Key Takeaways

- I take a hard look at my top setups and fails from the past year…

- Valuable lessons you can learn from my huge wins and brutal losses…

- PLUS — don’t miss this EXCLUSIVE offer from Tim Sykes!

Every December, I spend a lot of time reflecting on my trading from the past year. And this year is no different.

Over the past few weeks, I’ve gone over every trade I executed in 2021. I experienced epic triumphs and regrettable failures, and there’s a valuable trading lesson to learn from all of them.

Let’s get right into it. It’s time to break down two of my best and two of my worst trades from 2021.

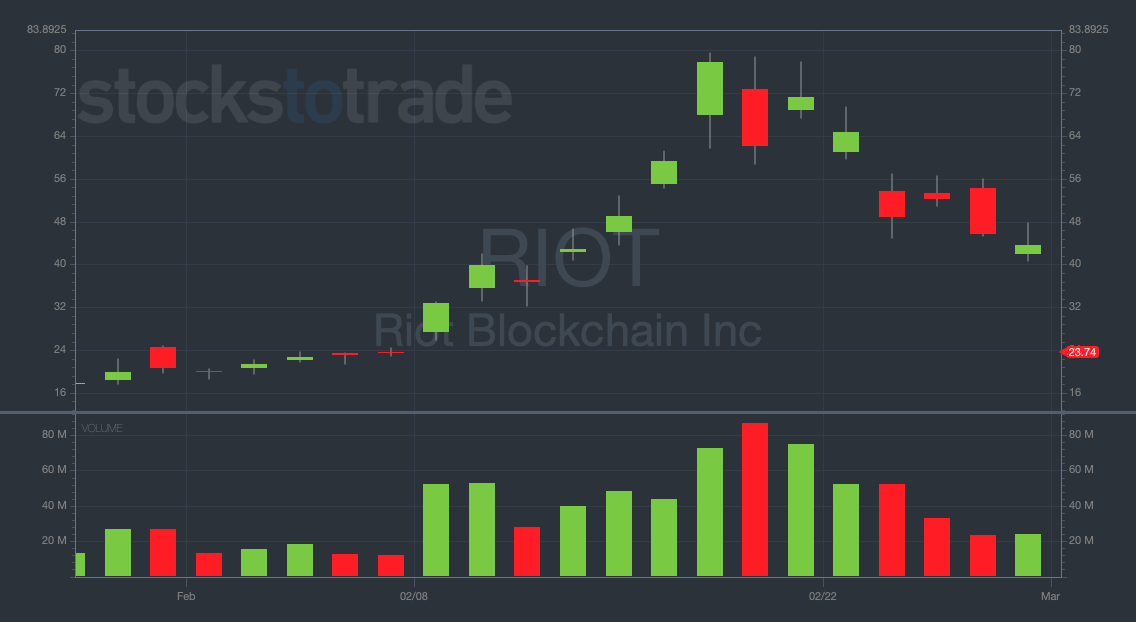

#1 Best Trade: RIOT Puts in February

Back in February, I traded Riot Blockchain Inc. (NASDAQ: RIOT) puts toward the end of the month – a textbook supernova reversal play.

I could feel that the cryptocurrency market was overextended. I knew that crypto stocks like RIOT would suffer greatly on any crypto market weakness.

I won’t bore you with the entire trade again. But at one point I was down about $40,000…

Instead of cutting my losses in frustration, I decided to stick to my convictions and let the setup play out. (CAUTION: Don’t try this at home. Always cut losses quickly!)

Sure enough, RIOT went from about $56 down to $46 in the first 20 minutes of trading the following day.

I got out around my target price and profited just shy of $128,000. This is still the biggest gain on a single trade in my career!

My all-time biggest trade is an example of a time when sticking to my conviction paid off handsomely.

But as I said, February featured unique market conditions, so I was forced to break some of my rules.

