The 5 Greatest Options Trades of All Time

Let’s be real … It’s a rough time for anyone just getting into trading.

I have sympathy for students trying to learn how to trade this brutal bear market.

It’s not easy for me — a multimillionaire trader with 10+ years of experience — to find quality setups with this price action.

I can’t even imagine how difficult this environment must be for beginners.

When I first started in Tim Sykes’ Trading Challenge, back in 2010, a historic bull market was just beginning.

Now, more than a decade later, it’s finally unwinding…

But here’s the thing … For options traders, bear markets can present the best opportunities in the game — if you know how to play the setups correctly.

I’ve recently been doing some research on some of the biggest options trades ever.

And guess what? Four out of five were bearish put trades during legendary bear markets.

Are any of us going to trade the dollar amounts these whales are dealing in? No.

But I want you all to view these trades as inspiration — a guide for how you can potentially capitalize while others don’t.

Without further ado, here are the five greatest options trades of all time…

Paul Tudor Jones Makes $100 Million Shorting the Stock Market

These days, Paul Tudor Jones is a household name in the trading world.

But in the mid-1980s, he was just another young trader trying to make a few bucks in the options pits…

By the midway point of 1987, Jones began to see something that others didn’t — the S&P 500 was wildly overvalued.

Studying historical market data, Jones decided that valuations were too high compared to the interest rate environment at the time. Rates were near 10%, while stocks were returning 5% annually.

So what did Jones do? He bought a spattering of put options on the major indexes. And the rest is history…

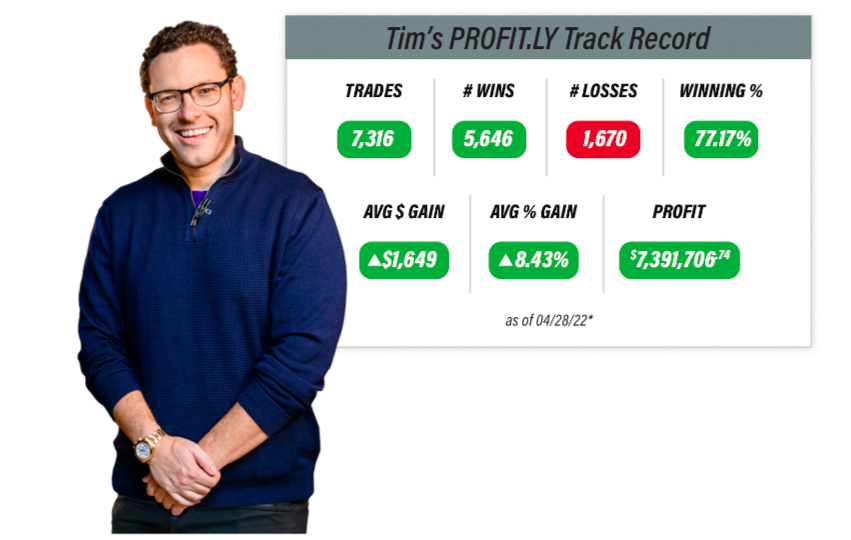

Learn the secret Tim used to turn a small investment into a fortune

On October 19, 1987, the Dow Jones plunged 22% — while Jones bagged approximately $100 million on the trade.

He tripled his net worth and made himself an options trading legend in the process.

Andy Krieger Makes $300 Million Shorting the Kiwi

While Jones was busy shorting the U.S. stock market, a trader named Andy Krieger was eyeing a different setup overseas.

Krieger was preparing to put a massive short on New Zealand’s dollar, sometimes called the kiwi…

By the tail end of 1987, the fall of the U.S. stock market had depressed the U.S. dollar and driven investors to speculate on other currencies.

The kiwi had been bid up to astronomical levels, and Krieger saw a slam-dunk short setup developing in front of him.

Krieger had so much conviction in his thesis that his sell orders exceeded the entire New Zealand money supply. He shorted every kiwi he could get his hands on…

Over the following few weeks, the kiwi plummeted as much as 5%. Meanwhile, Krieger made $300 million for his employers and cemented his place in the annals of options trading history.

Nassim Nicholas Taleb Makes $1 Billion in a Day on SPY Puts

Best-selling author Nassim Nicholas Taleb is no stranger to options traders. He has written some incredible books about risk management and derivatives strategy. Better yet, he puts his money where his mouth is…

Just like me, Taleb has a negative bias. His strategy revolves around constantly buying bearish, out-of-the-money contracts.

Most months, he loses a small amount of money. But whenever the market experiences big moves to the downside (or exaggerated volatility) — Taleb makes a fortune.

In the late summer of 2015, Taleb was doing his usual thing, buying cheap SPY puts and VIX calls.

Then on August 24, the S&P 500 tanked 8% while the VIX surged 50%.

Watch This BEFORE 9:30AM!

Have you seen what Tim Bohen has been up to EVERY morning between 9:29 and 9:30am?

If not, click here now because he’s getting ready to do it again.

Do NOT wait to see this.

As the rest of the market was panic selling, Taleb’s entire portfolio increased by 20%. He profited more than $1 billion in a single day.

Ruffer Makes $2.6 Billion in Pandemic Sell-Off

In late 2018, a mystery trader started gathering attention online due to their huge block buys of cheap VIX calls.

This trader had a habit of buying enormous tranches of volatility insurance contracts for 50 cents. This earned them the nickname ‘50 Cent.’

In April 2020, when the market crashed due to the pandemic, the world found out who ‘50 Cent’ was all along…

It turns out the huge VIX buyer was none other than London-based hedge fund Ruffer Investment Management.

Ruffer had purchased an eye-popping amount of volatility insurance from 2018 to 2020.

Take a look at the profits netted from each leg of the position:

- VIX calls — +$800 million

- Corporate bond puts — +$1.3 billion

- S&P 500 and Euro Stoxx puts — +$350 million

- Gold hedges — +$145 million

When all was said and done — Ruffer bagged $2.6 billion in the pandemic selloff. Well played, ‘50 Cent.’

Michael Burry Makes Undisclosed Profit on GOOG Calls

While Ruffer was still popping champagne and counting profits from the massive pandemic insurance win, legendary trader Michael Burry was buying the dip…

Burry is best known for his famous credit default swap bet against the U.S. housing market. You may know that from the movie “The Big Short.”

But if you pay close attention to his 13F filings, Burry constantly makes interesting moves in the market. And he loves to use options to leverage his bets.

In August 2020, Burry laid out 36% of his entire fund to buy $118 million worth of Alphabet Inc. (NASDAQ: GOOG) call options.

Unfortunately, we don’t know what strike or expiration he purchased — but that doesn’t make much of a difference…

GOOG was up a whopping 97% less than a year after Burry bought the calls. We can only speculate, but Burry’s trade was probably a 5-bagger, if not a 10-bagger.

Final Thoughts

What can we learn from these unbelievable trades?

There are two valuable lessons that I’ve taken away from these stories — trust your gut and don’t underestimate the value of a massive short play.

Surely, all of these plays took major mental strength. The biggest winning trades are often the most psychologically difficult.

So if you have strong conviction in your trade … stick with it. And always be looking for five-star opportunities. Even in a brutal bear market, if you look hard enough, you can find them.