Today, I’d like to take a break from our normally scheduled trading lessons to discuss the story that’s been rocking the finance world for the past week…

Of course, I’m talking about the overnight implosion of Sam Bankman-Fried (SBF) and his crypto exchange, FTX.

It’s not every day we see a fall from grace of this magnitude…

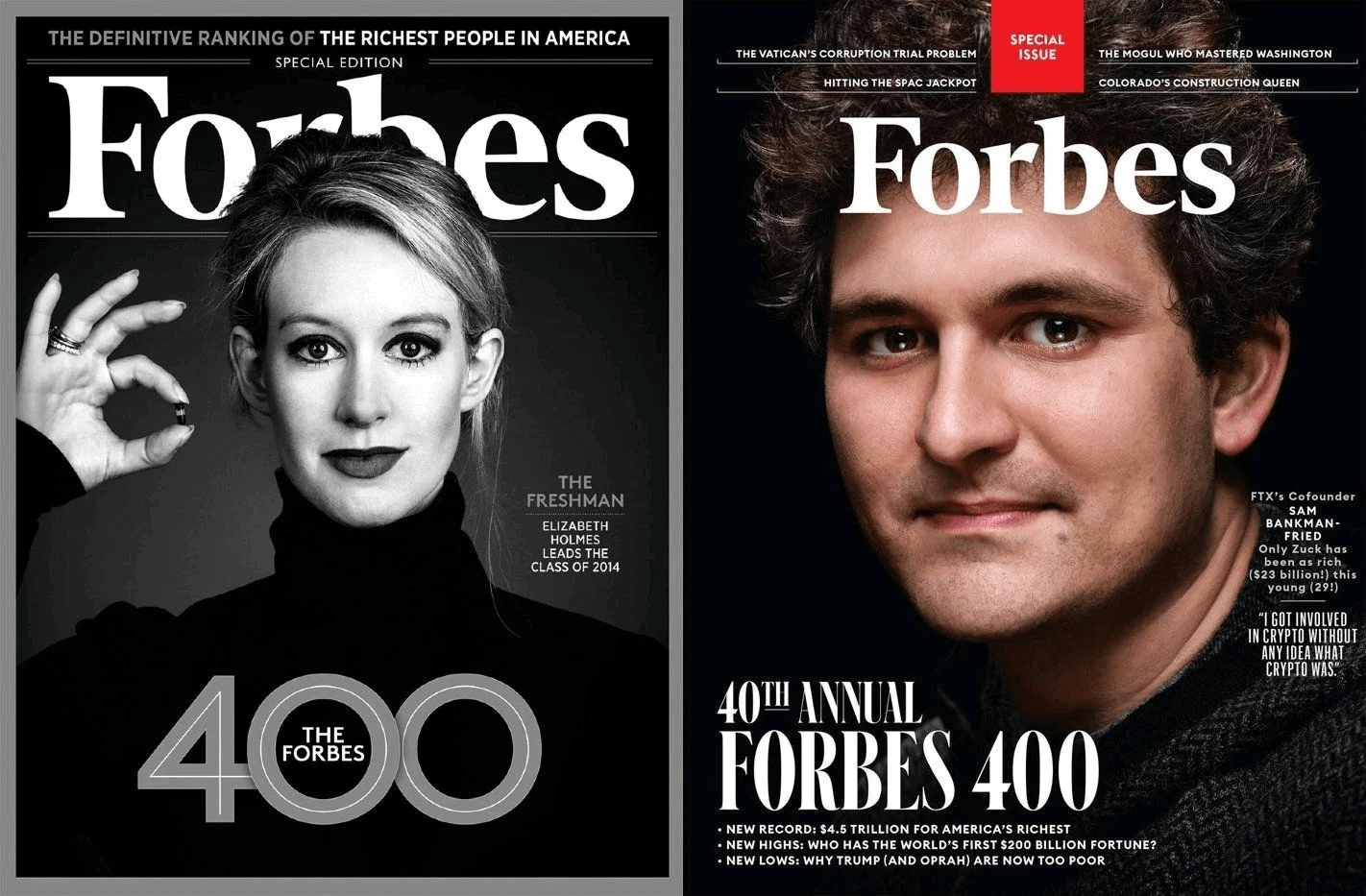

SBF went from being one of the most revered, lauded, and richest figures in crypto (at one point being featured in Forbes’ ‘30 Under 30’ with a reported net worth of $22.5 billion) to a bankrupt disgrace in less than 24 hours.

Notice who else was once featured on Forbes’ world-renowned list…

Yikes! I’m not normally interested in going over the news with my students, but…

This story is too big to ignore — a tale that’s mind-blowing, earth-shaking, and paradigm-shifting.

Even if you aren’t a crypto trader — or you’re someone with little interest in the sector — you’ve gotta understand what happened to FTX and what led to the company’s rapid-fire demise.

Why? Because there’s much to learn from SBF and FTX’s sudden plunge. The implications of this story are reaching far beyond the crypto sector and rippling through the entire market.

Keep reading and I’ll show you what I mean…

A Brief Recap of the Events So Far

Without boring you with details you can read on any financial news outlet … allow me to briefly summarize what happened to SBF and FTX.

