Unless you’ve been trading with blinders on, you’ve probably noticed that rip-roaring short squeezes are back … with a vengeance!

Carvana Inc. (NYSE: CVNA) and Nikola Corporation (NASDAQ: NKLA) are two perfect recent examples of wild short squeezes that I’ve dipped my toes into trading (making 598% overnight on CVNA).

These worthless companies, on the verge of bankruptcy, got rallied up by speculative retail traders looking to put pressure on short sellers.

This is not a new phenomenon, but it’s gaining steam right now. Everyone and their grandma remembers the infamous GameStop Corp. (NYSE: GME) short squeeze of 2021. They’re even making a Hollywood movie about it.

That said, traditional short squeezing is only half the story. Many don’t realize that option contracts play a vital role in the specific kind of squeeze mechanic that’s so common in today’s stock market.

SPOILER ALERT: The real story is gamma squeezes…

If you wanna understand what’s really going on with some of these crazy upside moves in trashy companies, keep reading and I’ll show you…

Who’s Pulling the Strings?

Before we get into gamma squeezes and how they work, there’s another factor that you need to understand.

The puppetmasters behind the options market are where it all begins…

As an options trader, every time you buy contracts, there’s a market maker (MM) on the other side of the trade who’s gaining money by selling them to you.

MMs are individuals or entities who professionally buy and sell options contracts, looking to profit off of the bid-ask spread.

MMs use a variety of pricing metrics to determine how much the buyer of an option should pay for a particular contract.

These guys aren’t like me — trying to book 100%+ gains on weekly options. They instead focus on selling contracts with size and volume. The more you trade, the more they make.

But just like smart traders, experienced MMs always want to protect themselves from losses…

The ideal strategy for market makers is to stay market neutral. They try to avoid oversized positions in one direction or another.

But maintaining a neutral stance can be a double-edged sword…

When bullish traders spot an opportunity to take advantage of this neutrality, that’s when the possibility of a gamma squeeze takes center stage…

What is a Gamma Squeeze?

A gamma squeeze is like a short squeeze on steroids.

Options contracts provide leverage to traders. So gamma squeezes can spark a larger price increase than a traditional short squeeze.

Let me explain…

Gamma increases as a contract gets more toward the center of an options chain. In contrast, the gamma value will decrease as the contract gets further into, or out of, the money.

(If the concept of gamma is confusing to you, read my full breakdown on ‘The Greeks’ right here.)

Want to be alerted to hot trade ideas before anywhere else?

Check out the alert for LTRY on August 2nd:

This is a tool you’ll want in your trading toolbox.

In this crazy market, gamma and implied volatility (IV) can combine to create remarkable upside moves.

In a gamma squeeze, bulls target short-dated, low-delta option contracts and buy them up furiously — sending IV and gamma to astronomical highs.

The squeeze rallies the price of the targeted contract (and all of its surrounding strikes). It’s exactly what we saw with the now-famous GME and AMC Entertainment Holdings Inc. (NYSE: AMC) squeezes…

These moonshots would’ve been impossible without the use of options. But they’re more noticeable at certain times than others…

Why Gamma Squeezes Can Be So Profitable

I find that gamma squeezes go in and out of style. Months will pass without any major squeezes.

But you need to be paying attention. Because, then, suddenly, they’ll start occurring again.

And that’s exactly what I’m noticing now with the recent moves in CVNA, NKLA, and even Ride Aid Corp. (NYSE: RAD) — which was up as much as 36% on Wednesday, even amid major corporate headwinds.

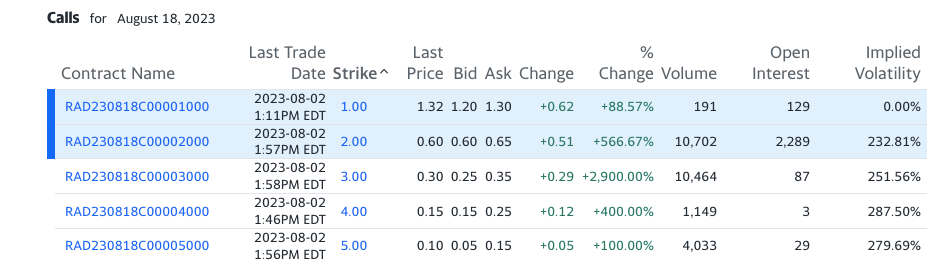

With RAD’s shares up 36%, the short-dated call options were on fire. Take a look at Wednesday’s intraday call option chain for the nearest-expiring strike, August 18…

The $2 and $3 strikes had over 10,000 contracts traded intraday, with the $3 strike up nearly 3,000% in one day.

This is a prime example of the supreme power of options. Retail traders targeted this low-priced, low-float, optionable stock and caused the contracts to skyrocket.

This is just one example from yesterday. But if you watch the options market closely, you’ll see these sorts of crazy moves all the time.

And if you can catch the right moves at the right time, the gains possible with options are beyond anything you can realistically make by trading common shares.

Final Thoughts

With volatility ramping up, short and gamma squeezes are happening more and more…

Keep an eye out for these moves, as they can provide incredibly juicy trading opportunities on the way up (and on the way down).