- What you can learn from the epic blow-off top in ATER…

- A breakdown of how blow-off tops lead to first red days…

- How watching price and volume can help Evolvers identify these moves on their own…

Hey, Evolver.

First, I’d like to mention that today is Yom Kippur, the Jewish Day of Atonement. As we say in Hebrew, G’mar chatima tova…

It’s an important day for Jews, but a normal day in the stock market. As usual, another high-flying momentum stock is crashing back to earth — Aterian Inc. (NASDAQ: ATER).

After surging nearly 500% in three weeks, ATER hit a nasty first red day on Tuesday, plummeting 35%. Of course, I bought puts.

Let’s go over the bearish indicators I saw leading into ATER’S blow-off top. Read on to learn how you can potentially spot similar setups in the future.

ATER Goes Parabolic

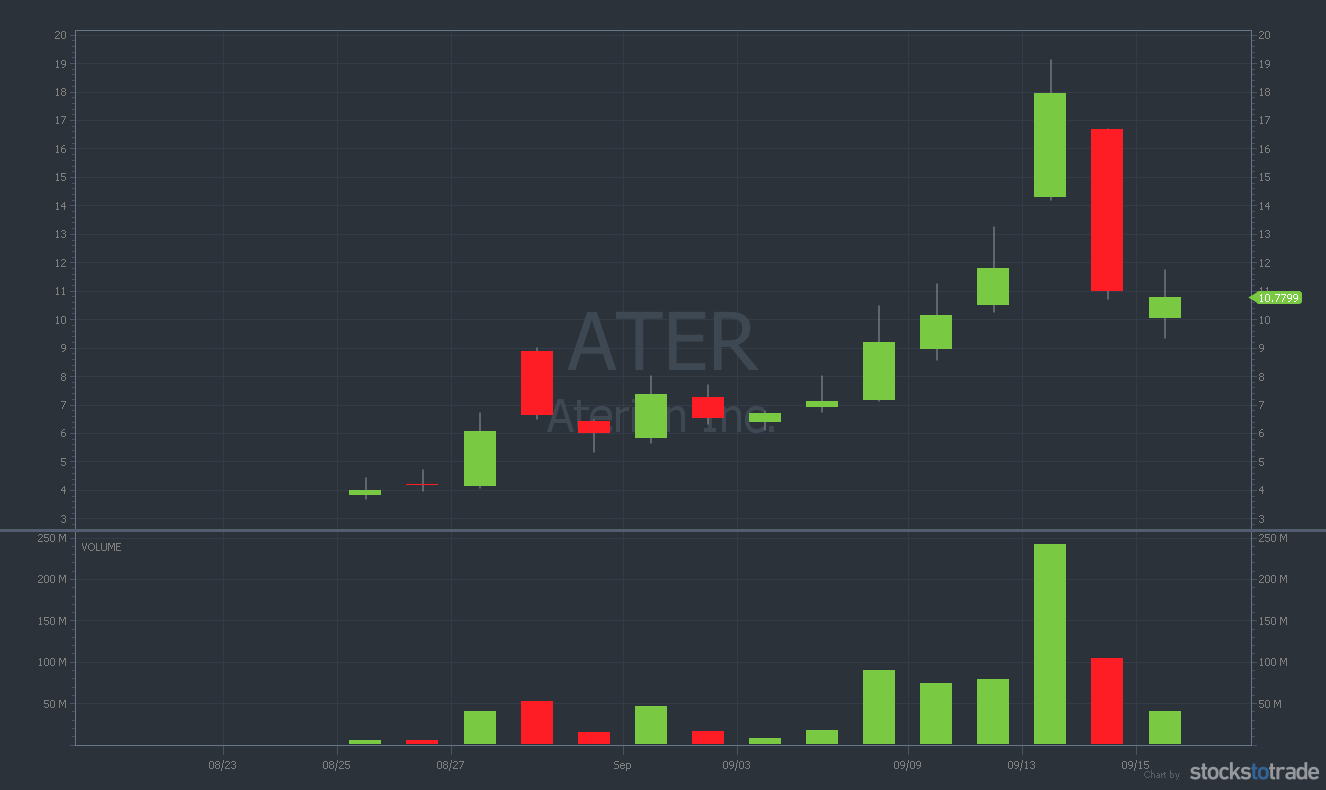

ATER’s recent rally is impressive. Day after day, it surged higher on increasing volume. And let’s not forget the big picture. Zooming out even further, three weeks ago the stock was trading for under $4…

After finding support in the high $3s, ATER had taken off on an exponential ramp of volume and price. Heading into Tuesday, ATER had been green six days in a row.

The stock blasted through $10 and $15 and was rapidly approaching the psychological resistance level of $20.

Blow-off Top Signals

Just like UPST getting rejected right before $300, ATER got rejected right before $20.

Do you see the pattern yet? These aren’t coincidences…

Stocks that are up hundreds of percent in a few weeks generally get rejected at predictable levels — usually big round numbers.

Additionally, you can potentially bolster your conviction in an imminent crash by paying close attention to the daily trading volume.

I’ve mentioned this before. When a stock’s hitting a blow-off top, the volume is usually two to five times the average daily trading volume.

This is exactly what we saw in ATER on Monday. In the previous three sessions, ATER traded an average of 81 million shares.

But on Monday — in a perfect confluence with the $20 resistance — ATER traded a whopping 240 million shares.

Alerting the Puts

Once I’d seen the topping signs I look for — it was time to execute my plan.

- I bought the 9/17 $15 puts early Tuesday morning, for a price of $1.54.

- I alerted this to Evolvers with a price target of $12–$13…

- Then I sold the puts just over an hour later during a massive flush, for a price of $2.17 — and a profit of $14,934.82.*

I didn’t want to get overexuberant, but I wish I’d held onto a few contracts…

By Wednesday, the puts were trading for $5. To any Evolvers who held into Wednesday, well done.

Lesson Summary

- ATER displayed nearly all of the indicators I look for in both blow-off top and first red day patterns…

- From round-number resistance at $20 to 2.5x average trading volume on Tuesday — this was a heck of a setup…

- Congrats to Evolvers who banked on this play!

Conclusion

I hope you’re starting to see the commonalities between the charts I watch week after week.

ATER is a picture-perfect example of some of my favorite topping signals. Take note of these moves…

It was a gorgeous blow-off top, followed by a textbook first red day. These are the setups we patiently wait for.

Watch and learn,

Mark Croock

Editor, Evolved Trader Daily

P.S.

*All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following Evolved Trader Daily strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by Evolved Trader Daily to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.

Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.