The first thing to understand is that crypto exchanges aren’t regulated in the same way stock exchanges are.

Entities like the SEC and FINRA haven’t yet set hard-and-fast rules for regulations in the crypto sector.

This makes the crypto sector a potential ‘wild west’ of fraud, scams, and schemes.

Once your money is deposited onto an unregulated crypto exchange, it might as well be sitting on a Chinese online poker platform.

In other words, your funds aren’t safe. There’s no guarantee that you’ll get your money back when you want to withdraw it, which has been evidenced multiple times this year…

Watch This BEFORE 9:30AM!

Have you seen what Tim Bohen has been up to EVERY morning between 9:29 and 9:30am?

If not, click here now because he’s getting ready to do it again.

Do NOT wait to see this.

For example, simply look to another multi-billion dollar crypto scam from this year — the downfall of Do Kwon’s Terraform Labs and LUNA token — to see the common symptoms occurring in this unregulated breeding ground for scams.

The FTX debacle is similar. It all started when FTX entered a “liquidity crunch”…

Then, rival crypto exchange Binance signed a letter of intent to purchase FTX. That is, until Binance did due diligence…

What it found must have been damning. Just one day later, Binance withdrew its offer to buy FTX, citing mishandling of user funds.

FTX allegedly used user deposits to make speculative bets on unregulated crypto tokens through its sister company Alameda Research.

When the trades went belly-up, those user funds disappeared, and both companies immediately filed for bankruptcy.

To make matters worse, just hours after filing for bankruptcy, FTX said it was investigating “unauthorized transactions,” where another $515 million flowed out of the company’s coffers to who knows where. It was hacked.

If you’re wondering how so many ‘sophisticated investors’ let this happen … you’re not alone.

How did SBF convince the world he was a modern-day crypto Robin Hood masquerading for the good of the world … when he was likely doing the exact opposite?!

The answer lies in a phenomenon as old as the stock market…

SBF is Like All Other Promoters

FTX’s multi-billion dollar grift is just another example of a virus that’s endemic to the crypto and stock markets — promoters.

There will always be scummy promoters trying to convince the masses to invest in their doomed products.

(This is why my mentor, Tim Sykes, has been warning traders about the dangers of trusting stock promoters for years.)

I can't help but laugh when people say they're so surprised by FTX & SBF's collapse/shady dealings…#Crypto has CONSISTENTLY been the single most scam-filled sector I've ever seen, making penny stocks/forex, even binary options look like angels. Play with scams, you get scammed!

— Timothy Sykes (@timothysykes) November 11, 2022

Get it through your head that you cannot trust anyone in finance, especially traders who don't show ALL trades/performance publicly. SBF is NOT the only scammer, there are thousands of scams/fakes on Twitter alone, SBF/FTX was just a big one so be more cynical & wake the fuck up

— Timothy Sykes (@timothysykes) November 11, 2022

Think about the litany of highly-publicized financial scams we’ve seen in recent history: Enron, WorldCom, Madoff, Theranos, Nikola … the list goes on!

SBF and FTX are no different. He’s not the first grifter in markets and he won’t be the last.

But he found an opportunity to create a scam in the unregulated world of cryptocurrency, making it difficult for even the smartest traders to see through his smoke screen of fraud.

Even worse, he used the guise of charity (which he dubbed “effective altruism”) to lure unsuspecting market participants into an ‘investment’ they thought would ultimately be used to help those less fortunate.

Instead, it turns out it was all about enriching those involved.

Proprietary Algorithm Forecasts The 20 Hottest Stock Movers … Before The Market Opens!

Traders have seen stocks move 35%, 72% and 275%+ within a day, by replacing shady “mainstream” watchlists

SBF even had the gall to boast about how little he spent — masquerading as a homeless, multi-billionaire programmer — sleeping on a beanbag in the FTX offices and driving a Toyota Corolla…

When in reality, he was buying over $70 million in Bahamian real estate and living in a $40 million, 12,00 square foot penthouse dubbed “The Orchid.”

You can’t make this stuff up.

Meanwhile, $1 billion-$2 billion in user funds have disappeared from the platform as law enforcement officials at home and abroad try to deconstruct what really happened, where in the world SBF is, and if those funds can ever be returned to their rightful owners.

Now, think about this quote from the aforementioned Forbes article: “[Fried] was fundamentally more interested in ethics and morality. ‘There’s a chicken tortured for five weeks on a factory farm, and you spend half an hour eating it,’ says Bankman-Fried, who is a vegan. ‘That was hard for me to justify.’

So, it was difficult for this guy to justify others eating chicken, but he had no problem gambling (and losing) over $1 billion from his trusting investors, while spending their money on the sorts of lavish things he claimed to resent?

Final Thoughts

There are many lessons to learn from this insane story.

But I think the most important thing to remember is to take everything you hear from so-called “geniuses” with a grain of salt.

If they haven’t proven their results with receipts … there’s no reason to believe them.

You never know who’s a scammy promoter trying to take your hard-earned money away.

And in the crypto industry, those characteristics are more common than anywhere else in the markets.

Please be careful out there, Evolvers!