.

So, keep an eye on how this trio reacts to overall market pressure over the next week or two.

If we start to see some bullish momentum in the big tech names, the SPY could recover.

On the other hand, if the price action stays how it is right now, the near-term future of the SPY is looking rather bearish.

Finally, there’s another sector I’m watching as a potential indicator for where the overall market is headed…

Energy? Running Out of Gas…

There’s one corner of the market that’s held up remarkably well in 2022 … and that’s the energy sector.

Oil stocks have been absolutely surging this year as geopolitical tensions and resource scarcity have bid-up energy costs.

That is, until this Monday…

Oil stocks have been running out of gas this week with the Energy Select Sector SPDR Fund (NYSEARCA: XLE) down nearly 8% in three trading days.

This is notable because, during past market routs this year, the energy sector hasn’t been sold off this hard.

But now, it feels like we may be entering a true ‘risk-off’ environment as traders are dumping the one basket of stocks that’s performed well in 2022.

I suggest that you keep watching the energy sector closely for directional hints about the overall markets.

If energy catches a bid, the SPY could as well…

But if oil stocks continue to lose steam, look out below!

Final Thoughts

Don’t ignore these red flags, Evolvers!

The market is taking a breather before a pair of HUGE catalysts next week … the consumer price index (CPI) print and the Federal Reserve’s FOMC meeting.

I expect to see some insane volatility next week. And I’m watching these red flags for signs of where we might be headed.