Yesterday, I placed a trade in a sector that I haven’t played in years…

After years of downtrends, a recent catalyst is blowing new smoke into cannabis stocks.

As weed stocks soar, I’m making one specific bet on a beaten-down name that I think could run into the end of the week.

Keep reading to see what’s behind the recent moves and why I bought calls on a particular cannabis stock…

A Brief History of Cannabis Stocks

Cannabis stocks have experienced significant volatility since the beginning.

Initially, many cannabis stocks soared due to the growing legalization movement in the United States and other countries.

Increasing acceptance of cannabis products for both medicinal and recreational use also helped to propel weed stocks in their early days.

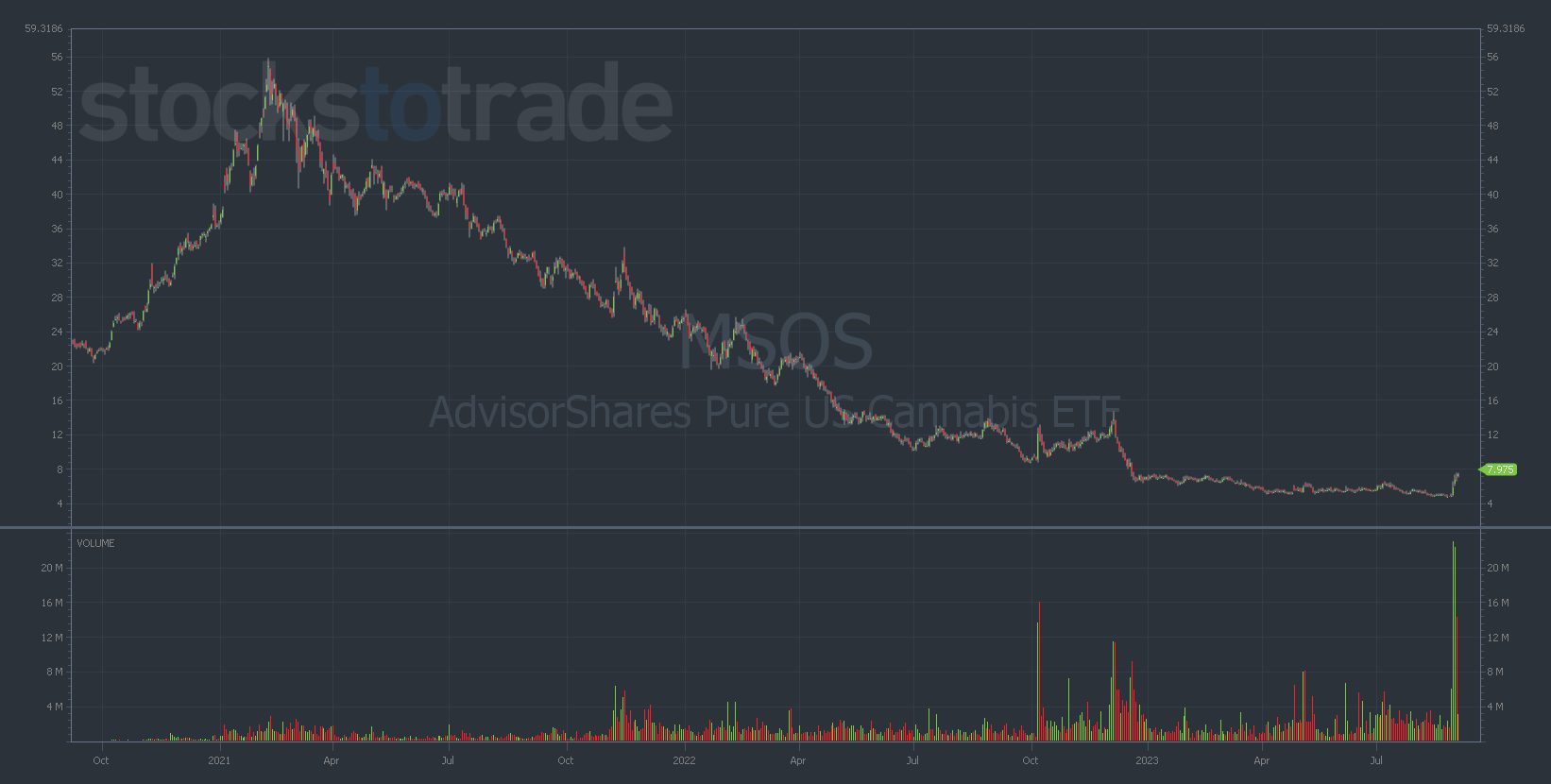

At its inception in September 2020, the AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS) rose from a debut of $23.77 to an all-time high of $51.49 in February 2021.

However, like any initially overhyped sector, weed stocks eventually had to face some harsh realities.

Since its initial surge, MSOS has been on a straight line down, losing 90% of its value and trading as low as $4.90 just last week…

MSOS 3-year daily chart — courtesy of StocksToTrade.com

Why the huge dump?

The cannabis sector has faced several challenges over the past several years, including…

Regulatory Challenges: Different regions have different legal and regulatory frameworks surrounding the use and sale of cannabis. These frameworks could change rapidly, impacting the stocks considerably.

Supply Chain Issues: Like many sectors, the cannabis industry has faced supply chain issues, which can impact the operations and profitability of companies in this sector.

Market Saturation: There has been a proliferation of companies in the cannabis sector, which led to market saturation and increased competition, potentially impacting the profitability of individual companies.

Economic Fluctuations: The economic downturns and market fluctuations during the pandemic had varying effects on the cannabis industry, with many companies facing significant financial challenges.

Investment and Banking Challenges: Due to the legal status of cannabis at the federal level in the U.S., many companies in this sector have faced problems with securing investment and banking services.

But now, a recent catalyst is sparking a bullish tone in the cannabis sector…

