One of the most valuable skills a trader can strive towards is the ability to nail both the upside and the downside of a chart.

I hear some traders say they ‘only buy puts on this stock’ or ‘only buy calls on that stock’ … but this is a dead wrong approach.

You’ve gotta be nimble, ready to strike on both sides of the momentum cycle.

Sure, I’m a generally short-biased trader. But I’m just as willing to put a bullish trade on if the opportunity arises.

Having the ability and foresight to trade puts and calls is a crucial skill you must develop if you wanna have a long and successful career in the options market.

And since I’ve recently played both puts and calls on the highly-volatile Palantir Technologies Inc. (NYSE: PLTR), it’s a great time to go over the importance of flexibility.

With that in mind, keep reading and I’ll show you how to play both sides of your charts…

Take Your Blinders Off!

The key to trading both sides of a chart is to remove emotions from your mindset.

Don’t EVER fall in love with — or hold a grudge against — any particular stock.

I see this all the time with inexperienced newbies. They’ll have blinders on, only looking to trade calls or puts, failing to see the opportunities on the other side of the options chain.

But these inherent biases will do you a major disservice as a trader. You’ll only consider half of the possible setups on a chart.

Listen…

If you can time the rally by buying calls early and selling them into strength, then follow through by buying puts near the blow-off top — that’s a nearly perfect trade.

And the inverse play can be just as profitable…

If you can buy puts near the top of a run, then profit off of a bounce at a near-term bottom, you can potentially make a fortune.

Additionally, being one-sided in your trading can be extremely limiting during specific market cycles.

Think about it…

If you usually only trade calls on the SPY, and then the market starts tanking … what’s your move?

Conversely, if you’re a perma-bear in a rip-roaring bull market, it’s gonna be difficult to find enough quality short setups to pay the bills.

All this to say, if one side of the chart doesn’t work out — don’t close your mind off to potentially trading the opposite.

How I Play Both Sides of My Charts

You’ve gotta constantly adapt and evolve your game plan if you wanna survive in the stock market.

This is especially true for my strategy, which relies heavily on following the hype in hyped-up sectors.

A sector can be red-hot one week, only to go ice cold and gap down the following week.

Here’s a recent example…

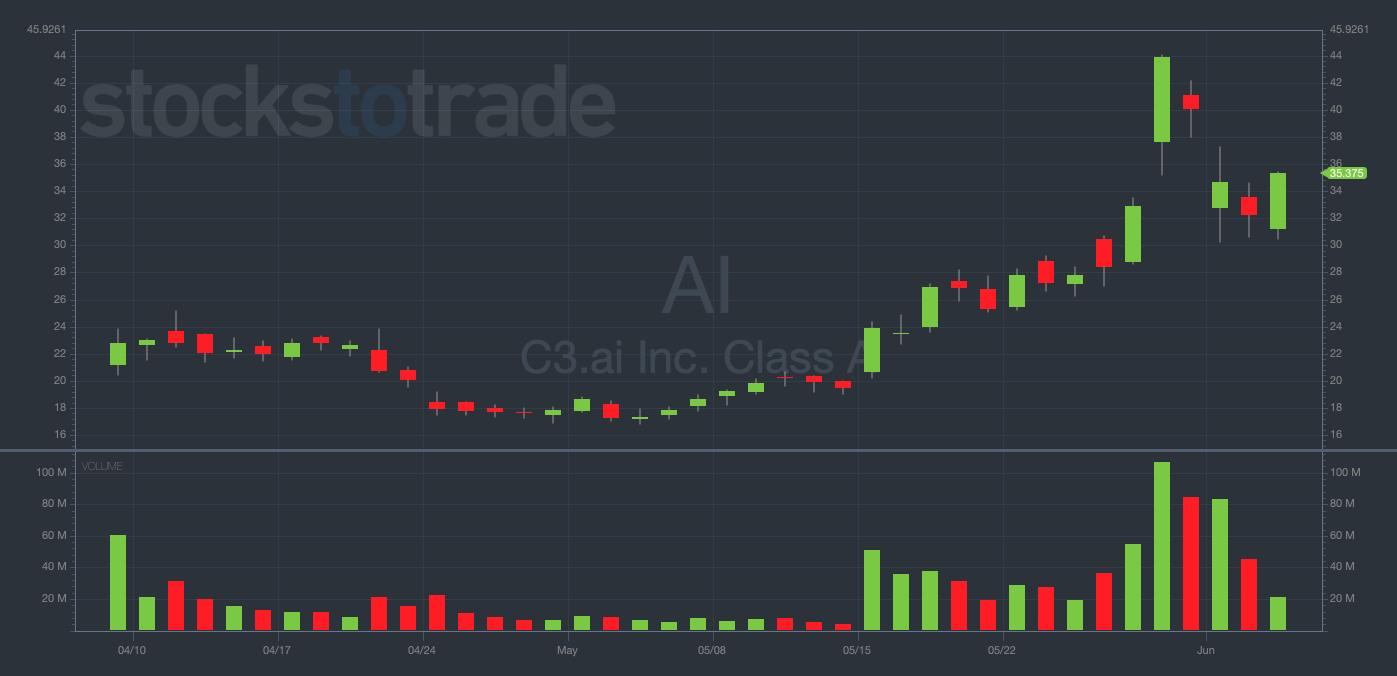

AI 2-month daily chart — courtesy of StocksToTrade.com

As AI has gained popularity, the company C3.ai Inc (NYSE: AI) surged more than 100% in May.

