Most of you know that I’m a technical trader. I use technical indicators to gauge the future market direction and lead me toward potentially promising setups.

In that spirit, I’ve been diving deep into technical analysis over the past week, trying to find hints as to where the markets may be headed next…

A few indicators, in particular, are standing out to me right now … and they’re not what you might think.

Instead of looking at individual stocks or indexes, I’ve been tracking commodities and currencies…

In other words, I’m switching my analysis up based on the current market environment…

Specifically, I’m finding clues within the charts for the Invesco DB U.S. Dollar Index Bullish Fund (NYSEARCA: UUP) and the SPDR Gold Trust (NYSEARCA: GLD).

The U.S. dollar and gold trade inversely, but both have a huge effect on how the S&P 500 ETF Trust (NYSEARCA: SPY) will perform in the near term.

If you understand how commodities, currencies, and stocks play together … you can get a huge leg up on your trading competition.

On the other hand, if you fail to understand how these charts play together, you could potentially misunderstand a hugely important aspect of the stock market.

Keep reading and I’ll show you what I’m talking about…

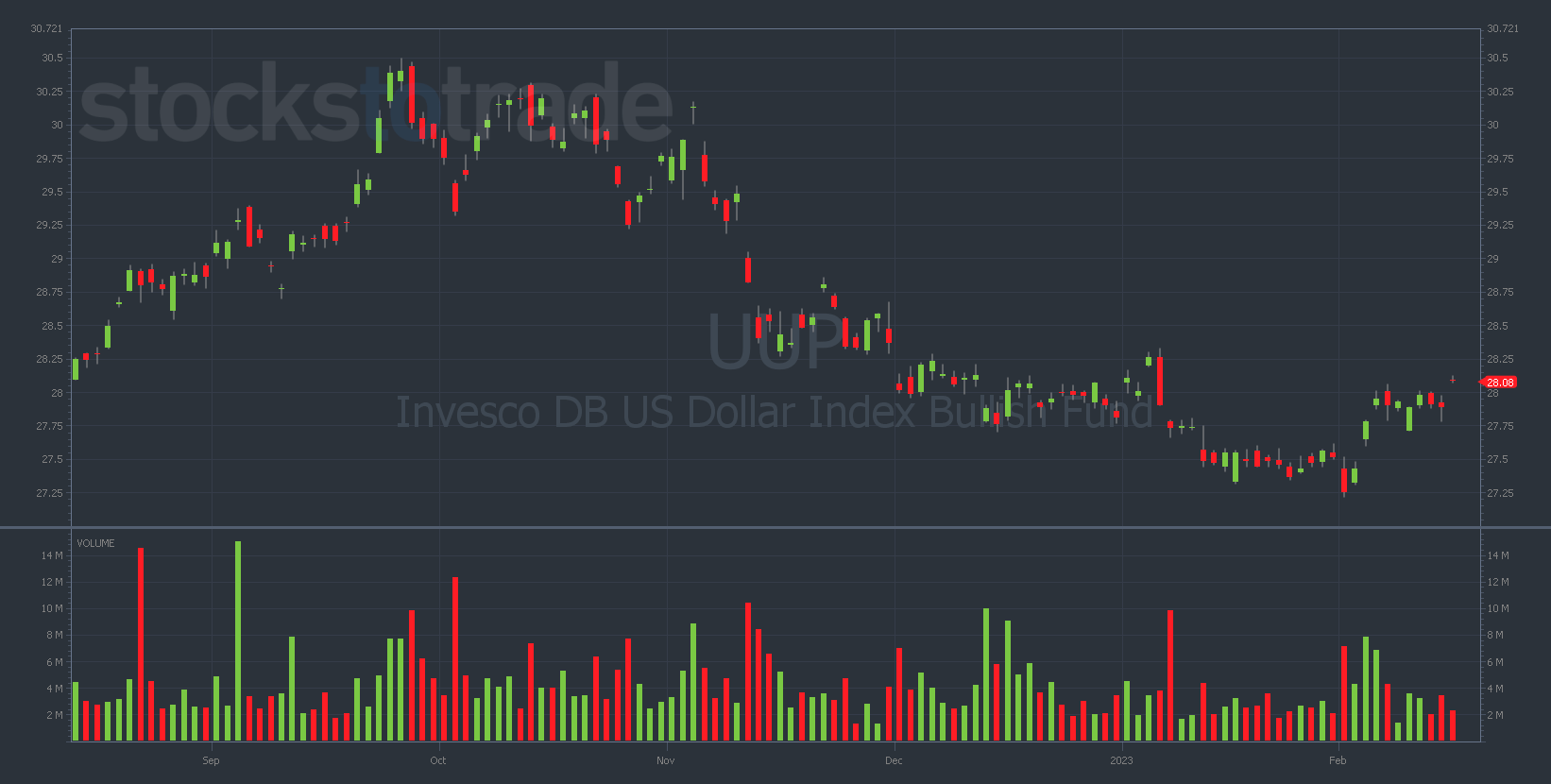

Invesco DB U.S. Dollar Index Bullish Fund (NYSEARCA: UUP)

UUP 6-month daily chart — courtesy of StocksToTrade.com

If you’ve been watching my weekly webinars, you’ve probably noticed that I’ve been tracking the U.S. dollar closely of late.

Why am I watching the dollar? It’s simple…

With the Fed raising rates over the last year or so, the U.S. dollar has become considerably stronger.

And this, in turn, affects the equity markets because the stronger the U.S. dollar gets, the weaker the stock market becomes.

Additionally, the dollar’s price action leads the markets to speculate how much further the Fed will go with interest rate hikes.

That’s what I’m watching UUP intraday. The chart has really regained its uptrend after breaking a multi-week downtrend.

