When longs are suffering, shorts should be printing money — which is exactly what many Evolvers did over the past several weeks by trading my put strategy. (Congrats again to anyone who banked huge on the downside!)

That being said, many traders are struggling right now. It’s not just because of the current market. It’s because a lot of traders haven’t refined a truly A+ setup.

My success didn’t happen overnight. I spent years studying under Tim Sykes, perfecting my trading strategy.

I had to try a variety of patterns out before I settled on the ones that work for me. And I’m still learning every single day…

That’s why this news is so exciting. Tim’s revealing the three steps he uses to make $3,921, $4,625, and even $6,237 OVERNIGHT next Wednesday, Feb. 9! Sign up for FREE here!

Once again, we have to do some strategy-refining of our own. The market is bouncing hard off of the recent lows. It’s the perfect time to focus on the setups that will work for you moving forward.

In that spirit, let’s break down my weekly watchlist and the critical price levels I’m paying close attention to…

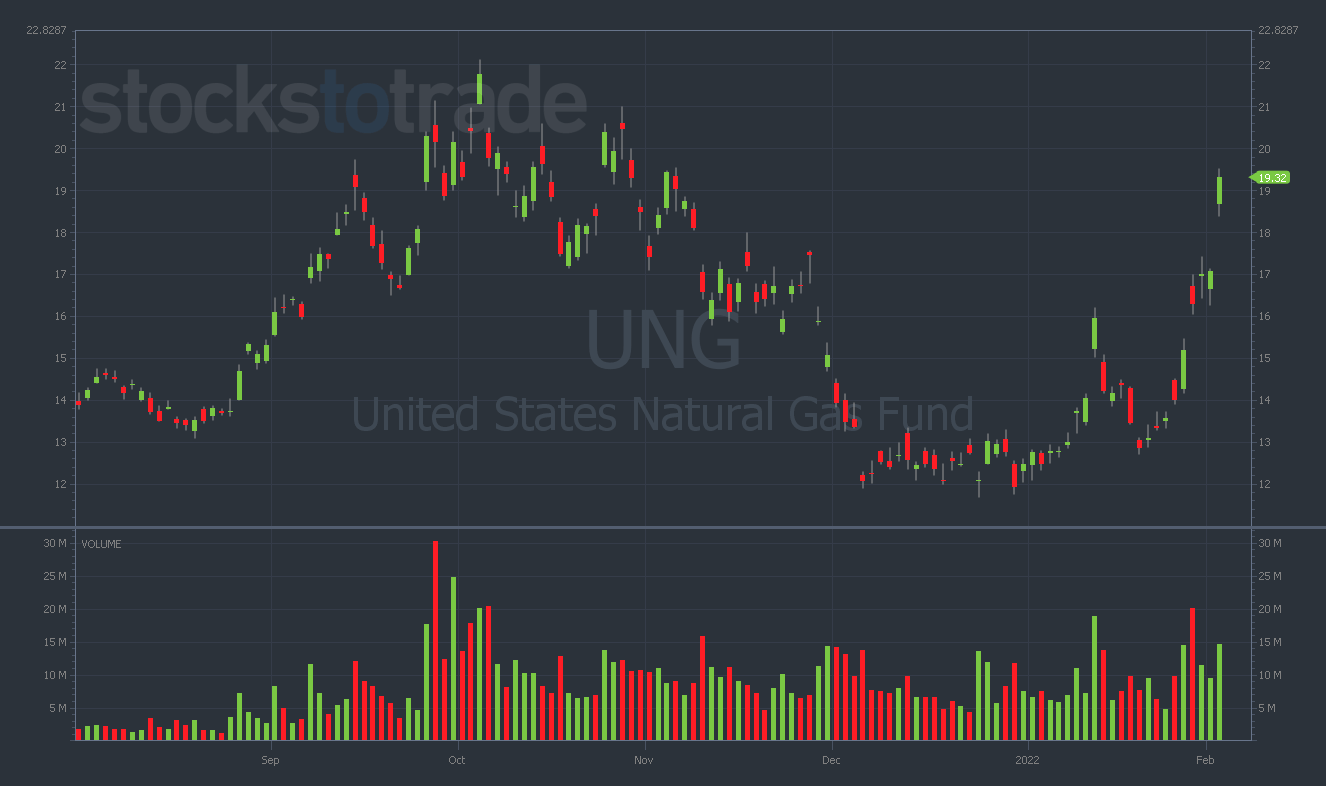

United States Natural Gas Fund (NYSE: UNG)

Whenever a stock is green nine days in a row — pushing 50% gains in a little over a week — I’m on high alert for a potential massive puts play.

This is exactly what’s occurring with UNG currently. Just look at how inflated this chart is.

I want you to think about the psychology of this chart. Without question, a huge amount of retail buying has taken place over the past 10 trading days.

If a bear raid happens on UNG, anyone who bought in the last few days will be trapped bag-holding near the top.

This is exactly the kind of game theory I’m looking for in a short setup. I think a huge panic could take place if UNG starts to dump on huge volume.

Key Levels: $20 (resistance) and $16 (support).

I’m watching the $20 level as potential round-number resistance. It’s a logical place for traders to set limit orders — and a standard level where we see stocks back off time and time again.

If I see a strong rejection near $20, I’ll likely have the confirmation I need to load up on UNG puts. Watch this one closely.

