Key Takeaways

- See my approach to last week’s put trade on a thinly traded crypto ETF…

- Why (and how) I use optionable crypto stocks to short the broader market…

- Want top stocks and educational resources delivered to you — for life? Stay tuned for a HUGE announcement this week!

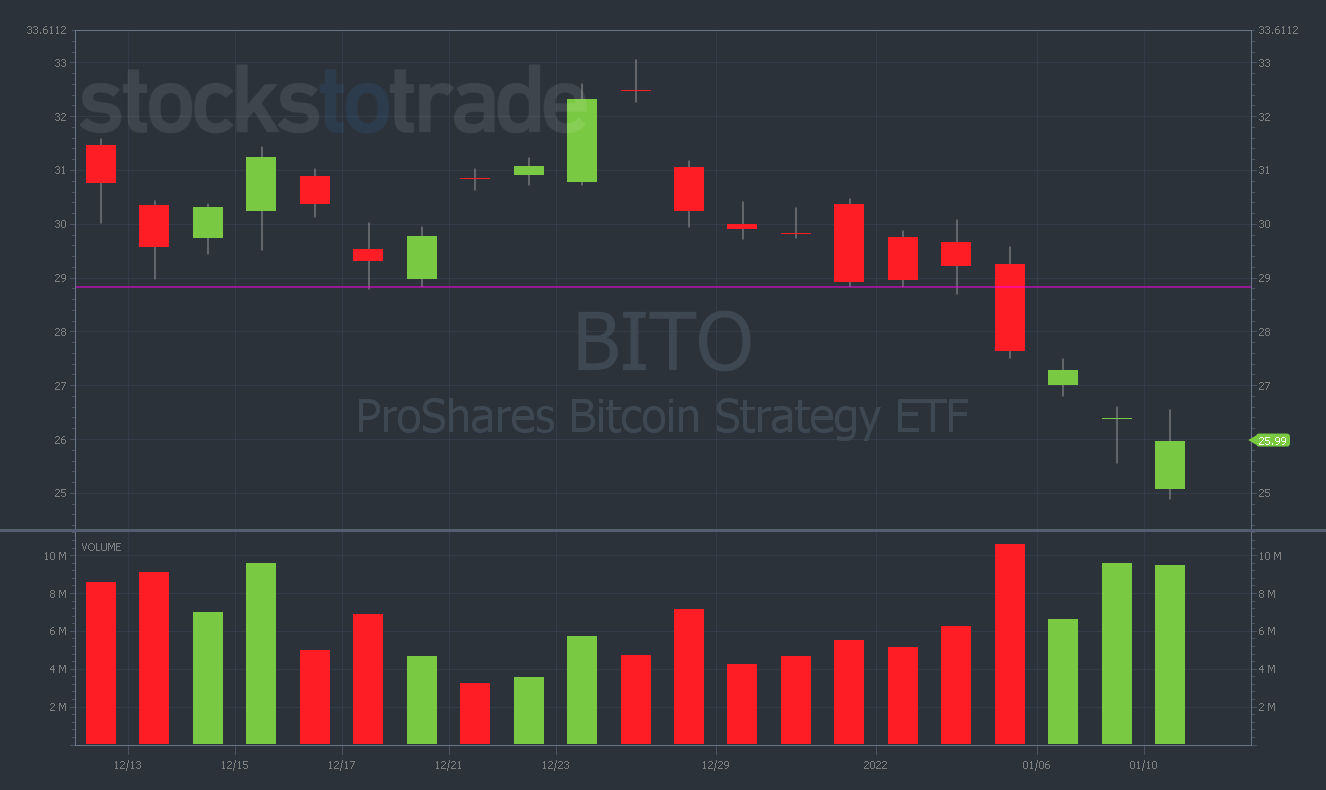

Last week, as the crypto market was heading into a bearish tailspin, I nailed a juicy put trade on the ProShares Bitcoin Strategy ETF (NYSE: BITO).

Let’s break down what I saw in the chart and how I approached the setup…

Why I Shorted BTC

Instead of focusing on BITO individually, I was primarily watching the bitcoin (BTC) chart.

Specifically, I was tracking the critical support level at $45,000. As I was recording a video lesson on Wednesday, January 5 — the chart started cracking toward $44,000…

This is how technical analysis works. You need to identify the key support and resistance level in a chart — especially when the overall markets are coming down.

The Nasdaq, featuring the hottest tech stocks of the moment, has been in a serious reversal pattern since early December.

When you get a key break lower following sideways price action, it can crush the bulls’ morale. BTC is now on the verge of a potential significant breakdown.

I’ll put it this way … If BTC can’t hold $40,000, I think it’s going to $30,000 pretty quickly.

That’s why I was short — and will continue to look for short setups in — BTC until bottoming signals start appearing.

Pay close attention to the price action as BTC gets dangerously close to $40,000. I wouldn’t be surprised if it bounced there.

If a bounce occurs, maybe BTC can creep back up to $42,000, $43,000, or even $44,000.

But I think a lot will depend on what the overall markets do. When the key level broke at $45,000, the BTC short setup got considerably more compelling to me.

And that’s where it’s good to be short, near the key level. Especially on a very momentum-driven play like BTC.

Had you been short at $45,000, you could’ve caught a solid 10% drop…

Remember: You don’t need to catch the whole move! I didn’t and I still made about $40,000 on it.

I don’t want to chase this trade now that BTC’s down quite a bit. But you can see that the momentum has fractured, and more short setups could appear soon.

How I Trade Options on Crypto Setups

Why did I choose BITO as my vehicle for trading options on this setup?

The main reason is that BITO tracks BTC’s price moves directly. Crypto stocks like MARA and RIOT get pretty darn close, but because I wanted the closest parallel possible to the BTC chart for this trade — I chose BITO.

Look at the BITO daily chart. Notice that for three weeks it held support just under $29.

So naturally, I had the short-term $29 puts. But I’ve said multiple times that I wouldn’t alert this play.

The BITO options trade thinly. They move quickly, too, when they get too much volume (and too many people start chasing).

I have to emphasize this again: Don’t chase alerts!

Disclaimer: My trade alerts are for educational purposes only. You should never blindly chase them.

If you’re going to take a position, wait for an ideal entry (and choose a different strike or expiration date if necessary).

I know a lot of people look to enter certain strikes because the volume’s pushing up. This can work, but it can also be dangerous.

The BITO options, which are less liquid, are more sensitive to volume.

Now, BITO’s trying to put in a bottom. We might see a reversal and maybe a first green day.

That being said, I think BITO’s a good way to potentially play any future BTC short setup using options.

Final Thoughts

Once again, we have a solid short play based on important levels in the chart. Always look for those key levels.

When $45,000 broke on BTC, that’s when we got the big drop to $40,000. This wasn’t a coincidence.

As I said, I suspect that crypto could unwind even more.

On the other hand, crypto bulls worldwide are calling for “BTC to $100,000” … But in reality, BTC keeps failing at critical levels and making new lows in the chart.

For me, this was a one-and-done, near-term trade.

Was it a perfect trade? No. Maybe I could have been more patient and caught a tiny bit more downside.

But overall, I’m happy with the trade and not getting back into this. From here, the volatility can go one way or the other.

Conclusion

This solid setup in BITO was an example of three key lessons we’ve covered before:

- Identifying critical price levels

- Picking the right strike prices

- Using put options on crypto stocks to synthetically short the broader market

So, next time you’re approaching a potentially juicy setup, keep these critical steps in mind.

They could mean the difference between nailing the trade and unnecessarily leaving money on the table.