Do you know which trades are right for YOU?

As a trader, it’s important to find your bread-and-butter setups — the trades that work for your personality, account size, and risk tolerance.

The ability to identify ideal setups is what separates truly great traders — like my top student Jenny — from the 90% who lose money.

My bread-and-butter trades usually target high-flying momentum stocks. I look to “fade them” by buying puts.

I don’t care if it’s a former runner, supernova, multi-week breakout, or meme stock…

…If the chart has the volume, volatility, and catalyst I’m looking for, I’ll be paying close attention.

This brings me to the first trade in my brand-new, small-account challenge — 6/17/2022 $11 calls on the Teucrium Wheat Fund (NYSEARCA: WEAT).

If you’ve been following my trades for a while, this play may surprise you.

I’m buying calls when I normally prefer to trade puts. Plus, I’m playing an exotic commodities index that I’ve never traded before.

But I have a good reason for making this play. Keep reading to find out why I think WEAT is poised for a re-test of its previous highs…

Fundamentals

Once again, the Russia-Ukraine conflict is shaking up global commodity markets.

Here’s what’s happening…

The Russian army has set up blockades at ports on the Black Sea, blocking wheat shipments from Ukraine for several months now.

Ukraine’s grain silos are filled to the brim, but it has no way to safely access the surplus of wheat.

Want to be alerted to hot trade ideas before anywhere else?

Check out the alert for DWAC on October 21st:

This is a tool you’ll want in your trading toolbox.

From there, the simple economics of supply and demand have begun to take control…

Bottom line: If there’s a huge threat to one of the world’s biggest supplies of wheat, demand (and prices) will likely skyrocket.

Additionally, I’m bullish on WEAT because of the recent price action in oil stocks.

When Russia first invaded Ukraine, it put pressure on the global supply of crude oil, driving prices up astronomically.

Now, a very similar situation is brewing in the grain markets.

If the following price action is anything like it was in oil stocks, WEAT could be gearing up for a massive breakout.

Technicals

Once I’ve determined I like the fundamentals behind a trade, I look to the chart for further confirmation…

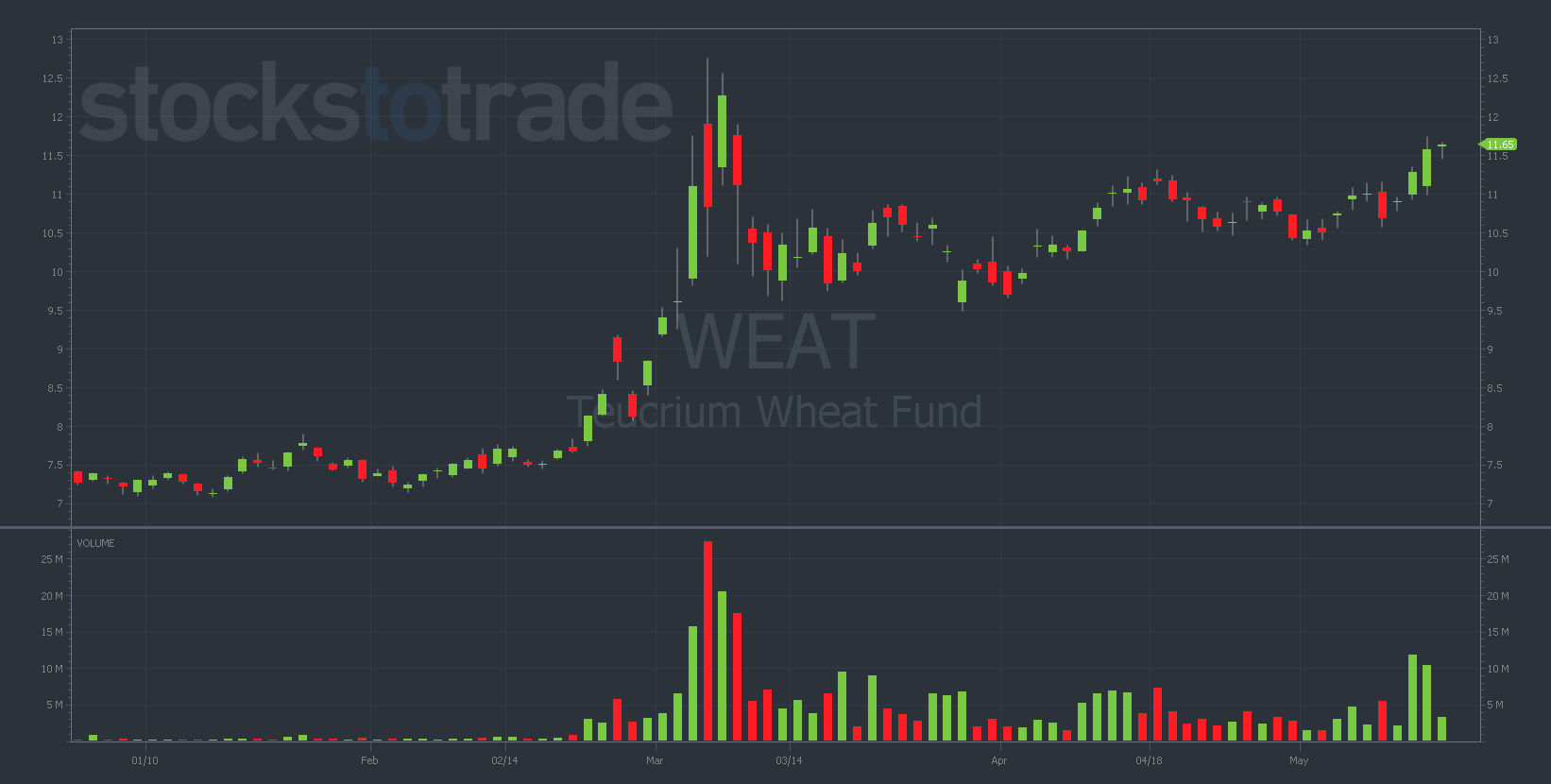

WEAT YTD daily chart — courtesy of StocksToTrade.com

And to me, the WEAT daily chart looks like it’s setting up for a bullish re-test of the highs near $12.50.

Notice that WEAT didn’t crash back to the $7s after the big initial surge in March.

It held support at $9.50, then consolidated into a beautiful ramp back up to the low $11s.

The chart has been resilient. I think this is because the play is news-driven and the headlines continue to work in favor of the catalyst.

If another breakout happens, I’ll probably sell half of my contracts at $12.50 and hold the rest for a potential grand-slam move to $13 or even $14.

I’m gonna be greedy with any gains on this trade since I’m all in on WEAT in the small account.

Plus, the news could change at any moment. It’s better to take profits while you still have them.

Final Thoughts

I’ve been very discerning about picking my first trade for the new small account challenge.

But the more I looked at the fundamentals and technicals, I realized WEAT checked all of my boxes.

Bottom line: News-driven trades have been working in this historic bear market.

I don’t know when it’ll happen, but I have a feeling that WEAT is gonna break out sooner rather than later.