Right now, it seems like every retail trader on the planet is talking about one stock — Revlon Inc. (NYSE: REV).

REV came out of nowhere with a massive short squeeze at the end of last week. The struggling nail polish manufacturer has since taken the market — and specifically the options pits — by storm.

After filing for bankruptcy last Wednesday, REV took off into a bullish frenzy as Reddit meme stock traders started talking up the name in huge numbers. It’s now up more than 650% in the past two weeks.

Remember the wild post-bankruptcy move in Hertz Global Holdings Inc. (NASDAQ: HTZ) a while back? This REV squeeze feels very similar to that one — pure hysteria that makes no sense.

When I see momentum stocks get this hyped up, I start to think about buying puts. After all, I’d love another win like my $200,000+ trade last week.

But a very specific problem is making it difficult for me to justify buying REV options at these levels.

Keep reading and I’ll show you what I mean…

Timeline of Events

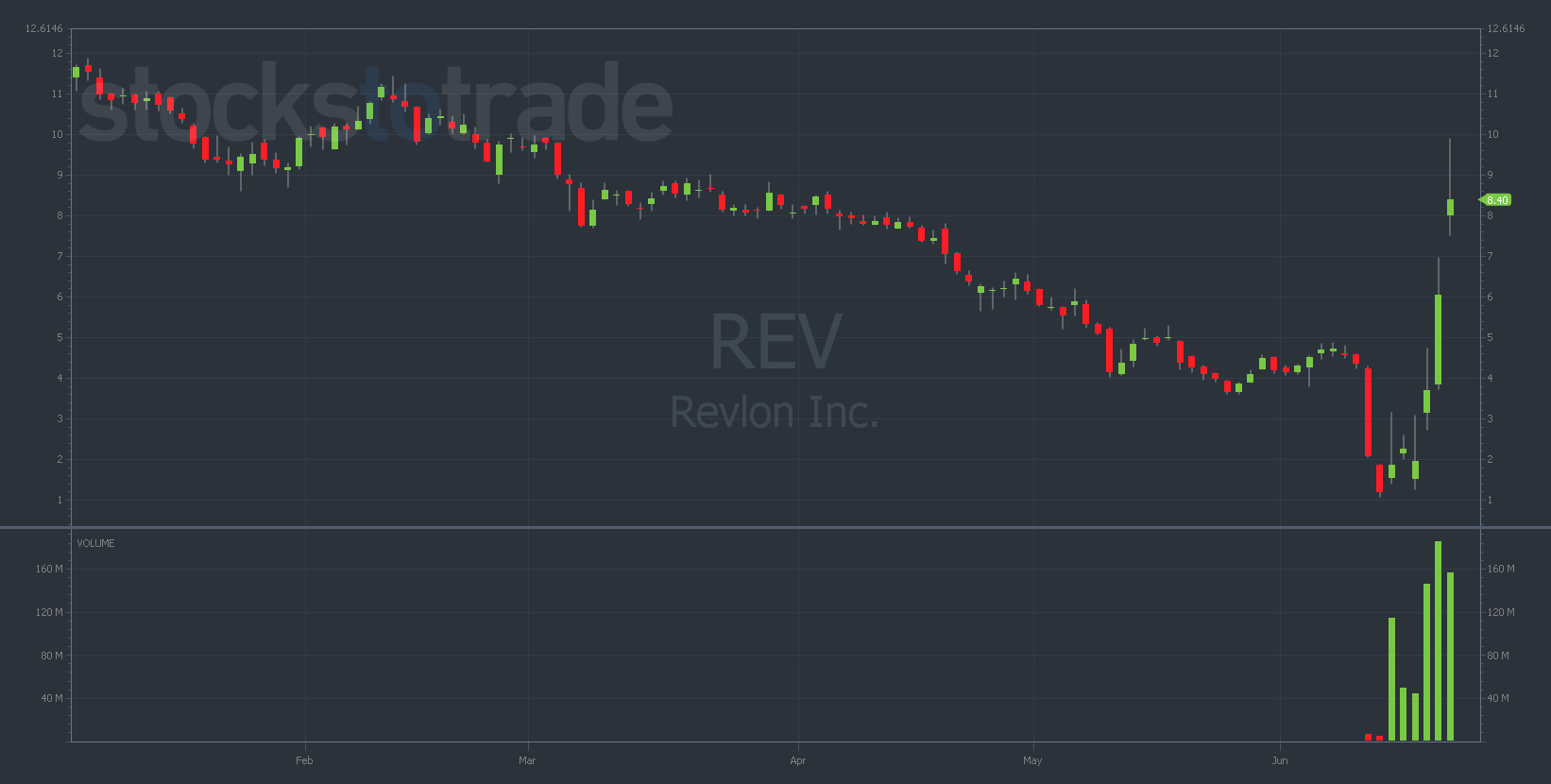

REV YTD daily chart — courtesy of StocksToTrade.com

Before we break down the options chain for REV, let’s run through a brief timeline of what’s happened with this crazy stock so far…

Tuesday, June 14: REV opened 30% higher than Monday’s close, then gained as much as 100% intraday, closing at $1.87.

Wednesday, June 15: REV opened 12% higher than Tuesday’s close, then gained as much as 22% intraday, closing at $2.25. (This was the day that the company officially filed for bankruptcy.)

Thursday, June 16: REV opened 33% lower than Wednesday’s close, but recovered some gains intraday, closing at $1.95.

Friday, June 17: REV opened 55% higher than Thursday’s close, then gained another 55% intraday, closing at $3.73.

Tuesday, June 21: After the long weekend, REV opened trading on Tuesday only 2% higher than Friday’s close. But then, the stock gained as much as 80% intraday, closing at $6.06.

Wednesday, June 22: REV opened 30% higher than Tuesday’s close, then gained as much as 25% intraday, closing at $8.39. Meanwhile, a perfect double top appeared at $9.44 — the stock backed off at this level once at 10:25 a.m. Eastern and then again at 2:10 p.m.

At this point, I was interested in potentially shorting this stock. But when examining the prices of the options chain, it was clear that buying puts would be a risky move…

The Problem With REV Options

Some momentum stocks get so hot that the options become expensive to the point of being untradeable. Unfortunately, this is the case with REV options currently.

This is all due to a concept we’ve discussed before — implied volatility (IV).

Do you know this mystery man?

