Key Takeaways

- Revealing four more powerful trading lessons I learned from this historic year in the stock market…

- Revisiting the best aspects of my textbook trades on TSLA, MRNA, and BNTX…

- PLUS — Check out this EXCLUSIVE class Tim and I recently taught to help you get your small account to $100,000!

Happy Hanukkah, Evolvers!

Last night was the final night of celebration, but I’ve still got four more trading lessons from 2021 to share with you.

I had to learn many of these lessons the hard way. So I’m sharing them all here so you don’t have to.

Enough small talk — it’s time to study. Sit back, grab a latke, and get ready to learn some critical trading lessons…

Lesson #5: Patiently Wait for Ideal Setups

Let’s talk about a timely lesson for the ‘bear market’ we find ourselves in — you should patiently wait for ideal setups.

This is what I’ve been doing. By being patient, I found an ideal setup for the small account by trading puts on Nvidia Corporation (NASDAQ: NVDA) — but more on that next week…

I think it’s fair to say the broader stock market is in a short-term downtrend. Big picture — the S&P 500 is down 3% in just 10 days.

This kind of volatility can lead some traders to get overexuberant.

Trust me, I get it — trading a broad market dip can be very tempting. (For a trader with a negative bias like me, these market conditions can be downright tantalizing.)

But we must fight the urge to trade just because the market’s volatile. A volatile market doesn’t turn a subpar setup into an excellent one — but it can certainly fool newbie traders this way.

As soon as the indexes started dipping on November 22, I saw a lot of retail traders discussing their big wins shorting nearly anything.

Meanwhile, as certain stocks find bottoms, other traders may be having success dip buying. (That’s one of Tim Sykes’ favorite patterns.)

As all of this was going on last week, I reminded myself to be patient. And now I’m here to pass the message along to you…

Don’t let FOMO (or lack of discipline) get the best of you. This is not a market to mess around with.

Instead, sit on the sidelines until the setup you’ve been waiting for emerges from the rubble.

As a young’un with no discipline, I’d enter trades without an excellent setup. Don’t be like young me.

Patience is a virtue for any trader — harness it to your advantage.

Practice honing the discipline to wait for ideal setups and perfect chart patterns.

Lesson #6: Trust Your Gut

Here’s another vital pillar that I’ve taken away from my trading this year — trust your gut.

The biggest winning trades are often the most psychologically difficult. If you have strong conviction in your trade, stick with it.

I learned this lesson the hard way trading BioNTech SE (NASDAQ: BNTX) puts toward the end of September.

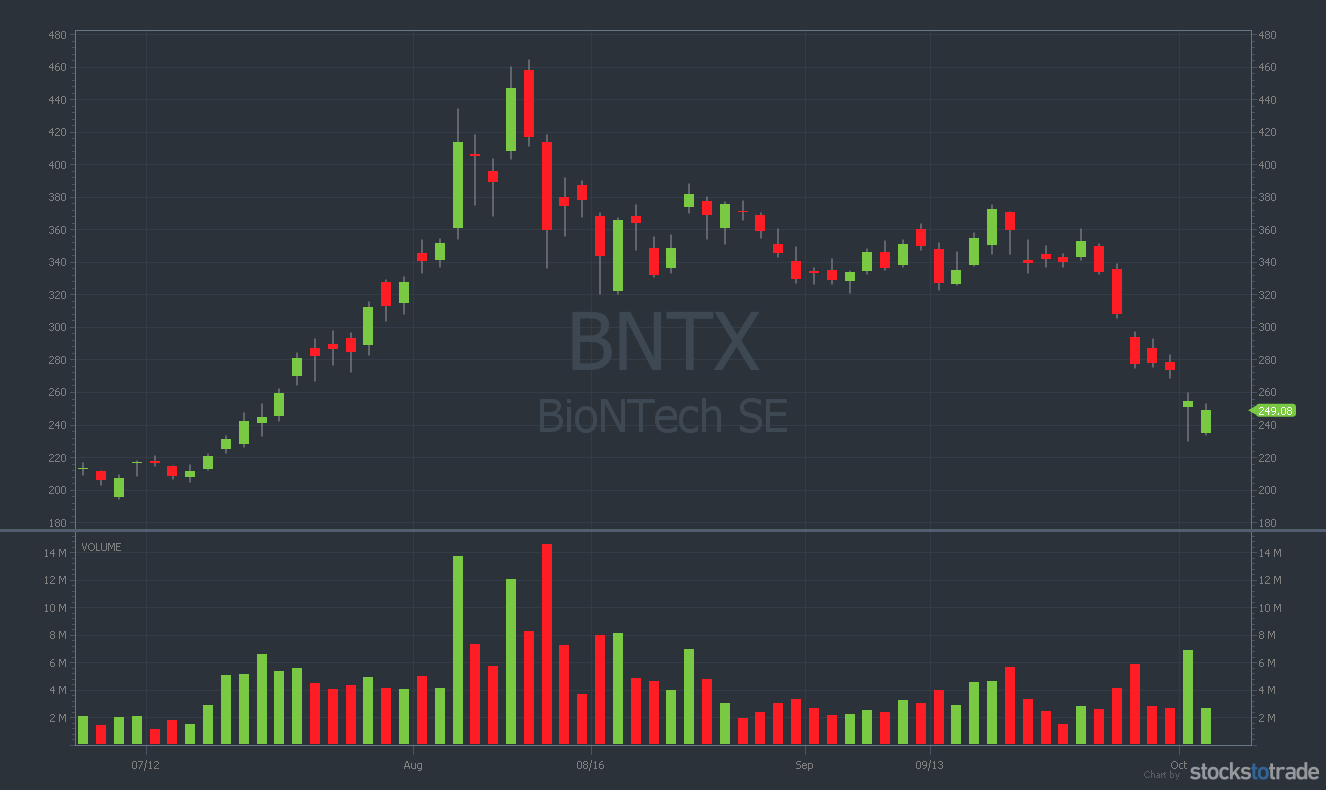

The daily chart had been in a steady downtrend since the stock hit a blow-off top at $464 on August 10:

