I hope you’re all enjoying a much-deserved day off from the markets.

I’d like to take a break from our normally-scheduled market madness and dive into a topic that a lot of students seem to struggle with — the Greeks!

Understanding these four fundamental values of the options market can be overwhelming and confusing.

But if you understand them, you’ll be miles ahead of many clueless ‘options traders.’ And luckily, I’m here to help you do just that.

Let’s get into how and why you should pay attention to these numbers…

What Are the Greeks?

The Greeks — delta, gamma, theta, and vega — are four values that track different effects the price of the underlying stock has on a given options contract.

If you hadn’t noticed, options pricing can be weird. The price of contracts often varies wildly over a single day. Plus, option premiums don’t perfectly track the moves in the underlying stock.

Do you know this mystery man?

He’s just discovered one of the most powerful ways to take on this bear market as a trader…

All from exploiting one tiny niche of the stock market (only 4% of stocks) that can bring in 2x, 5x, even 10x BETTER returns than penny stocks.

And he just went live on camera to talk with the public for the first time.

This is why options traders have utilized the Greeks for decades. Each one of the four terms focuses on a different aspect of options pricing.

The Greeks help to demystify the pricing of options. If you get a firm grasp on how they work, the options market becomes easier to understand.

Delta

Delta is a ratio that measures how closely an options contract is trading with the moves in the underlying stock.

Specifically, delta is calculated by projecting how much the price of a contract is expected to change following a $1 move in the underlying stock.

Because of the way it’s calculated, delta is represented as a number between -1 and 1. The higher the delta, the closer the contract will track the moves of the underlying stock.

The contracts I like to trade (out-of-the-money weekly put options) generally have a very low, negative delta.

This is why I’m selective about the setups and options I trade. I know they’re extremely volatile, but that’s also why my winners pay out as much as they do.

Note: Call options have a positive delta, while put options have a negative delta.

Gamma

Unlike delta (which is represented by a single number), gamma is a percentage value that indicates how much the delta of a contract is changing with its underlying security.

Gamma increases as a contract gets more toward the center of an options chain. In contrast, the gamma value will decrease as the contract gets further into, or out of, the money.

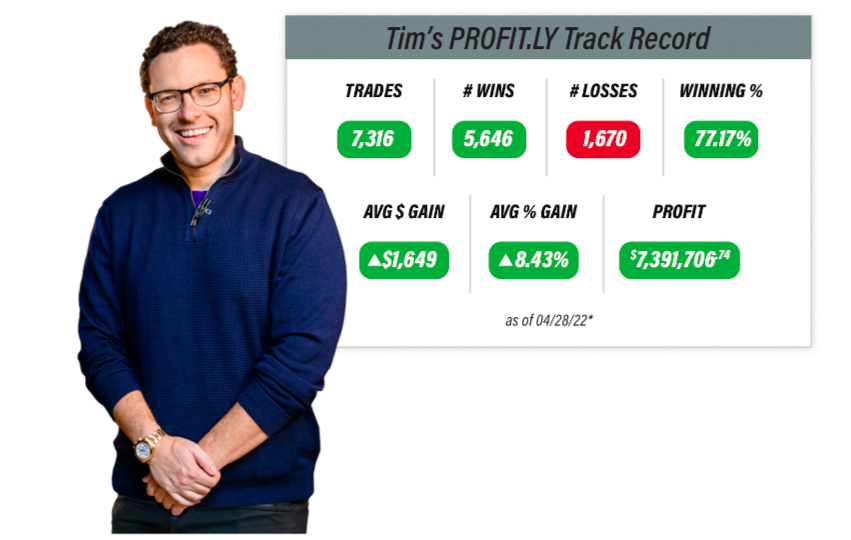

Learn the secret Tim used to turn a small investment into a fortune

In this crazy market, gamma and implied volatility (IV) are closely related. For evidence of this, look no further than the recent phenomenon of “gamma squeezes”…

A gamma squeeze is like a short squeeze on steroids. Bulls target short-dated, low-delta option contracts and buy them up furiously — sending IV and gamma to astronomical highs.