Cannabis Could Be Reclassified as a Schedule III Drug

Last week, the Department of Health and Human Services this week recommended that marijuana be moved from Schedule I (the category reserved for the most dangerous drugs) to Schedule III (a category for certain prescription drugs).

If this reclassification gets finalized, it would be extremely bullish for weed stocks.

The reaction is already happening…

Remember MSOS from earlier? The fund has doubled from $4 to $8 in four trading days…

MSOS 3-month daily chart — courtesy of StocksToTrade.com

However, there are more hurdles to clear first…

Although this is positive news for cannabis companies, nothing has actually changed yet. It’s still up to the Drug Enforcement Administration (DEA) to make the final decision, which could take months.

That said, considering how beaten-down weed stocks are, I think there’s significant upside on the charts.

One stock, in particular, has me buying calls for a breakout…

Why I Bought CGC Calls

From 2018 to 2021, Canopy Growth Corporation (NASDAQ: CGC) was seen as one of the most promising stocks in the weed game.

Once trading as high as $51, CGC has been the poster child for weed stock destruction over the past few years.

It currently trades for 67 cents…

CGC 3-year daily chart — courtesy of StocksToTrade.com

But with the possibility of cannabis being reclassified as a less dangerous drug by the government, I think this stock should move higher in the near term.

So, I bought CGC 9/8/2023 $1 Calls for $0.03.

This is a very small bet, expiring this Friday. But look how cheap the contracts are…

The upside on these options is impossible for me to ignore. If they trade at just $0.06, I’ll be up 100%.

Additionally, CGC is a former runner. A lot of traders remember the days when this stock was going parabolic.

REMEMBER: A former runner can always run again.

All in all, I like the setup, there’s a strong catalyst behind it, and the risk/reward on the contracts is excellent.

That said, I don’t want anyone chasing me into this play. It’s risky and I’m betting small.

Always do your own due diligence, conduct thorough research, and make sure the trade fits your strategy first.

By following these steps, you’ll set yourself up to trade your best.

And speaking of learning to trade your best…

Are You Ready To Level Up Your Trading Game?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!