You’ve heard me say it before — knowing your history is critical in trading and the market.

If you don’t know your history, you can doom yourself to repeating obvious mistakes from the past.

Yesterday, we went over part one of options trading history.

Now, we’ll bring the story up to the present day. Grab your popcorn and let’s get to it.

April 26, 1973: Chicago Board Options Exchange Opens

April 27, 1973, might be the single most important day in the history of options trading. It was when the Chicago Board Options Exchange (CBOE) first opened its doors.

Located at 400 South LaSalle Street in Chicago, the CBOE is the largest options exchange in the world.

Growing A Small Trading Account? Check this Out

When multi-millionaire trader Mark Croock first started trading, he was an overworked and underpaid accountant…

So he knows what it’s like to start small while wanting to massively grow your wealth as quickly as possible.

That’s why he just recorded a step-by-step training that reveals what he believes is the best options trading method for someone trading with a small account.

And back then, the CBOE “pit” was to options trading what the Colosseum once was to gladiator fighting…

Every day, hundreds of traders stormed the pit, yelling and screaming their orders in a process known as “open outcry” trading.

Fortunes were made and lost in the CBOE pit throughout the 70s and 80s. The derivatives market grew exponentially as a result, giving birth to options trading as we know it today.

Of course, now almost all trading takes place online — but we’ll get to that later…

May 1973: The ‘Black-Scholes Formula’

As the CBOE was changing the options market in person, two mathematicians were working on changing the way options prices were calculated.

Fischer Black and Myron Scholes created an equation — now known as the Black-Scholes Formula.

Their formula showed how to determine a stock option’s price. It included the underlying stock’s price, the stock’s volatility, the exercise price and maturity of the option, and the interest rate.

The constantly shifting options prices that we see today are a product of this very formula.

1982–1985: Online Trading Begins

In the early 1980s, the stock market would change forever with the invention of online trading platforms.

The very first online trading platform, NAICO-NET, came out in 1982. However, the program came with some drawbacks…

The software was clunky and expensive. Plus, online trading wasn’t liquid enough at the time to support the high cost to run the software.

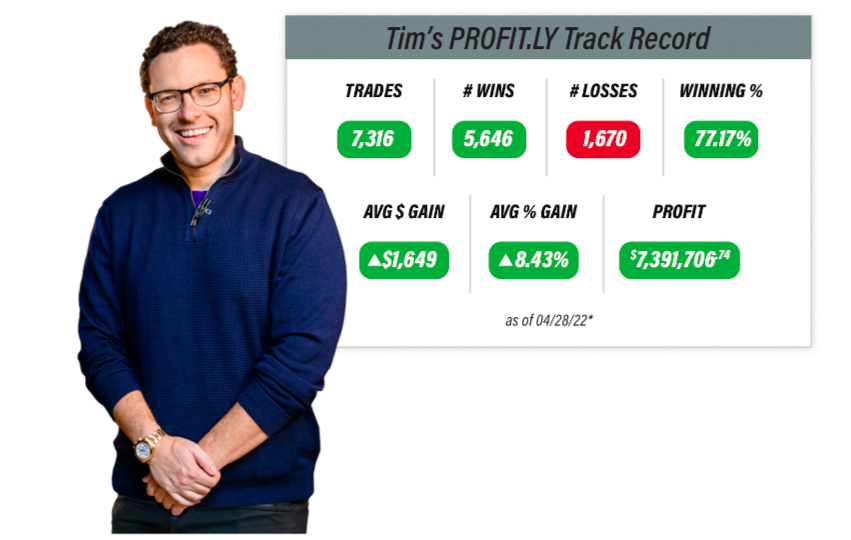

Learn the secret Tim used to turn a small investment into a fortune

And back then, the CBOE “pit” was to options trading what the Colosseum once was to gladiator fighting…

Every day, hundreds of traders stormed the pit, yelling and screaming their orders in a process known as “open outcry” trading.

Fortunes were made and lost in the CBOE pit throughout the 70s and 80s. The derivatives market grew exponentially as a result, giving birth to options trading as we know it today.

Of course, now almost all trading takes place online — but we’ll get to that later…

May 1973: The ‘Black-Scholes Formula’

As the CBOE was changing the options market in person, two mathematicians were working on changing the way options prices were calculated.

Fischer Black and Myron Scholes created an equation — now known as the Black-Scholes Formula.

Their formula showed how to determine a stock option’s price. It included the underlying stock’s price, the stock’s volatility, the exercise price and maturity of the option, and the interest rate.

The constantly shifting options prices that we see today are a product of this very formula.

1982–1985: Online Trading Begins

In the early 1980s, the stock market would change forever with the invention of online trading platforms.

The very first online trading platform, NAICO-NET, came out in 1982. However, the program came with some drawbacks…

The software was clunky and expensive. Plus, online trading wasn’t liquid enough at the time to support the high cost to run the software.

WSB traders used call options to create a gamma squeeze — where options amplify a short squeeze by 100 times. It’s like a short squeeze on steroids.

The GME gamma squeeze sent ripples through the entire market, and in my opinion, changed options trading forever.

Final Thoughts

I hope this short history lesson has given you some valuable perspective.

We only scratched the surface. But this historical context can help you understand the wildly complex options market we trade today.

In turn, my favorite bit of wisdom from Tim Sykes still holds true — know your history.