Key Takeaways

- The secrets to scalping bounces on beaten-down charts…

- The indicators I look for in potential bounce play setups…

- Why bounce plays can provide better risk/reward than the average long setup…

I usually prefer to short the first red day on overextended momentum stocks, but today I’d like to talk about one of my favorite ways to go long — bounce plays.

In a lot of ways, bounce plays and the first red day pattern work similarly. Both setups apply when charts move too far in one direction, which can lead to huge pivots in price action.

When I go long, I try to buy beaten-down bounce plays the same way I look to short the most bloated, ramped-up charts. Let’s go over a few bounce plays I’m watching currently…

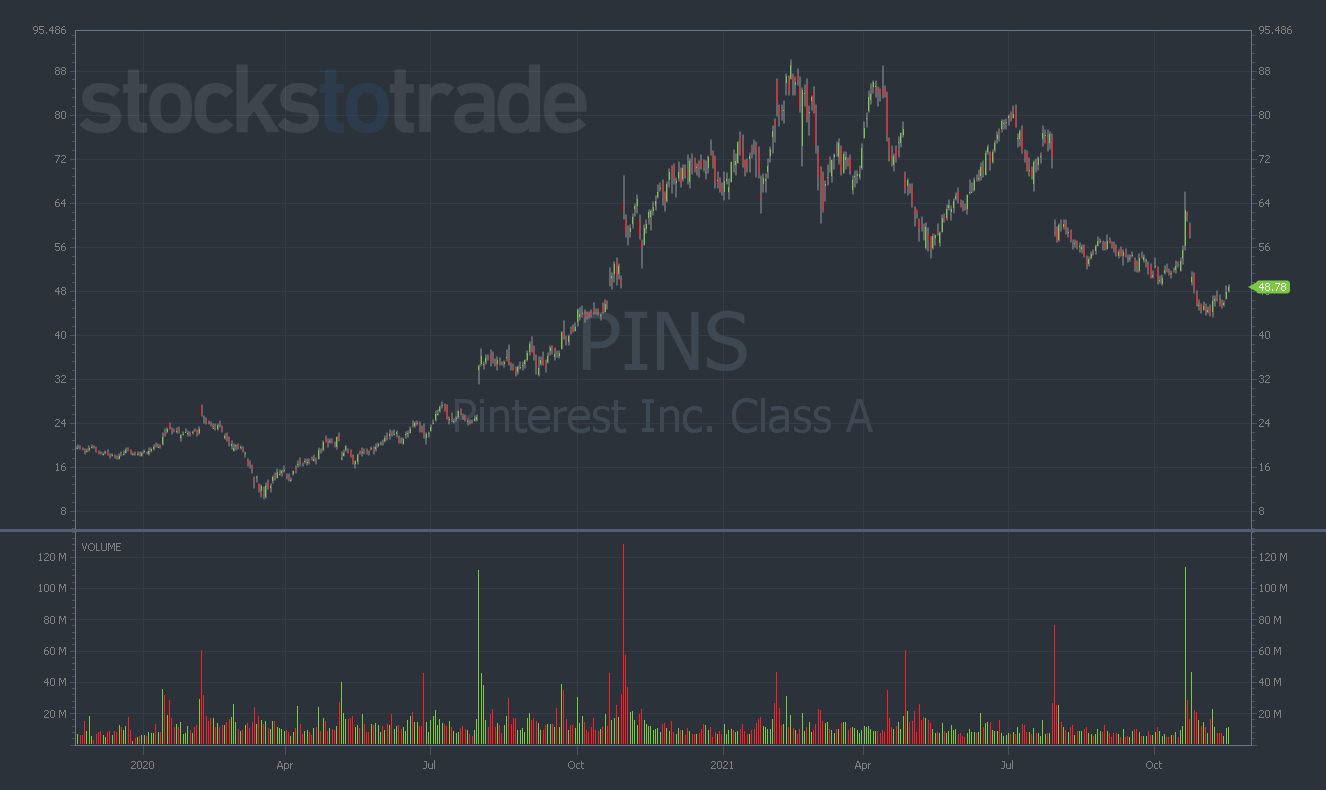

Pinterest Inc. (NASDAQ: PINS)

PINS stock has been on a wild ride recently…

On October 20, news outlets began to circle rumors that PayPal Holdings Inc. (NASDAQ: PYPL) was in late-stage talks to acquire the entire company.

In a single day, PINS stock went from a monthly low of $49.01 to $66 — an upside move of nearly 30%.

Five days later, on October 25, PayPal said it was no longer pursuing the purchase. PINS traded as low as $43.30 following the news. Now it seems to be bouncing, trading back to $48 at the time of this writing.