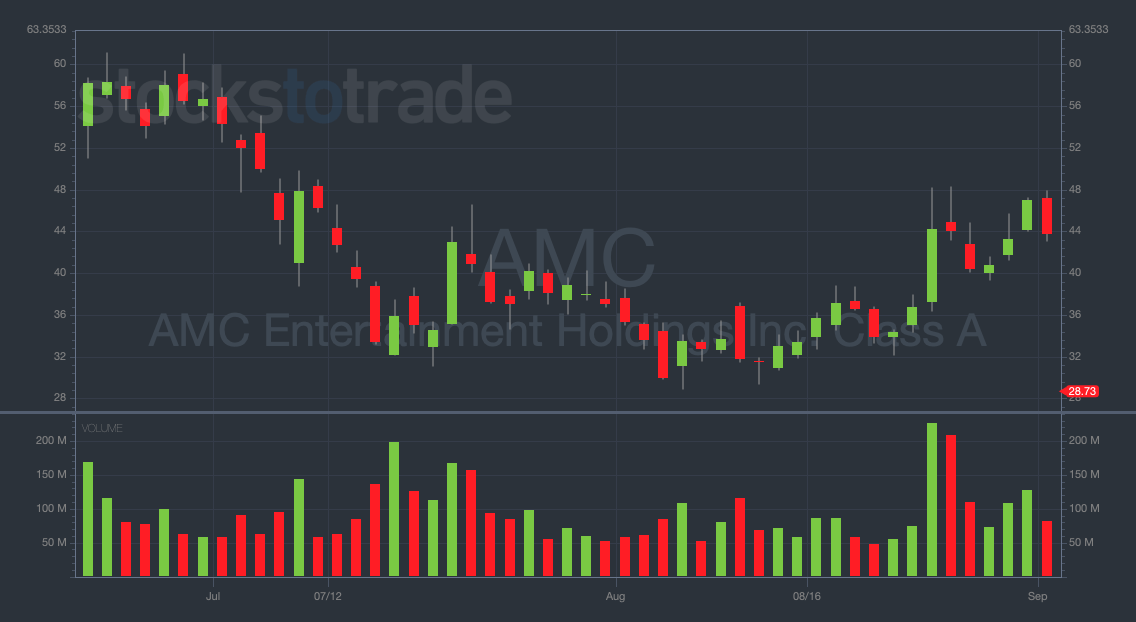

#2 Best Trade: AMC Puts in July

If you follow my alerts, you know AMC Entertainment Holdings Inc. (NYSE: AMC) was one of my favorite stocks to trade this year. It had the volume and volatility I look for when trading weekly options.

But I admittedly overtraded this stock at certain points. I vowed that I would wait patiently on the sidelines for a clear indication of price direction.

On July 7, I got the supernova reversal setup I was waiting for on AMC. AMC briefly lost the all-important $50 level intraday, and I decided it was time to pounce.

I bought 100 puts at a strike price of $45, expiring the following Friday, July 16. Then I added another 50 contracts when the premium dipped slightly in the late afternoon.

At that point, we were just over 20 minutes away from the close. I held all of the contracts — the key is to be aggressive when this part of the setup emerges.

Sure enough, the following morning AMC dumped hard. It was an even bigger panic than I anticipated. Seller volume flooded in and AMC reached lows of $42.80.

My target was always somewhere in the low $40s, so I decided to sell all of the puts for a price of $4.95. In doing so, I locked in a gain of nearly $55,000!

This trade is a great example of a “late in the game” play, where shorts tend to have a built-in psychological advantage over longs.

Why? Because the major gains have already been booked on the long side, and the shorts know this.

The experienced bulls likely sold into strength long ago and moved on, making AMC a prime target for short sellers and negative-biased put traders like me.

When the psychology of the trade is at this stage — with desperation and panic beginning to noticeably set in — it’s time to be aggressive.

If a momentum stock tries to bounce at a key support level and fails, press your advantage on the short side.

#1 Worst Trade: BNTX Calls in August

Back in August, I stepped outside of my usual put-buying strategy and did something a bit out of character — I bought calls on BioNTech SE (NASDAQ: BNTX).

Let’s put this in context. I’d been shorting the big pharma stocks ever since the epic blow-off top in Moderna, Inc. (NASDAQ: MRNA) on August 10. The entire time, the MRNA and BNTX charts have been nearly identical. Stocks in a hot sector often trade similarly.

But just like momentum runs inevitably run out of steam, short-term bear markets in hot stocks usually end with sharp reversals to the upside.

These bullish pivots can be incredible call-trading opportunities. When a stock hits a hard bottom, it can be like a blow-off top in reverse.

But ultimately, my fatal error was trying to go long before the official first green day.

I broke my rules, entered the trade too early, and missed out on some HUGE gains.

Even worse, I let a big opening panic scare me away and I lost money!

This is a trade to learn from. I made a simple mistake that I think every Evolver should try to avoid.

I saw the long reversal forming on BNTX, but I mistimed my call-buying. Never forget that timing is everything!

Wait for the first green day and adjust your trading plan from there.