But throughout September, BNTX had found strong support near $325. (It hadn’t closed below this level since mid-August.)

Naturally, I had this level bookmarked. If BNTX broke below it, I knew the price action would be ripe for put trading.

On Monday, September 27, this is exactly what happened…

By mid-morning, I could feel the weakness. 10 minutes later, I bought 25 BNTX 10/1 $300 puts.

These contracts gave me five days to hit my target, and I planned on holding as strong as I could.

Spoiler alert: It didn’t take until Friday.

Just hours later, my puts were deep in the green as BNTX plunged through $325.

This is where the big decision comes for any trader. You have two choices:

- Be greedy with your gains. Sell it all. Take the money and run.

- Sell some of your position — but hold the rest overnight for a potential grand slam.

90% of the time, I recommend option A. In general, it’s best to lock in profits on your winning trades — before they evaporate.

10% of the time, you need to find the guts to go with option B.

It’s this decision-making process that separates expert traders — like Tim Sykes — from the rest of the crowd.

Having the conviction to hold a winner isn’t easy. It requires mental toughness. But to me, missing that grand slam is almost as bad as taking losses. Keyword: almost.

On the BNTX trade — my gut was telling me to go with option B, yet I chose option A. I sold my puts before the close of the trading day for a profit of $21,040.

This was a great trade, but I’m very self-critical. I can’t help it…

Had I chosen option B (and held until Friday), I could’ve banked six figures in a single day!

I hit a home run — but I missed a potential grand slam. Don’t make the same mistake … trust your gut.

Lesson #7: Use Bounces as Re-Entry Opportunities

Let’s say you’re in a put trade and it’s going well. You’ve hopefully booked profits on the way down as the stock sliced towards your price targets.

This is where a lot of traders pack up and call it a day, but that’s a mistake.

If you simply move on to another chart at this point, you’re potentially leaving money on the table.

This is why I want you to start seeing bounces as re-entry opportunities.

Looking back on my trades this year, some of my biggest wins came from playing bounces on downtrends (after I’d already locked in some gains).

I could’ve been happy with the initial profits and moved on. But I’m never satisfied.

Without succumbing to greed, I have a constant hunger for more. It’s not about the money to me … it’s about maximizing the trade opportunity.

When I see beaten-down charts going into relief rally mode, I identify these rushes as potential re-entry opportunities.

Example: Back in July, I traded Moderna Inc. (NASDAQ: MRNA) puts four times in a row for nearly $80,000 in profits.

I tell you this to explain the importance of paying close attention to these high-volume momentum charts (and taking advantage of the bounces on the way down).

Don’t assume the trade is over because one wave has ended. Another is likely coming.

Volatile charts zig and zag like bumper cars. For options traders like me, this is a dream come true.

See the bounces for what they are: slam-dunk opportunities.

By doing so, you could potentially pocket money that other traders are foolishly leaving on the table.

Lesson #8: Don’t Try to Be a Hero

I’ll tell you something important that nobody wants to hear: Making mistakes is an unavoidable reality of being a trader.

You’re never going to nail every setup perfectly…

Additionally, it seems like every trader who’s ever tried to bet against TSLA has failed.

You can add me to that list. A subpar TSLA put trade in early November left me extremely unsatisfied…

But can you really blame me (or anyone) for trying? Elon Musk’s electric-vehicle powerhouse was up 50% since the beginning of October.

Plus, if we zoom out and look at the big picture, the daily chart looked even more overextended:

Since the beginning of 2020, TSLA had surged from $85 to $1,177 at the time of my trade. That’s a gain of over 1,250% in less than two years…

But it’s always an uphill battle when you’re trying to short massive runners.

On Tuesday, November 2, I made some CRUCIAL mistakes trading TSLA…

As I was watching the chart, it looked like every intraday bounce attempt was failing. The share price was stuck under the VWAP. I thought it was time to buy some puts.

I was dead wrong. TSLA rallied 2% into the close and I sold my puts for a loss.

Before I knew it, I was another TSLA short seller with egg on his face (and losses in his account).

The lesson? Avoid trades that have historically been losers for other traders…

Don’t try to be a hero. It’s not worth the risk.

Conclusion

Self-reflection is crucial for traders. If you don’t look back on the good (and the bad) of your setups from the past year, you may miss critical lessons that could help you in the future.

I encourage you to do what I just did for yourself. Write down the most important lessons you learned this year — then make sure you stand by them in 2022.

It’s been a fantastic year for me, but there’s always room for improvement. I’m happy with my work in 2021 and looking forward to evolving further in 2022.