I’ve said it before and I’ll say it again … if you trade options like stocks, you’re setting yourself up for disaster.

But it’s not always easy to make these distinctions…

Understanding the options market can sometimes feel like navigating a maze with twists, turns, and unexpected surprises.

One such surprise that often catches traders off guard is the phenomenon known as Implied Volatility Crush or “IV Crush” for short.

Understanding IV Crush is crucial for anyone diving into the world of options. If you fail to, you’ll eventually experience a shocking loss that could’ve been easily avoided.

With that in mind, keep reading to see everything you need to know about IV Crush (and how you can work towards avoiding it)…

Volatility in the Options Market

To fully grasp IV Crush, we first need to understand the concept of implied volatility (IV).

Volatility, in its simplest form, refers to the price fluctuations of an asset, such as a stock.

When we talk about IV in options, we’re talking about the expected future volatility of the underlying stock.

IV doesn’t give us the direction of the move (whether the stock is going up or down).

Instead, it measures the expected size (or magnitude) of the stock’s future movement.

IV is represented as a % figure. The higher the IV, the larger the expected price swing in the stock…

Conversely, a lower IV % indicates that the market expects the stock to remain relatively stable with smaller price movements.

The Build-Up: Uncertainty and Speculation

The biggest driver of IV is uncertainty.

Imagine a major tech company gearing up to release its quarterly earnings report…

Traders are buzzing with anticipation … Will the company surpass expectations? Or will it fall short?!

This uncertainty, the collective “not knowing”, often drives up IV because traders are preparing for the stock to make a significant move once the earnings are announced.

In the days or weeks leading up to such major announcements, the demand for options tends to increase.

Everyone wants a piece of the action, hoping to profit from the expected big moves in the stock price.

This heightened demand, combined with the uncertainty of the upcoming event, can inflate the premiums on options, making them more expensive.

The Event and the Aftermath: IV Gets Crushed

Once the awaited event, say our tech company’s earnings announcement, finally happens, the mystery dissipates.

The market now has the information it was waiting for. Based on this new data, the stock price will adjust, but another crucial adjustment happens almost simultaneously — the IV often drops sharply.

Why does this occur? Because the major source of uncertainty has been resolved.

The market now “knows,” and when it knows, there’s less speculation and less expectation of drastic future price swings for the stock.

This sudden and steep decline in IV is the famed IV Crush, which causes the prices of all options to decrease dramatically (but more on that later)…

The Implications of IV Crush for Evolvers

For options traders, especially those who bought options leading up to the event, IV Crush can have profound implications.

Here’s why…

The price (or premium) of an option isn’t just based on the difference between the stock price and the option’s strike price.

Other factors play a role, and one of the most influential among them is IV.

When IV is high leading up to an uncertain event, it inflates the option’s price. But when IV suddenly drops after the event — even if the stock moves in the direction the trader hoped for — the decrease in IV can cause the option’s premium to drop significantly.

In other words, you can potentially face a loss in the option’s value due to the IV crush, despite predicting the stock’s directional move correctly.

For example, imagine you bought a call option on our tech company, expecting its stock price to rise after the earnings announcement.

You were right! The share price did go up…

But, if the IV dropped substantially after the announcement, the value of your option will probably still decrease.

The drop in IV could outweigh the gain from the stock’s upward move, leading to an unexpected loss.

Does this sound familiar, like anything that’s happened recently?

