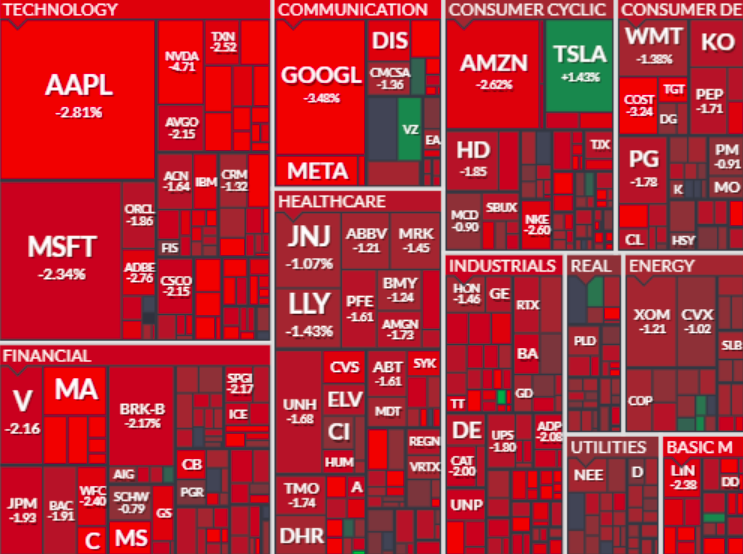

Yesterday’s Fed announcement was not what the market wanted to hear. And while inflation seems to be cooling off, the Fed Funds futures are pricing in a 52% chance of a 50 BPS hike for the March meeting.

To make matters worse, this morning, we received the worst retail sales numbers we’ve seen in nearly a year, as November retail sales fell 0.6%.

Of course, the market’s reaction to the news has been negative, and we’re now in jeopardy of missing out on the Santa-Clause rally.

I expect the market to stay volatile and choppy.

The current environment is extremely dangerous for traders. One or two poor decisions can lead to substantial losses if you’re not careful.

I want to keep you safe. That’s why I want to share with you the three adjustments you must make if you want to weather the storm and position yourself to make money when market conditions improve.

The Fed is not ready to stop raising interest rates. And now we are seeing softness in the economy, with the latest retail sales numbers showing a drop of 0.6%.

Fears of a recession are growing, and volatility in the stock market is surging.

As a trader, it’s hard not to get emotional and react to the news when stocks are moving so fast. However, more than ever, now is the time to be patient and selective.

If you want to survive this recent surge in volatility, I have three tips for you.

Trade Non-Correlated Stocks

When markets sell off like they do today, all stocks seem to be correlated.

However, small-cap stocks will often buck that trend, especially if they have a strong catalyst.

For example, despite the strong market sell-off this morning, the ticker symbol DPLS is surging. The company announced it would move from the OTC to listing itself on the NASDAQ Exchange via a business combination with Global System Dynamics.

The news was obviously positive, and the stock reacted accordingly…

Source: StocksToTrade Breaking News

If you’d like to discover more about trading uncorrelated stocks, I recommend you watch this video from my mentor Tim Sykes.

Pay Attention To Options Implied Volatility

During a market sell-off, option volatility shoots up. That means you are paying higher premiums. I like using options because they define my risk, but a good idea can be ruined if I’m paying too much for my options.

One strategy you can implement to help reduce the cost of your option trades is spreading your options.

For example, OTM $250 MSFT puts expiring in 15 days is trading at $5 per contract at the time of this writing. If you’re bearish on MSFT and don’t want to pay $500 per contract, you can sell a lower put strike against it to bring the cost down.

The OTM $240 MSFT puts expiring in 15 days are trading at $1.95. If you sold those against the $250 puts, your cost would be reduced from $5 to $3.05.

Spreading your option trades allows you to bring down the cost of the trade and lower the impact from higher implied volatility. The main drawback of spreads is that it defines your profit potential. But it’s a safer way to play options in a volatile market.

Reduce Your Trading Size

The price swings are greater in market sell-offs. That means you should reduce your trading size. If you trade your normal size you can get stopped much faster because there’s more volatility.

Another consideration is to piece into trades. For example, if you wanted to dip buy with the plan of buying ten option contracts. You might want to consider buying five contracts first, leaving you with some dry powder to add and get better pricing later.

But what you don’t want to do is trade the same size you’ve been using and the same levels of stopping out. You’ve got to adjust your stops wider. And that’s another reason why you should be trading smaller during this volatile stretch in the market.

Final Thoughts

Now is not the time to be playing hero ball. Stocks are very sensitive to news headlines, and the market seems vulnerable. If you want to stay ahead, focus on non-correlated stocks, avoid paying high option premiums, reduce your trading size, and widen your stops.