The squeeze rallies the price of the targeted contract (and all of its surrounding strikes). It’s exactly what we saw with GME and AMC, and these moonshots would be impossible without the existence of the Greeks.

(If you had understood gamma in March 2020, maybe you would’ve gotten in on the GME squeeze yourself…)

Theta

If you’re thinking about selling options, listen closely…

Theta measures how much a contract’s premium will decrease from now until its expiration date.

It helps traders (and market makers) evaluate the time decay associated with a given option contract.

Theta is always represented as a negative value because every options contract is technically a depreciating asset.

In general — if you’re selling options, you want higher theta (more time decay). If you’re buying options, you want lower theta (less time decay).

Of course, this is debatable. There’s no one rule for anything in the options market.

For example, the weeklies I like to trade tend to have extreme time decay and high theta. But buying them still works for me.

Once again, it’s all about being selective and focusing on ideal setups.

Vega

Vega measures how much a contract’s price is subject to change in response to changes in IV.

Vega will be high if the underlying share price is close to the option’s strike price.

On the other hand, Vega lessens as we move further in or out of the money.

Are You Missing Out On Epic Trades?

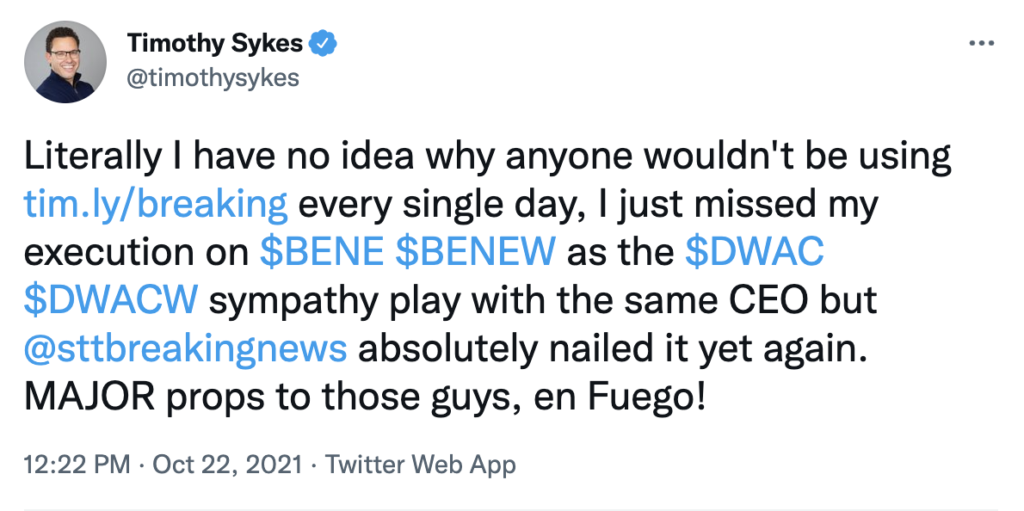

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

Vega also moves lower as the option nears expiration. This is because there’s less intrinsic value in the contract by that point in its life cycle.

The important thing to understand is the effect that vega has. If the vega is ramped on a stock, every option on the chain will increase in value.

Key Points to Remember

- The Greeks are extremely helpful tools to have in your trading arsenal — particularly useful when you’re trying to make sense of option prices…

- Start paying attention to these values and make notes of any trends you see between your trading and the Greeks associated with your contracts…

- Selling or buying, long or short, puts or calls — no matter which options you trade, you should have a basic understanding of these ideas…

Final Thoughts

Are you ‘Greeked out’ yet?

I get it, the options market is a confusing place. Regardless, I hope you now have a slightly better understanding of delta, gamma, theta, and vega.

Spend some time with these metrics, connect them to your trading, and you may be surprised at how they can help you improve.