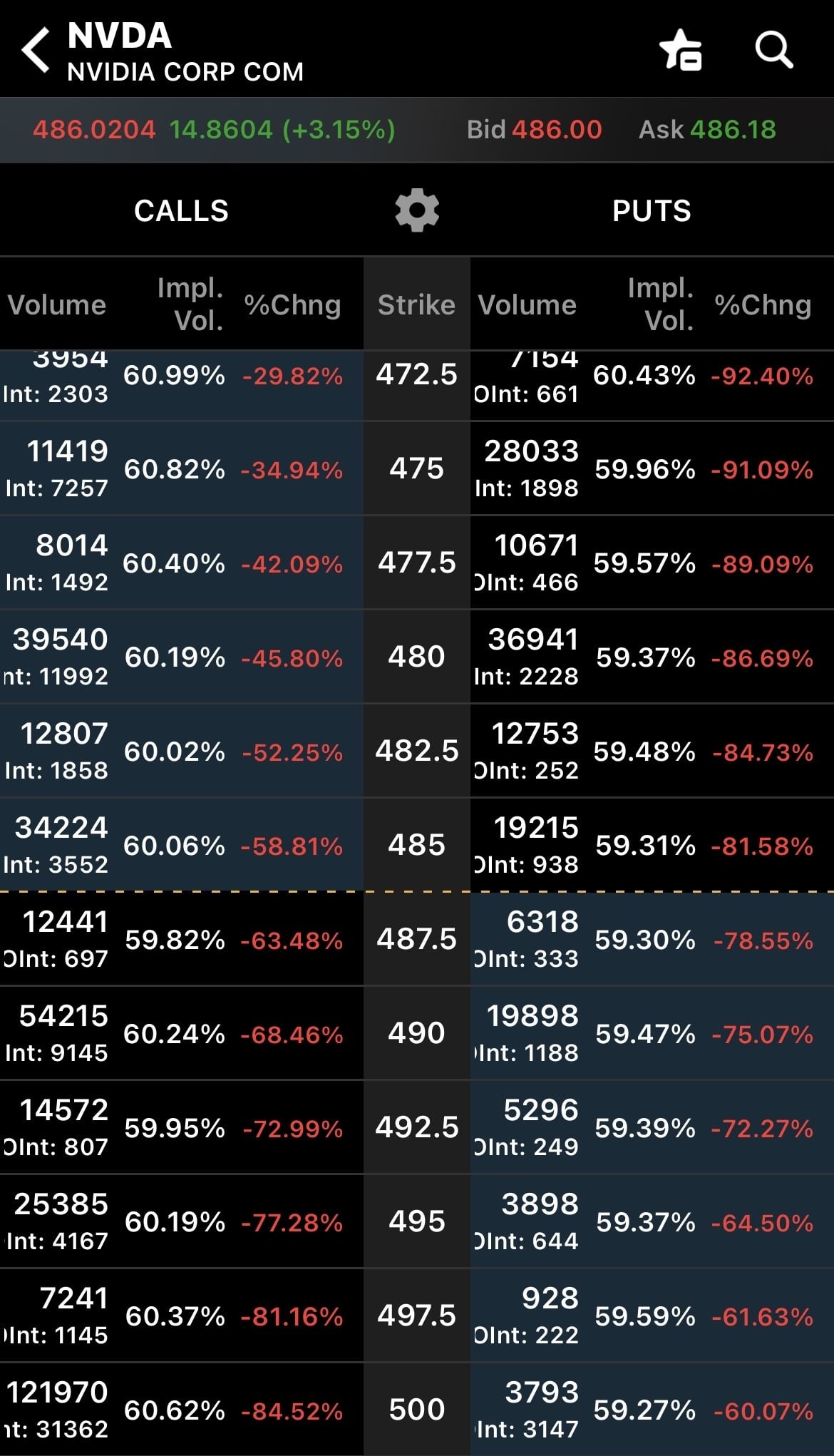

I’m talking about IV Crush today because of what recently happened to Nvidia Corporation (NASDAQ: NVDA) options following its recent earnings report.

Going into the report, the IV on the weekly options was 250%+, implying a 10% move in the underlying stock.

The following day, NVDA opened 3% higher, a far cry from 10%.

So, what happened to the call options? IV crush destroyed them.

An overnight IV shift from 250% to 60% overshadowed the 3% gain in NVDA shares…

NVDA 08/25/2023 Options Chain — ThinkorSwim

Ultimately, IV Crush is a nuance that underscores the importance of understanding not just the directional movements of stocks, but also the unique factors that influence option prices.

How can you avoid it? That’s simple … Don’t trade weekly options with IV in the triple-digits.

By being aware of the effects of volatility and anticipating the IV crush, you can set yourself up for long-term, options-trading success.

And speaking of setting yourself up for success…

Are You Ready To Take The Next Step?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!