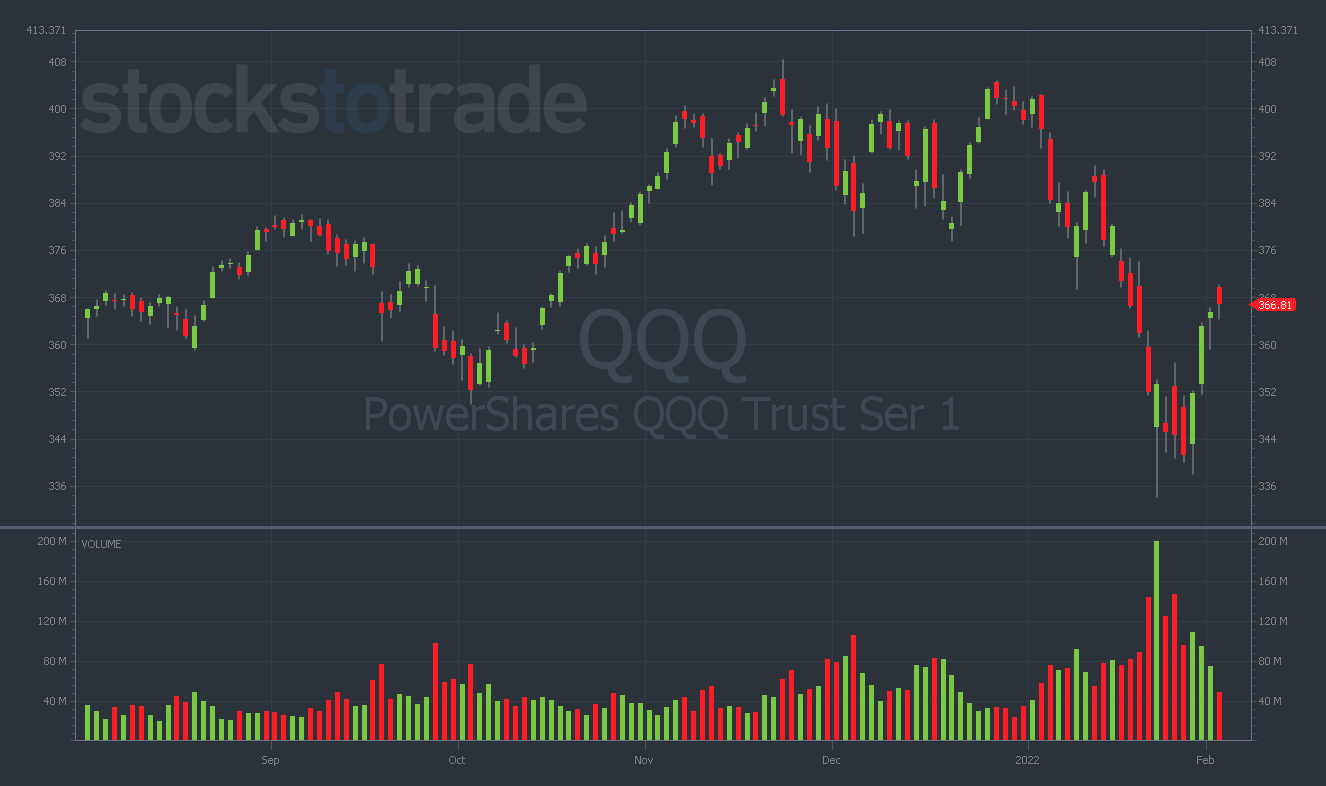

Invesco QQQ Trust (NASDAQ: QQQ)

In my opinion, QQQ is the most important chart in the market right now. Take a look…

The Nasdaq led the January bear market, dropping more than SPY and DIA.

And I think it’ll continue to set the tone for the entire stock market over the next few months.

After four green days in a row, I’m watching QQQ closely for a potential reversal to the downside.

Key Levels: $360 (support) and $370 (resistance).

The $370 level stands out to me as a potential failed bounce spot for resistance.

On the low end, there’s some weak support at $360, but if QQQ gets bearish it could realistically re-test the $340 area.

That’s why I bought QQQ 2/9/2022 $365 puts this morning. I’m hoping for a breakdown in the chart over the next few days.

I’ll use the $370 area as my risk on this trade. If QQQ boosts above $370, I’ll probably dump these contracts.

Digital World Acquisition Corp. (NASDAQ: DWAC)

While the entire market was selling off in January, DWAC gained 65%. This sort of divergence is worth taking note of.

The “Trump SPAC” has regained clout among social media traders over the past month as discussions of a potential short squeeze have taken place.

WARNING: This stock is HIGHLY SHORTED. It could violently flip in either direction at any moment. A short squeeze — or a bear raid — are both very real possibilities. Trade accordingly!

Whenever this kind of volatility takes place in a retail-heavy stock, I’m frothing at the mouth to buy puts at the top.

I’d love to see DWAC pull off an insane short squeeze like it did in October after it first appeared on the Nasdaq. Here’s the chart.

If I could buy puts above $100 — or even $150 — that would be an amazing risk/reward proposition.

Key Levels: $65 (support) and $90 (resistance).

In the meantime, I’ll wait to see what DWAC does at the $90 level (where the chart topped out earlier this month).

If DWAC cracks that resistance, grab your popcorn. We could be in for a major short squeeze.

But if it fails again at $90, I’ll be happy to buy puts there as well.

Final Thoughts

I often hear traders talk about how much they love volatility. I don’t blame them — I’m in that category.

But if you’re relatively inexperienced, please don’t dive in headfirst and attempt to overtrade this madness.

Instead, take the opportunity this crazy market gives you to watch, study, and learn.