He’s just discovered one of the most powerful ways to take on this bear market as a trader…

All from exploiting one tiny niche of the stock market (only 4% of stocks) that can bring in 2x, 5x, even 10x BETTER returns than penny stocks.

And he just went live on camera to talk with the public for the first time.

When a stock makes double-digit moves day after day, market makers (individuals who sell options to traders like us) have no choice but to spike the premiums (the price of the options contracts) to astronomical levels.

Market makers do this by raising the IV associated with the contracts. This week, the IV on REV has been hovering around 400% for at-the-money straddles. That’s insanely high. To put this in perspective, ‘normal’ stocks usually have around 50-80% IV.

The high options prices are caused by the same mechanic that brings huge gains to the share price — a gamma squeeze.

Options contracts are leveraged (representing 100 shares of the underlying stock). So gamma squeezes generally spark more uproarious price action than a traditional common-share short squeeze.

It’s like a short squeeze on steroids.

Gamma squeezes are some of the only setups that offer options traders the ability to book 1,000%, 5,000%, or even 10,000% gains (I’ve seen it).

However, gamma squeezes bring huge surges in IV as well, making every option trade considerably more expensive.

Additionally, another issue has been the lack of weekly options offered on REV. If weeklies were written we could buy cheaper REV contracts.

But with only monthly options available, the IV has spiked the premiums to extreme levels. The contracts are expensive and the risk/reward is skewed. The IV will be working against you.

In other words, the setup needs to be a picture-perfect bullseye to make these expensive contracts worth it.

Final Thoughts

The same factors that make trading options so incredibly exciting — time decay, implied volatility, premium spikes — can occasionally render them untradeable.

This is the problem with REV options, for now.

If you miraculously got in on this trade before the premiums went crazy, congratulations. For the rest of us, the only move is to patiently sit on the sidelines and wait for a big dip in premiums (which probably won’t happen until the best moves have already happened).

That said, if REV squeezes up to $10 or $11, I might find the downside too juicy to pass up for a small position.

This is why you need to be acutely aware of the individual factors that affect the pricing of contracts.

If you stay on top of these things, you can potentially avoid entering trades that are working against you from the start.