Ask yourself … what’s the most important part of a trader’s job?

Some think it’s picking the hottest stocks. Others believe it’s predicting what will happen next.

Both are wrong.

A trader’s real job is to minimize risk.

I think the vast majority of traders fail because they don’t understand the risks they take or how to manage them.

I’m not saying you can avoid risk entirely in the stock market. You can’t. Trading is inherently risky.

But you can learn to manage your risk to avoid massive drawdowns, or worse, an account blow-up.

In other words, you can develop ways to minimize your risk.

Here’s my current market approach: I’m playing it safe this week.

It may sound boring, but it’s how I’ve avoided bad trades and unnecessary risk throughout the entirety of this brutal bear market.

And this week, as a major index nears a crucial resistance level, I’m being extra careful.

Why?

Because my sense of risk management has helped me stay in the markets for over a decade without any big drawdowns in my account.

Every trader must learn to manage their risk. Failing to do so could take you out of the game.

Keep reading and I’ll show you how (and why) I’m playing it safe this week…

Why I’m Playing It Safe

First, let’s look at the big picture…

Last week, talk of a possible recession in the U.S. seemed to reach new heights.

FREE training from Me & Bohen (Watch this)

Tomorrow right after market open…

I expect these 20 stocks could move FAST.

To make sure you get the names of these tickers, before it’s too late…

Nearly every financial news show I watched suggested we were already in a recession or floated the possibility of an economic slowdown on the horizon…

Meanwhile, the Fed hiked interest rates another 75 basis points last Wednesday in an attempt to combat the worst inflation the country has seen in decades.

It seemed like all the news was bad until Amazon.com Inc. (NASDAQ: AMZN) and Apple Inc. (NASDAQ: AAPL) beat earnings expectations…

Following the big tech prints, trader sentiment shifted rapidly, with the S&P 500 ETF Trust (NYSEARCA: SPY) rallying almost 5% in three days.

Now, this is where I started to feel like I needed to minimize my risk and play it safe heading into this week.

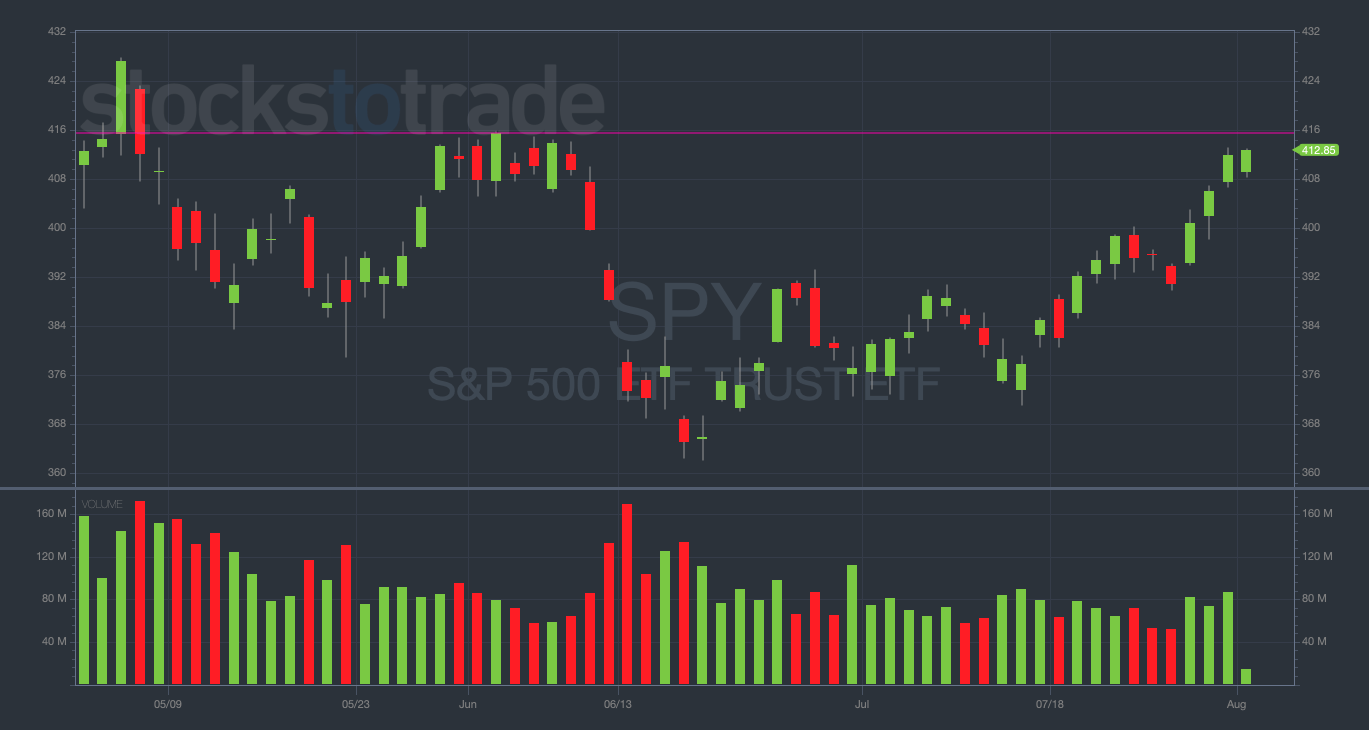

Take a look at this SPY chart…

See how the purple line I drew corresponds with an eight-day resistance zone from back in June?

Now, notice that the chart is once again getting dangerously close to this same level of resistance at $415.

As a technical trader, I can’t ignore this, but it’s not the ‘be-all-end-all’ indicator.

Do I let the price action in the major indexes dictate my entire trading strategy? Definitely not.

But I won’t ignore an important technical signal like this one when it’s so clear on the chart.

You might be wondering … how does all of this apply to you?

It depends on how far you plan on taking your trading journey…

Think about this. My top student Jenny has taken what I’ve taught her about technical indicators and turned it into a life-changing career. Click here to see what I’m talking about…

How I’m Playing It Safe

A lot of traders are getting caught up in a bullish frenzy after last week’s price action. But not me…

For the most part, I plan on staying on the sidelines this week. I won’t trade unless a perfect setup comes along.

Will I potentially scalp some call options if the upside momentum continues and SPY breaks resistance? I can’t rule it out entirely…

However, I’m much more interested in catching a potential downside move following a rejection.

Growing A Small Trading Account? Check this Out

When multi-millionaire trader Mark Croock first started trading, he was an overworked and underpaid accountant…

So he knows what it’s like to start small while wanting to massively grow your wealth as quickly as possible.

That’s why he just recorded a step-by-step training that reveals what he believes is the best options trading method for someone trading with a small account.

If SPY gets rejected at the crucial $415 resistance level once again, we could see put-trading opportunities open up in a variety of names.

AAPL, AMZN, and Tesla Inc. (NASDAQ: TSLA) are at the top of my watchlist for possible first red days this week.

That said, if I do trade any of these, they’ll be small positions.

I can’t stress this enough (especially this week)!

Keep your position sizing modest this week. Never risk more than you’re willing to lose.

Final Thoughts

I realize that it’s tempting to get caught up in the bullish whirlwind after a period like last week.

But please, take my advice and stay directionally neutral until the market sends you an obvious signal.

The next directional move in the major indexes should become more clear after SPY has tested the $415 level again. That’s what I’m watching closely.

Until then, I think we should all be working hard to minimize risk and play it safe.

Good luck and have a great week!