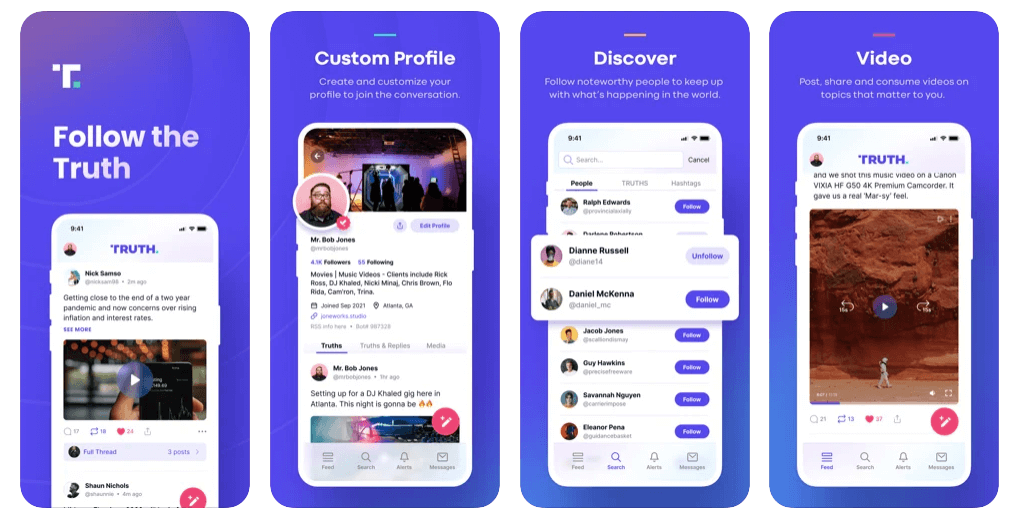

The “Trump SPAC”, created to bring the brand-new Truth Social app to the public markets, is #1 on both StockTwits and the Apple App Store this morning.

Image Source: Apple

The Truth Social app just went live last night, which is why today is such a critical day for DWAC stock.

With so much retail enthusiasm around such a speculative name, I’m intrigued at the prospect of buying puts on DWAC.

And speaking to all the day traders out there, there’s a VERY SPECIAL event coming up that you won’t want to miss…

My mentor Tim Sykes is hosting an all-day live trading session on Thursday, February 24! Learn Sykes’ method for finding the BEST STOCKS (even in a slow market!) Click here if you’re ready to trade!

But now it’s time to go over a few key points on what I’m looking for with DWAC.

Key Level: $90 Support

- The key support level I’m focused on today is $90.

- DWAC has consistently bounced at or near this level.

- If it loses $90 … look out below. But if it holds $90, that could be a sign of further strength.

Key Level: $100 Resistance

- The key resistance level I’m watching is $100.

- Big round numbers (like $100) tend to create psychological resistance.

- WARNING: Any move past $100 on high volume could trigger a massive short squeeze!

CAUTION: Extremely High Implied Volatility (IV)

- The risk/reward on the DWAC options chain is hard to stomach due to elevated IV.

- Market makers are pricing in a huge move, making the options more expensive.

- If I do buy DWAC puts, I’ll have to be perfect with my timing to catch the perfect near-term downside.

Waiting for a Huge Squeeze

- Ideally, I’d love to buy DWAC puts into a rollicking short squeeze.

- I think a high-volume move to the $150–$200 area is possible.

- If such a squeeze occurs, the risk/reward on puts will become considerably more attractive to me.

Final Thoughts

If you’re considering an options trade on DWAC … be cautious!

Don’t ignore the high premium on the contracts. Your timing must be perfect.

And keep a close eye on the $90 and $100 levels for a potential break above (or below) that range.