Big picture: PINS traded as high as $89.90 this year. There’s a HUGE amount of upside here if the chart can make a move back toward its highs. See the chart below.

Another important thing to note is that there’s been a crazy amount of options volume recently. Mystery traders are buying millions worth of 1/21/22 $55 calls on PINS. That could be a signal that a big move is about to take place…

Note: Whatever you do, NEVER follow random traders you don’t know into a setup!

Don’t believe the hype around options volume. Instead, look at the chart for yourself and notice how far down it’s come.

There are no guarantees that PINS will hit $55 by mid-January, but the incredible call volume tells us that somebody thinks it will happen.

Plus, with a chart this beaten-down, the risk/reward going long is much better than going short.

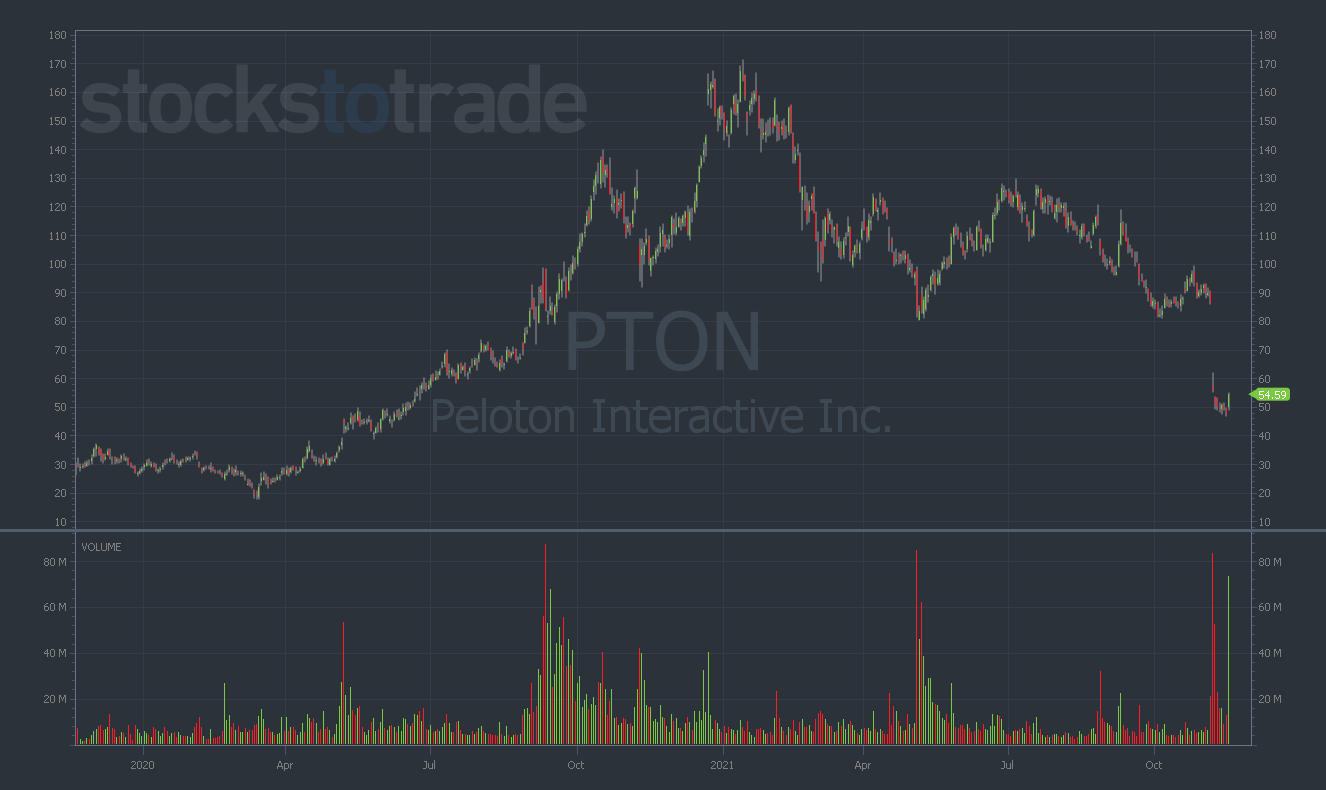

Peloton Interactive Inc. (NASDAQ: PTON)

PTON is another chart that’s gotten absolutely destroyed over the past few weeks.

It’s nearly 70% off of its all-time highs and down more than 40% in November … sound familiar?

Big picture: PTON is trading for $54 at the time of this writing. It hasn’t been this cheap since June 2020.

The most crushing blow to the stock came on November 5, when the company reported truly awful Q3 earnings numbers. PTON tanked more than 30% following the print and hadn’t recovered…

Until Tuesday, November 11 when PTON ramped 15% after the company netted $1.07 billion in a stock offering.