And speaking of intraday trading … Tim Sykes is hosting an all-day LIVE trading event this Friday, February 17!

During this event, Sykes will finally reveal what he calls “the most disruptive trading technology he’s ever seen…”

But seats are limited and the only way to guarantee your spot is to register NOW!

Don’t miss out … claim your free seat by clicking right here!

(Now that you’re signed up, back to our lesson…)

Once again, I believe the U.S. dollar is trying to tell us that it’s risky to be in stocks right now.

Bottom line: This is not bullish for the equity markets!

All this to say, I think it’s critical to be tracking UUP in this environment. It’s been giving me major hints as to the near-term direction of the stock market.

And right now, the UUP chart is leading me to believe the market may be headed lower soon. Trade accordingly!

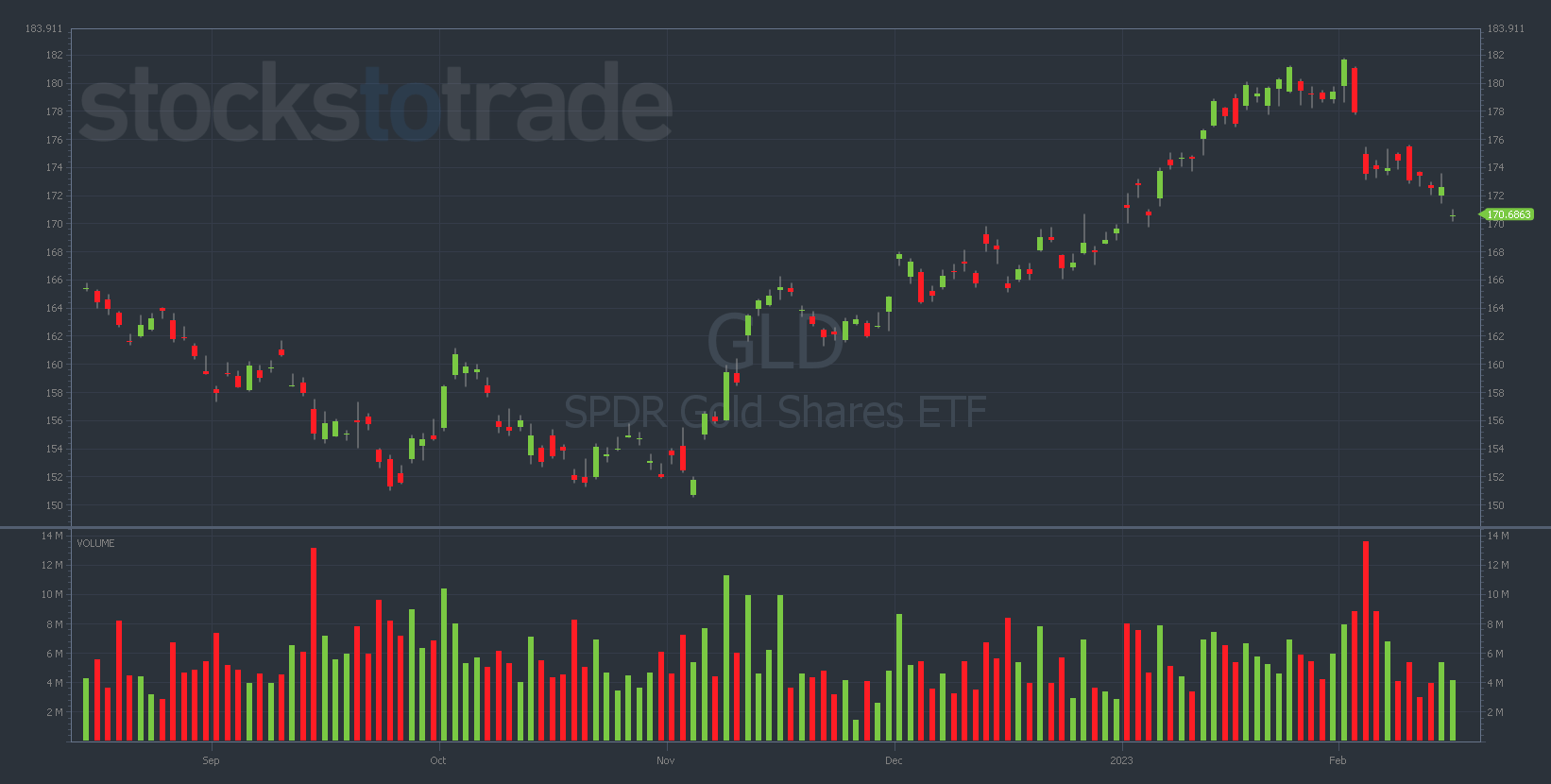

SPDR Gold Trust (NYSEARCA: GLD)

SPDR 6-month daily chart — courtesy of StocksToTrade.com

Aside from the U.S. dollar, I also like to use gold as a guide for my trades…

Gold trades inverse to the dollar, and you can see in the charts that gold is weakening because the dollar is strengthening.

Notice that gold has been gapping down as stocks have been surging over the past three weeks.

This shows me that the trend is very clear and that the markets may be topping out in the near term.

Now, I’m not saying that we’re going all the way back down to the lows and that the stock market’s gonna tank perfectly with gold as the dollar gets stronger…

WARNING: There are no guarantees in the stock market. And you must do your own due diligence on any trade you’re considering putting on … don’t just take it from me!

But based on what I’m seeing in the U.S. dollar and gold, I wouldn’t be surprised at all to see a considerable flush in the equity markets soon.

Final Thoughts

To me, the near-term trend is very clear…

The U.S. dollar is bullish, gold is bearish, and the stock market is showing several signs of heading lower.

I think it’s very important to watch what gold and the U.S. dollar index are doing because they go hand in hand and give us hints as to the direction of the major indexes.