But last Wednesday, the stock hit a near-term top at $44.99, then got decimated back to a low of $31.04 over the following three trading days.

I can’t say I’m surprised. This is the exact kind of momentum reversal I usually look to buy puts into…

That said, a lot of traders got caught chasing the highs in AI stocks while the better play last week was attempting to buy puts near the top.

PLTR, while a different setup, has some similarities…

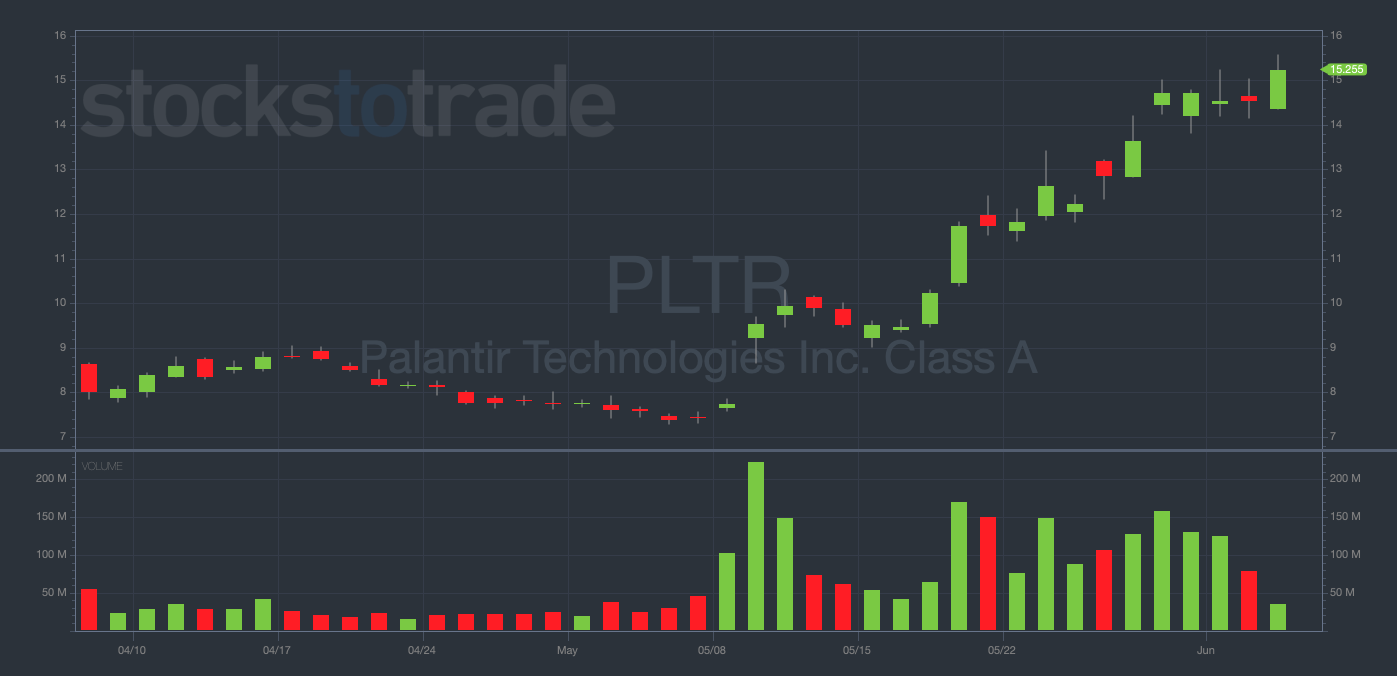

PLTR 2-month daily chart — courtesy of StocksToTrade.com

PLTR is a company that, like AI, has benefitted from artificial intelligence’s recent surge in popularity…

The stock is also up 100%+ in the past month, but it’s stronger than AI over the past week.

I tried to play puts on PLTR last week and failed miserably, eventually selling the contracts for a 50% loss.

Now, I’m being flexible and playing the other side of the chart, buying 400 6/9/2023 $16 Calls for $0.38.

In my view, if PLTR can crack $15.50 resistance on strong volume, a move to $16+ is more than likely.

Will my flexibility pay off? We’ll have to wait and see.

But without being results-oriented, I want you to start seeing the value in playing both sides of a chart.

Final Thoughts

I never would’ve survived 10+ years as a professional trader, earning over $4 million in the process, if I hadn’t adapted my strategy to the ever-changing market conditions.

Don’t get lazy and think one setup is all you need. Never get complacent and think your current strategy will work forever.

Always be prepared to adjust your game plan — and potentially play the other side of the chart — when the price action calls for it.