As soon as the press conference began, stocks looked like they were poised for a rally. But not long after that, the enthusiasm wore off and everything started to unravel. And that’s when I bought puts on a major index…

Let’s break down why I’m buying these contracts specifically — and address some of your burning questions in the process.

Trade Notes

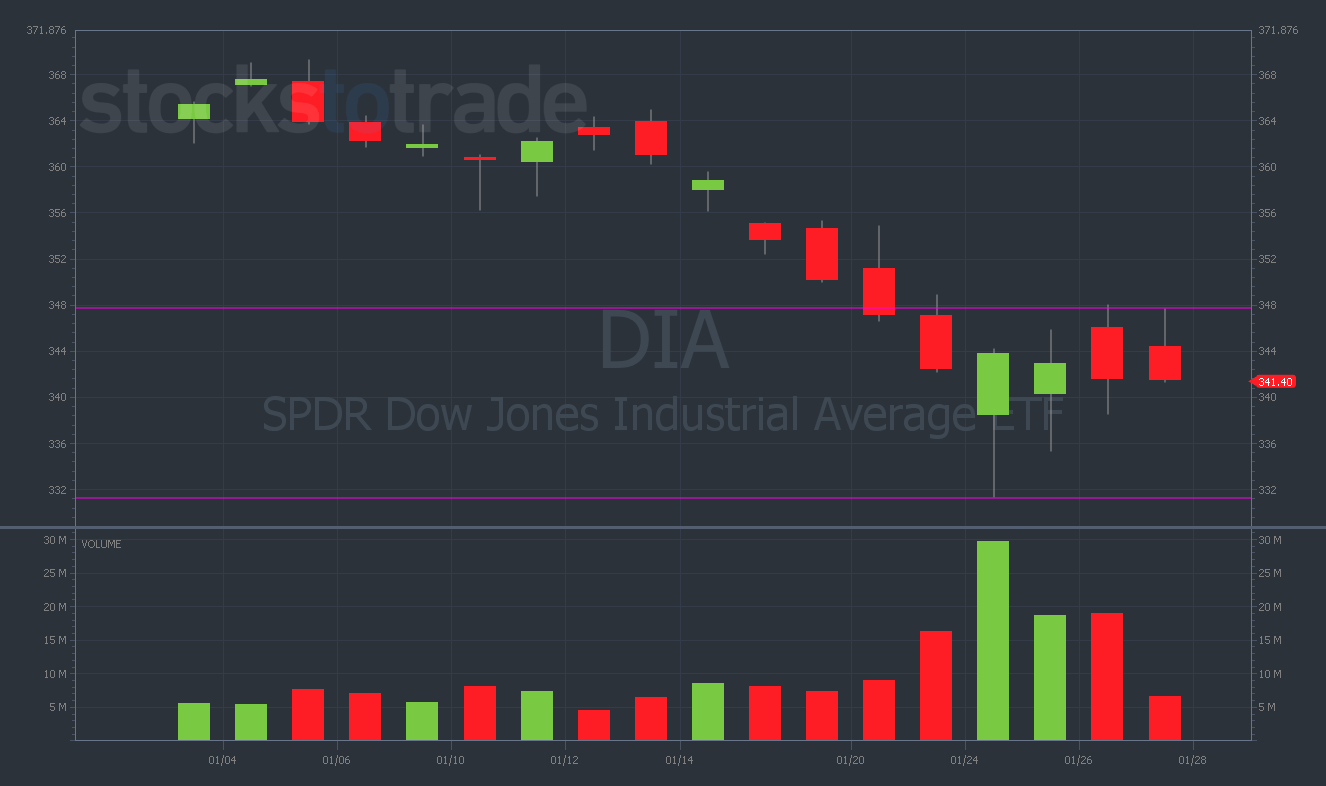

On Wednesday, I bought SPDR Dow Jones Industrial Average ETF (DIA) 2/18/2022 $330 puts for $5.20.

Key Levels: $330 (support) and $348 (resistance).

Here’s what I think … If the market was about to ramp higher, we would’ve seen a stronger bounce yesterday.

It’s tough to make a call here, but I’m drawing a line in the sand and predicting that the indexes head lower.

I’m using yesterday’s high of $348 as my risk level for this play. If DIA boosts above $348 on volume, I’ll likely cut this entire position.

But so far, the price action has been encouraging. This morning we got a clean rejection. Where? You guessed it … just cents below $348. Take a look at the daily chart:

This is a unique play for me in a few different ways. I’ve had several questions from students about it. Let’s go over some of them now…

“Why are you trading DIA as opposed to SPY or QQQ?”

I decided to buy puts on DIA because the Dow Jones hasn’t taken as brutal of a beating as the S&P 500 or the Nasdaq has … yet.

To put this in perspective, take a look at the YTD peak-to-trough losses for each of the three major indexes:

- S&P 500: -12%

- Nasdaq: -17%

- Dow Jones: -10%

As you can see, there’s a gap to fill. DIA hasn’t been hammered as hard as its counterparts — and I think there’s room for it to catch up on the downside.

“Why are you buying monthly options for this position (and not weeklies)?”

One of the most beautiful things about options trading is the ability to customize your time horizon. Let me explain…

If I’m extremely confident in a short-term move to the downside, I’m buying weekly puts every single time.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

But occasionally, a setup like DIA comes along, where I’m comfortable with the odds of a move lower — but I’m not fully convinced that it’ll happen in the next few trading days.

For these sorts of medium-term setups, monthly options are the way to go.

They still provide enormous upside if you’re right about the price action, but your position won’t lose half of its value in a day if you’re wrong about the timing.

“Why are you buying puts instead of shorting common shares?”

Two words: defined risk.

Honestly, I’m not sure why anyone would short common shares when the ‘option’ to buy puts is on the table (excuse the pun). Here are my thoughts…

Shorting stock has theoretically unlimited risk. If the stock you’re shorting rips to new highs, you can potentially lose more money than you invested in the position.

CAUTION: Don’t let this happen to you!

On the other hand, if you buy puts, you can only lose the amount you invested.

Additionally, put options have considerably more upside on the way down than common-share shorts do. Let’s look at an example…

Say you’re watching Stock XYZ and it’s trading for $100. If you sell shares short, and the stock goes to $0, you’ll make 100% on your principle.

Not bad, but not great for the amount of risk you’re taking.

But in the same hypothetical, where XYZ goes to $0, put options on any strike price would pay several multiples more than the common-share short. This is why I trade puts…

Bottom line: I can potentially make more money — while simultaneously risking less — on a put position vs. a common short position.

Conclusion

So far, I’m seeing exactly what I want on DIA — a clean rejection at yesterday’s high of $348 followed by unstoppable selling throughout the morning.

Now we’ll have to wait and see if the downtrend continues. If DIA drops near the $330 level, that’s when I’ll think about selling some (or all) of this position.

I think the odds are in my favor now, but you never know what will happen next in this volatile bear market.