Follow along with me here, Evolvers…

Let’s say you’re in a trade and you’re green on the day…

…you have a feeling that the chart pattern could continue in your favor, but you’re also tempted to take the money and run…

…the end of the trading day is getting close, and you need to make a tough decision…

To hold or not to hold?

Holding vs. not holding is one of the most difficult decisions traders have to make. Every great trader has debated this question at one point or another.

If you’re staring at unrealized gains, do you take your win and call it a day? Or hold for a potential grand slam?

It’s a tough call for any trader, but an even tougher one when you have 100% of your small account in monthly call options like I did yesterday.

Let’s break down my decision-making process. Did I hold or not?

WEAT Calls in the Green

I dealt with this exact question yesterday as I was deciding what to do with my Teucrium Wheat Fund (NYSEARCA: WEAT) 6/17/2022 $11 calls…

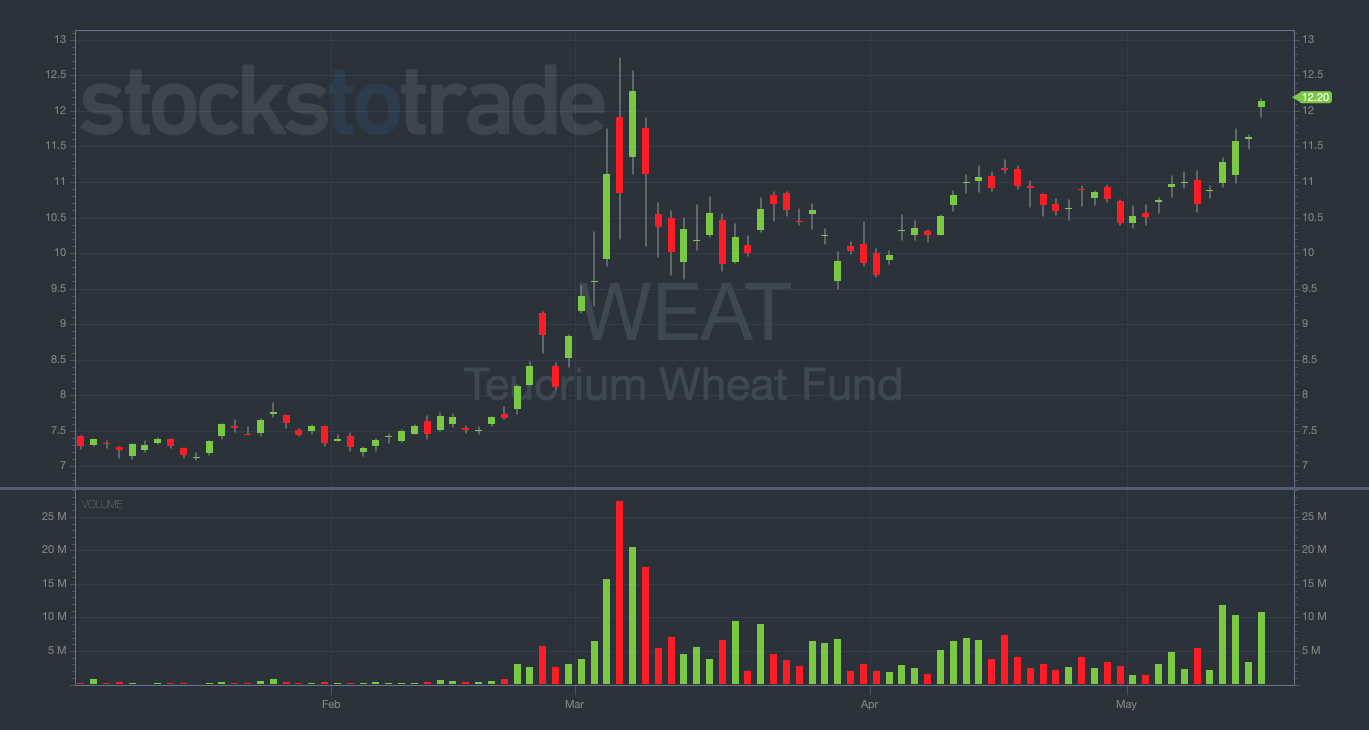

WEAT YTD daily chart — courtesy of StocksToTrade.com

I bought the calls on Friday. I explained my full trade thesis in a recent letter that you can read right here.

