One topic I get asked about all the time is setup selection.

Aside from volume, chart, and catalyst … How do I decide which setups are promising and which aren’t worth my time?

While there’s no surefire way to guarantee a setup will be a winner, there are areas you can focus on to potentially increase your chances of success.

And with the market as hot as it is right now, two specific categories of setups are at the top of my mind.

Without these setups, I’d be lost…

Keep reading and I’ll show you how to find them…

Pay Close Attention to Former Runners

When I see a stock moving, one of the first things I check is whether the stock’s a former runner.

A former runner is a stock that has made significant moves in the past — and it makes a big difference when determining potential trade setups.

REMEMBER: If a stock has moved big in the past, it’s likely to move big again in the future!

When it comes to volume and momentum, a stock that has already proven itself is far more likely to see a bullish move in the near term than a stock that never blasted off in the first place.

It’s a psychological thing. A stock with a history of runs and high volume attracts traders’ attention when a catalyst starts driving the stock again.

WARNING: Many traders focus on one-day spikers that are far less likely to continue their moves. This is a mistake!

Instead of getting distracted by one-day spikers, try to prioritize former runners…

That way you can have increased confidence and conviction of a major move happening when you see a promising setup forming.

As a significant catalyst develops, the chart pattern of a former runner can become a self-fulfilling prophecy of sorts. The bullish price action tends to repeat.

That said, remember that not all former runners will run again. You should reference The 3-Item Checklist, along with any other criteria you have for your trades, before simply trading a former runner on face value alone.

My advice? Be prepared by keeping a watchlist of former runners by sector.

That way, once a sector starts moving, you can look at your list and track the potential moves…

The Value of Trading Hot Sectors

Let me be blunt. Most traders lose because they aren’t prepared.

But I also notice many traders making it more difficult than it needs to be.

One problem they have? Trading stocks that aren’t in hot sectors…

If you follow my trades, you’ll notice that I pretty much only trade stocks in volatile, momentum-driven sectors.

If a sector or stock doesn’t have the volatility or momentum I look for, I don’t trade it. Pretty simple.

Here’s another important point about sector momentum…

Like former runners, previous hot sectors can always run again. You can use that to prepare.

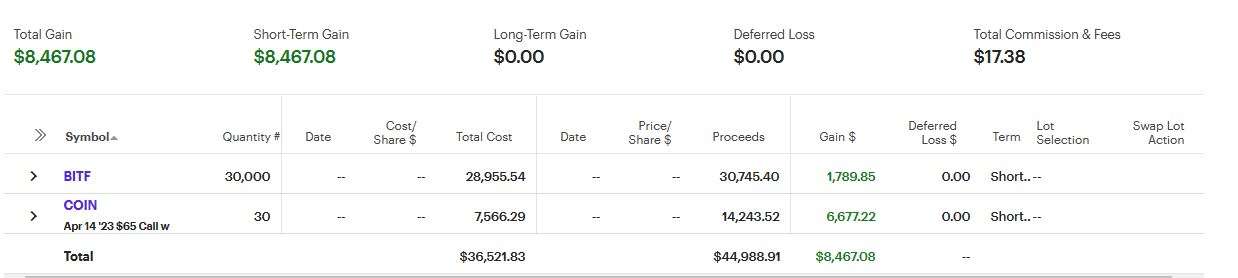

For example, when crypto was heating up in April, I knew it was a hot sector with former runners in it…

But one major player in the sector was lagging behind its peers…

This led me to buy calls on Coinbase Global Inc (NASDAQ: COIN) as a sympathy play and I nailed an 88% profit by doing so…

Additionally, tech is on fire right now. The Invesco QQQ Trust (NASDAQ: QQQ) is up 43% in 2023.

If you’re a long trader, it makes sense to be focusing primarily on tech stocks. Stick to the hottest sector.

Study the hot sectors. Learn — and follow — the sector leaders. And pay attention to how the other stocks move when the sector leaders move.

Hot sectors come and go. The question is will you be prepared to follow the money…

Final Thoughts

If you’re having trouble selecting five-star setups, stop overcomplicating things.

Look for former runners in hot sectors. Be patient and wait for the perfect moment to enter.

Some of the most straightforward and high-probability trades come from these categories. Don’t sleep on them.