Happy Friday, Evolvers!

This needs your attention…

Are you chasing dangerous plays?

I see some students missing the mark when they’re analyzing charts, leading to some potentially disastrous trades.

In today’s Q&A, I’ll explain why chasing the upside on overextended momentum charts is a recipe for disaster.

Keep reading and I’ll answer your questions…

“Would it be chasing to buy NVDA $320 calls for next week?”

I definitely wouldn’t trade calls on Nvidia Corporation (NASDAQ: NVDA) into next week.

If anything, I’m licking my chops waiting to short this stock.

But before we get into NVDA, to answer your question, let’s review exactly what chasing is…

To me, if a stock has several green days (or weeks) in a row without consolidation, and you enter a long trade … that’s chasing the upside.

On the other hand, if a stock sees several days of red without a bounce and you go short … that’s chasing the downside.

Chasing volatile stocks is extremely risky, especially if the chart has already moved significantly in a particular direction … like NVDA.

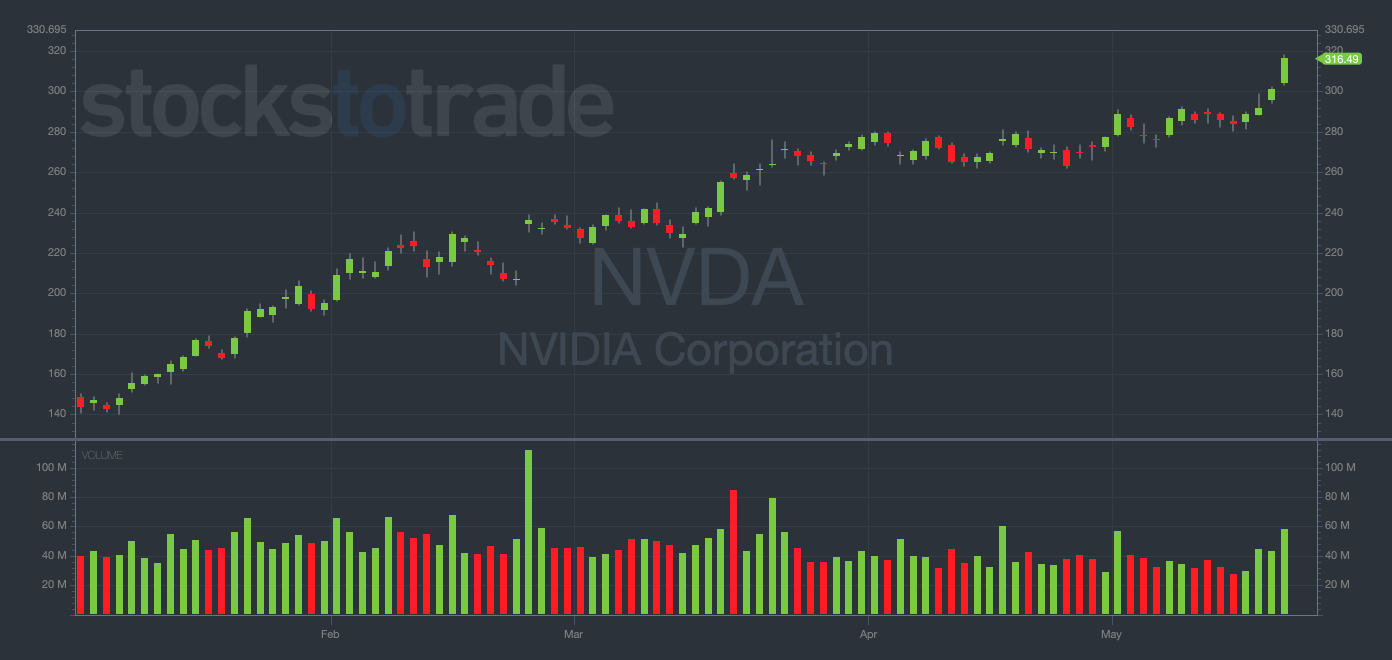

Just take a look at this chart…

NVDA YTD daily chart — courtesy of StocksToTrade.com

NVDA has done nothing but go up in a straight line for the entirety of 2023. The stock has gained more than 120% YTD!

This week was also a particularly bullish one, with NVDA surging 10%+ in the past five days alone.

Moreover, NVDA reports earnings next week on May 24. Any trade placed prior to the report is simply gambling on the result (and the market’s reaction).

If you look at all of this and want to buy calls, I think you should consider recalibrating how you analyze charts…

In my view, NVDA is actually a screaming put-buying opportunity as soon as momentum shifts.

Bottom line: I wouldn’t recommend that anyone chase NVDA calls at these levels. Be cautious with all longs in this market.

“Are there any aspects of trading you don’t like? How do you deal with them?”

I love most aspects of trading, so it’s somewhat hard to pick something I don’t like.

However, if I had to choose, it would be dealing with losses…

No matter how long you’ve been trading or how much money you have, it always hurts when you lose more than you expected.

But in the end, it’s actually a good thing. If losses didn’t hurt so much, we wouldn’t feel motivated to fix the mistakes that caused them in the first place.

The important thing is to turn the pain of losing money into something positive.

Use it as a reason to avoid feeling that way again.

Instead of dwelling on your mistakes, focus on identifying and fixing them.

Think of losses as opportunities to learn. There’s always something valuable to take away from a trade that didn’t go well.

Nowadays, I don’t fear losses anymore. I confront them directly and learn important lessons from them.

Does it still hurt to lose thousands of dollars in a few minutes? Definitely.

But losses are something that every trader has to face…

Trying to avoid them completely is pointless. What matters is learning from your mistakes.

Final Thoughts

Have a great weekend, Evolvers!

Be extremely careful with your long positions going into next week.

And whatever you do, don’t chase!