Earnings season is in full swing, Evolvers!

This week … Pfizer Inc. (NYSE: PFE), Advanced Micro Devices, Inc. (NASDAQ: AMD), Uber Technologies Inc. (NYSE: UBER), Moderna Inc. (NASDAQ: MRNA), Shopify Inc. (NYSE: SHOP), Cloudflare Inc. (NASDAQ: NET) and many other companies are reporting Q1 earnings…

And whenever massive companies are reporting their earnings, you can guarantee options traders are betting on whether it’s a ‘miss’ or a ‘beat.’

If you’ve thought about taking a trip to the earnings casino, I get it. Trading options around earnings reports can be tempting…

You go on Reddit and see some guy nailing a once-in-a-lifetime, 20,000% call trade based on an earnings prediction and think … Why can’t that happen to you?

I’m not here to tell you it’s impossible. Anything can happen in the stock market.

But throwing darts at earnings reports isn’t a strategy. It’s more like gambling.

It’s important that you understand the unique risks associated with trading options during earnings season.

A variety of factors make the options market more complicated at this time of the year.

And if you aren’t aware of them, you could end up making a rookie earnings season mistake that could’ve been easily avoided.

Let’s break down everything you need to know about earnings season…

Earnings Season: The Pros

For options traders, earnings season can provide a lot of crazy trading opportunities…

People love to trade options during earnings season. It tends to bring out the most degenerate, casino-like tendencies in traders.

Why is this a good thing? Because more money in the options market is great for experienced traders like me. I started with penny stocks and progressed into options, and I’ve learned from experience — liquidity is never a bad thing.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

Not only does earnings season bring more liquidity — it breeds volatility (which has its pros and cons as well).

The swings based on earnings reports can be massive, making the options volatility even more exaggerated.

Liquidity, volume, and volatility are three critical factors I look for in any options trade. And the fact that earnings season naturally delivers all three is hard for me to ignore…

So what’s the catch?

Well, there’s another factor that makes trading options during earnings season much more difficult than it may initially seem…

Earnings Season: The Cons

For options traders, the biggest obstacle to overcome during earnings season is higher-priced contracts due to elevated implied volatility (IV).

I often find that earnings winners don’t move enough, especially for higher-priced stocks.

Even if a company has solid earnings, the high IV (and expensive premium) makes it difficult to lock in the kind of gains I’m looking for.

For any options trade, I’m looking for 20% moves. That way, there’s enough meat on the bone to grab onto.

During normal periods, a 20% move in the underlying stock will give me the 150%, 200%, or 300% gains that weekly options have the potential for.

But during earnings season, IV can ruin these kinds of setups. Be aware of this. Try to avoid contracts with IV above 100%, as they can lead you into a dangerous trap…

CAUTION: Watch Out for IV Crush!

Every options trader should do their best to avoid IV crush. During earnings season, it’s everywhere.

Let me explain…

IV gets much higher than normal when a stock approaches a major catalyst like a webcast, product announcement, shareholder vote, or earnings report. (Need help catching catalysts as they happen? Check this out.)

High IV makes the risk/reward relationship on options contracts skewed against us traders.

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

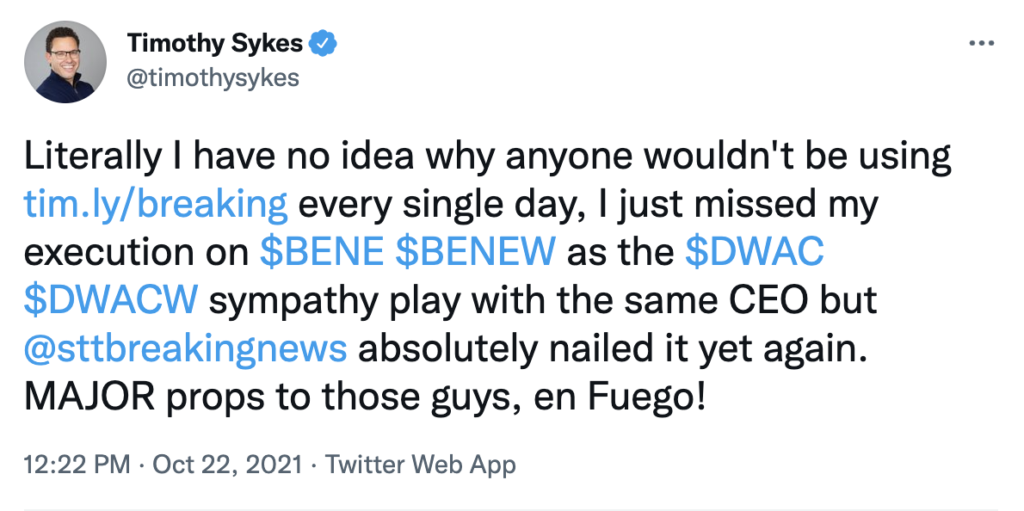

Tim Sykes encourages his students to use Breaking News Chat every day:

Market makers know the implied move in the underlying stock and price the contracts based on that.

Even if you nail your prediction about an earnings report, it’s nearly impossible to lock in meaningful gains if the IV is triple-digits.

The problem is this … After an earnings report has happened, there’s no volatile catalyst remaining in the immediate future.

So the IV gets crushed back to normal levels. (Hence the name…)

IV crush causes the premium on every single contract to plummet, regardless of direction.

In other words, you’ll need the move in the underlying stock to exceed what market makers are expecting if you wanna make any money.

And honestly, this is easier said than done…

My advice? Don’t throw darts during earnings season!

Final Thoughts

While it can be tempting for many to trade options based on earnings reports, I don’t recommend it.

I liken it to throwing darts. It’s gambling. And the unique challenges that IV crush presents make it especially difficult to capitalize on earnings with options.

Ignore the circus going on around you during earnings season. Focus on developing a consistent strategy that can be molded to any market conditions.