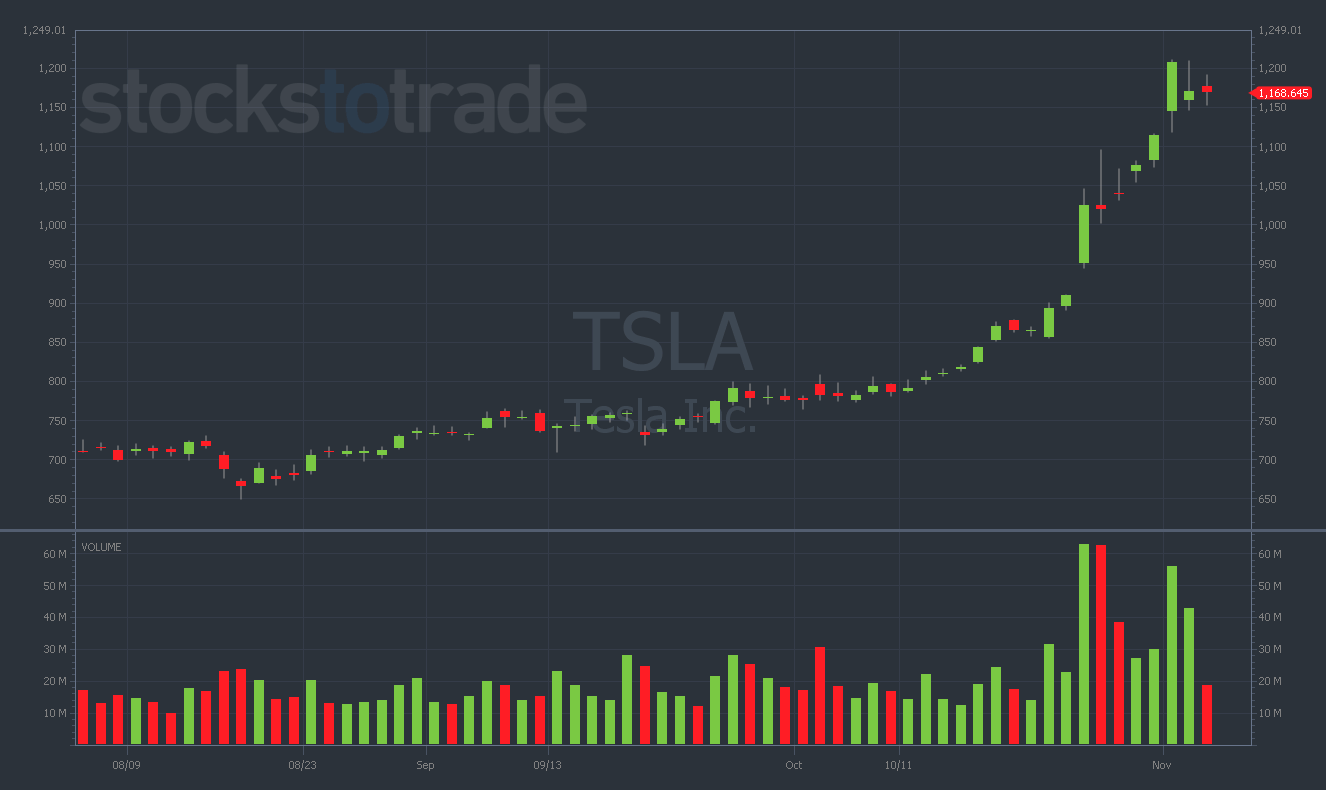

#2 Worst Trade: TSLA Puts in November

The same lessons that emerged from my BNTX trade – the importance of timing and patience – came roaring back into my mind when I bought puts on Tesla Inc. (NASDAQ: TSLA) in November.

It seems like every trader who’s ever tried to bet against TSLA has failed. After this regrettable trade, you can add me to that list.

But can you really blame me (or anyone) for trying? When I put this trade on, TSLA was up 50% in just over a month.

Regardless, it’s always an uphill battle when you’re trying to short cultish momentum runners. On Tuesday, November 2, I made some critical errors while trading TSLA…

As I was watching the chart, it looked like every intraday bounce attempt was failing. The share price was stuck under the VWAP.

Naturally, I thought it was time to buy some puts. I was dead wrong.

TSLA rallied 2% into the close and I sold my puts for a loss. My timing was terrible!

Moreover, I entered a trade that had proven to be a historical loser for nearly everyone who had tried it before me.

In other words, I made my job harder than it needed to be. I shouldn’t have attempted to nail a difficult trade when the market is filled with amazing opportunities.

Use my TSLA mistakes as lessons for the future…

Be patient. Don’t try to be a hero. And leave the historically difficult trades for some other trader to worry about.

Conclusion

There you have it, Evolvers! The good, the bad, and the ugly of my 2021 trading experience.

I learned a tremendous amount from these four trades. I hope you can all take something away from them as well.

Journal your own trades. Then, we can all compare notes at the end of 2022.