So when WEAT gapped up 4% on Monday, I had to consider every possibility for what I should do with my calls.

Remember that I put 100% of my $3,000 small account into these contracts. I couldn’t afford to let any of my gains disappear.

On the other hand, this modest 4% move wasn’t the massive momentum surge I was hoping for…

As I was watching the chart on Monday, I thought it could go either way.

There was some resistance ahead in the chart, but WEAT also could’ve gained the strength to blast through it.

Choosing Whether to Hold or Not

This is the point in the trade where a critical decision comes for any trader.

You have two choices:

- Sell it all — Be greedy with your gains … Take the money and run.

- Sell some of your position — But hold the rest overnight for a potential home run.

90% of the time, I recommend option A. In general, it’s best to lock in profits on your winning trades — before they evaporate.

That said, it’s moments like these where the art of technical analysis comes into focus.

Are You Missing Out On Epic Trades?

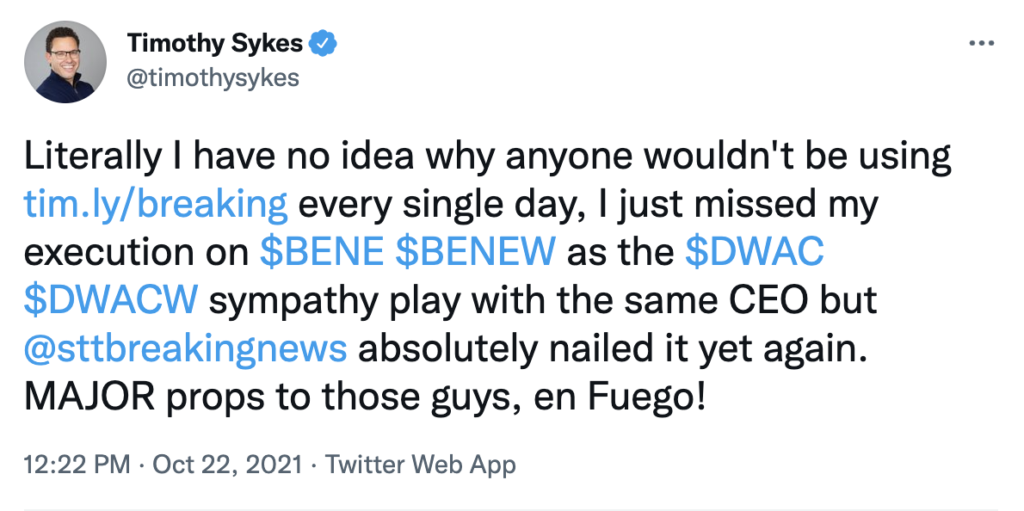

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

If you’ve studied chart patterns as much as I have, you may be able to pick out the rare, overnight-hold, grand-slam winner.

10% of the time, you need the guts to go with option B. It’s this decision-making process that separates expert traders — like my top student Jenny — from the rest of the crowd.

Having the conviction to hold a winner isn’t easy. It’s really difficult.

But missing that grand slam is almost as bad as losing money. Keyword: almost.

I chose option A for WEAT. I sold all of my calls before the close of trading on Monday.

Here were some of my thoughts on the decision:

- I said on Friday that I was gonna be greedy with my gains on this trade. By selling all of the calls yesterday, I was following through with my trading plan.

- The chart was nearing a resistance zone around $12.50. If WEAT had blasted through this level, I would’ve been more inclined to hold some of my calls. But with this resistance looming over the current share price, I didn’t like the risk/reward of holding.

- This was a respectable first trade for the small account challenge. I can’t be mad about making money, even if it wasn’t as big of a win as I would’ve liked.

Final Thoughts

My WEAT calls play was a news-driven trade in a market dominated by headlines. I wish the chart was a tad more volatile, but I’ve gotta take the small wins early in my small account.

Mazel tov to any Evolvers who profited. I’m happy to hit a single in this unpredictable bear market.

All in all, this was a solid ‘base hit’ of a trade. But soon, I’m looking to hit a home run (or maybe even a grand slam).