Trying to predict what happens next in this bear market is anyone’s guess.

Trust me, I get how tough it’s been to trade this market. I’ve taken some brutal losses myself.

So far, 2022 has been one of the most difficult years of my career. And considering I’ve been doing this professionally for 10+ years, making $3.5 million+ in the process … I think that’s saying something.

In times like this, it’s important to simplify things. Go back to the basics.

In that spirit, I took some time over the weekend to write down six simple tips that I want in the front of my mind this week.

Some of these lessons I’ve learned on my own. But most of my knowledge comes from my mentor, Tim Sykes. If you wanna take your trading to the next level, you should start where I did — in Sykes’ Trading Challenge.

Keep reading to learn my six tips to help you be a better trader…

Tip #1: Avoid Overtrading

My first piece of advice is to avoid overtrading at all costs.

You’ve probably noticed that I haven’t made many trades recently. It’s been a conscious decision to prevent my account from facing any major drawdowns.

While traders far and wide are blowing up their accounts trying to call the bottom, I’m staying patient and not forcing any trades.

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

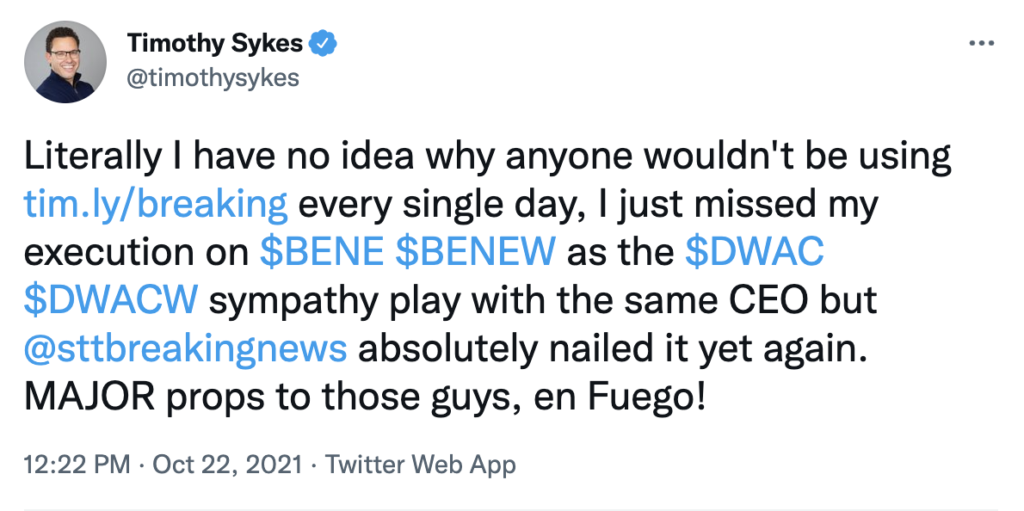

Tim Sykes encourages his students to use Breaking News Chat every day:

We all want to grow our small accounts in this crazy market … But if your attention is pulled in too many directions, the mental strain can cloud your judgment.

Don’t overtrade. Stay patient until the best setups come along.

Tip #2: Narrow Your Watchlist Down

Keep things extra simple … limit your watchlist to no more than five promising tickers.

By giving yourself limited options (excuse the pun), you can focus on the best setups only.

That way, when one of those stocks makes the move you’re looking for, you’re more likely to see it in the moment and capitalize on the play.

If you’ve got 30+ tickers on your watchlist, are you really gonna notice the best move right when it happens? Probably not.

Tip #3: Reduce Your Position Size

Don’t overexpose yourself to risk. Size your trades based on your account value and risk tolerance.

Smaller positions can give you more wiggle room to make mistakes, especially if you’re trading a small account.

The most important thing is that you go on to trade another day. NEVER risk more than you’re willing to lose.

I can’t tell you how many traders I’ve seen blow their entire careers on a few poorly-sized trades.

Don’t be like these failed prospects … be very deliberate with your position sizing.

Tip #4: Trade the Afternoon

Trading in the morning can be more stressful and emotional because of the volatility. There’s just so much chaos with up and down gap moves…

That’s especially true with so much premarket volume these days.

You can avoid all that mayhem by waiting until the afternoon to make your trades.

Plus, this can give stocks more time to prove themselves so you have confirmation for significant moves.

Tip #5: Forget About the Numbers

During the most stressful times, don’t worry about hitting any numbers or reaching a specific financial goal.

Just focus on making good trades. That’s it!

Consistently hitting singles is better than occasionally knocking one out of the park.

‘Making it’ as a trader isn’t about money. It’s about gaining knowledge more than anything.

Tip #6: Go Outside and Get Some Fresh Air

Believe it or not, getting off the computer and going outside is extremely important.

Your mental state is critical for making solid trading decisions. And if you stay inside all day, your mental state can languish.

As a trader, it can be easy to find yourself sitting in an office chair all day. Break this habit. Go outside and get some exercise.

Even if it’s just a walk around the neighborhood, take time each day to get some fresh air and release your mental tension.

Final Thoughts

If you’re in the trading game long enough, eventually a brutal bear market will come along and disrupt your market flow.

When that happens, there are plenty of simple steps you can take to adapt. By keeping with certain principles, you can help limit your risks and position yourself well for when the price action is back in your favor.

These are some of the most important tips I’ve learned on my trading journey. I hope they help you as they’ve helped me.