The reason this breakout stands out to me is the volume. PTON traded 75 million shares on Tuesday after a week-long period of trading roughly 10–15 million shares per day.

And just like PINS, the call volume on PTON is massive…

I think this would’ve been a great scalp on Tuesday, but at this point, I wouldn’t chase it.

I’m pointing it out so you can look for setups like this in the future and trade them as soon as they happen.

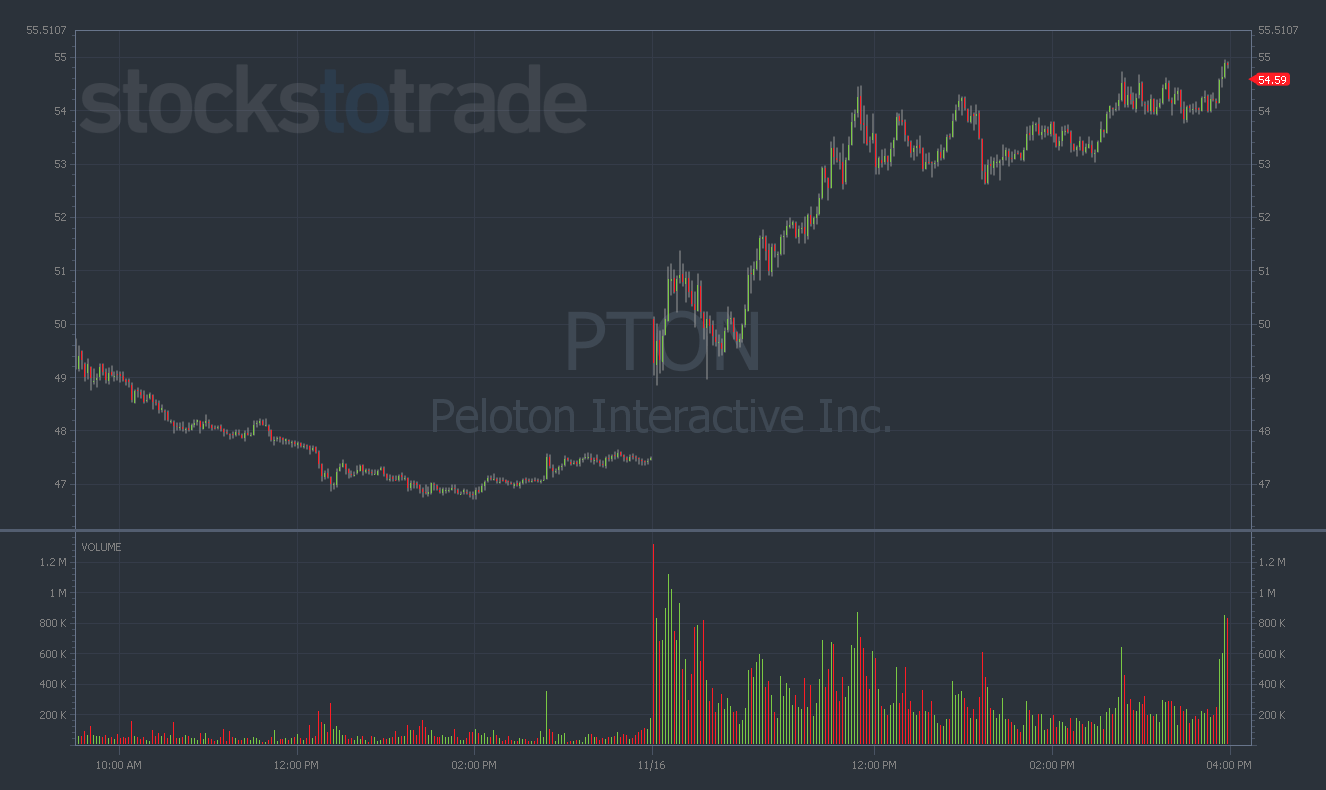

All the telltale bullish signs were there for PTON first thing in the morning. The volume on the first five-minute candle was INSANE. That should’ve caught every trader’s attention…

Even better, PTON provided long traders with a picture-perfect dip within the first 45 minutes of the trading day.

Look at this two-day chart to see what I’m talking about:

The ideal entry was in the $49 area. If you (or I) had bought 11/19/21 $50 calls in that region, they would have been up 250% less than two hours later!

Conclusion

I’m only showing you these charts for inspiration. I don’t want anyone to chase these plays.

But hopefully, you see why I like the risk/reward on bounce plays. They can provide a lot of upside with less risk than some other long setups.

So next time you see a huge volume breakout after several days (or weeks) of sideways trading — pay attention!