All eyes have been on oil prices for the past couple of weeks — and this week looks no different!

Looking back on setups, the ideal trading opportunity was to simply play puts on the United States Oil Fund (NYSE: USO), given the sharp crash it saw off of the $87 highs.

Reflecting on my trades, last week started well but ended disappointingly.

I initially made a trade on Chevron Corp. (NYSE: CVX) puts as USO crashed to the $73 area.

But I ended up forcing a bad CVX trade on Friday, giving a significant chunk of my profits back.

Heading into this week, I’ll look to be far more disciplined — and laser-focused on momentum reversals.

With these things in mind, let’s break down the main stocks I’m watching this week…

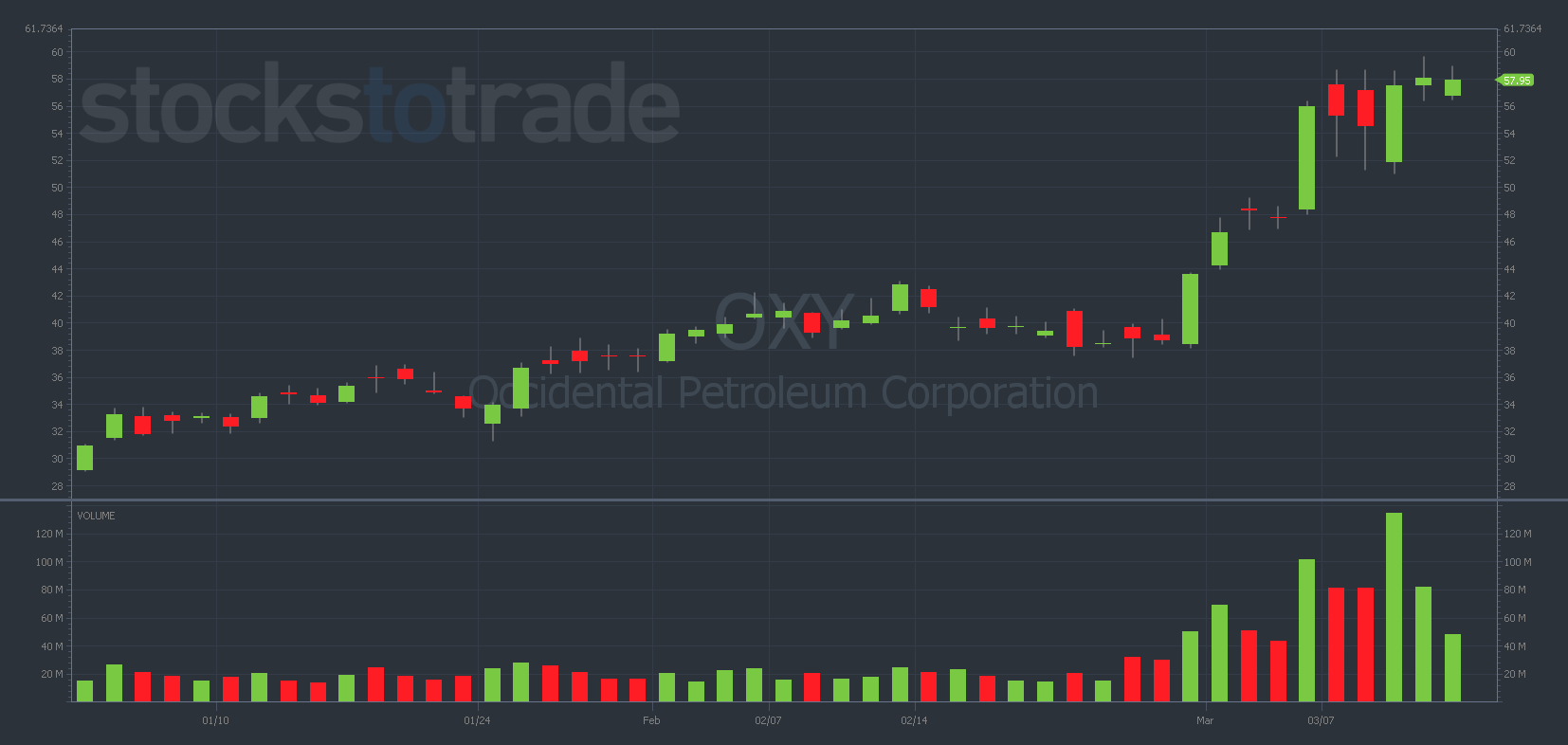

Chevron Corp. (NYSE: CVX) and Occidental Petroleum Corp. (NYSE: OXY)

Oil giants CVX and OXY are still high on my watchlist. I’m waiting for these stocks to see first red weeks, which could lead to some incredible puts plays.

Both stocks are up significantly over the last 10 trading days or so (while crude oil has already crashed 20% off its highs).

I suggest you watch to see how the USO momentum plays out this week.

Big picture: Oil futures are down over 2% as I type this. If the downside momentum continues, these stocks should follow the broader oil market lower.

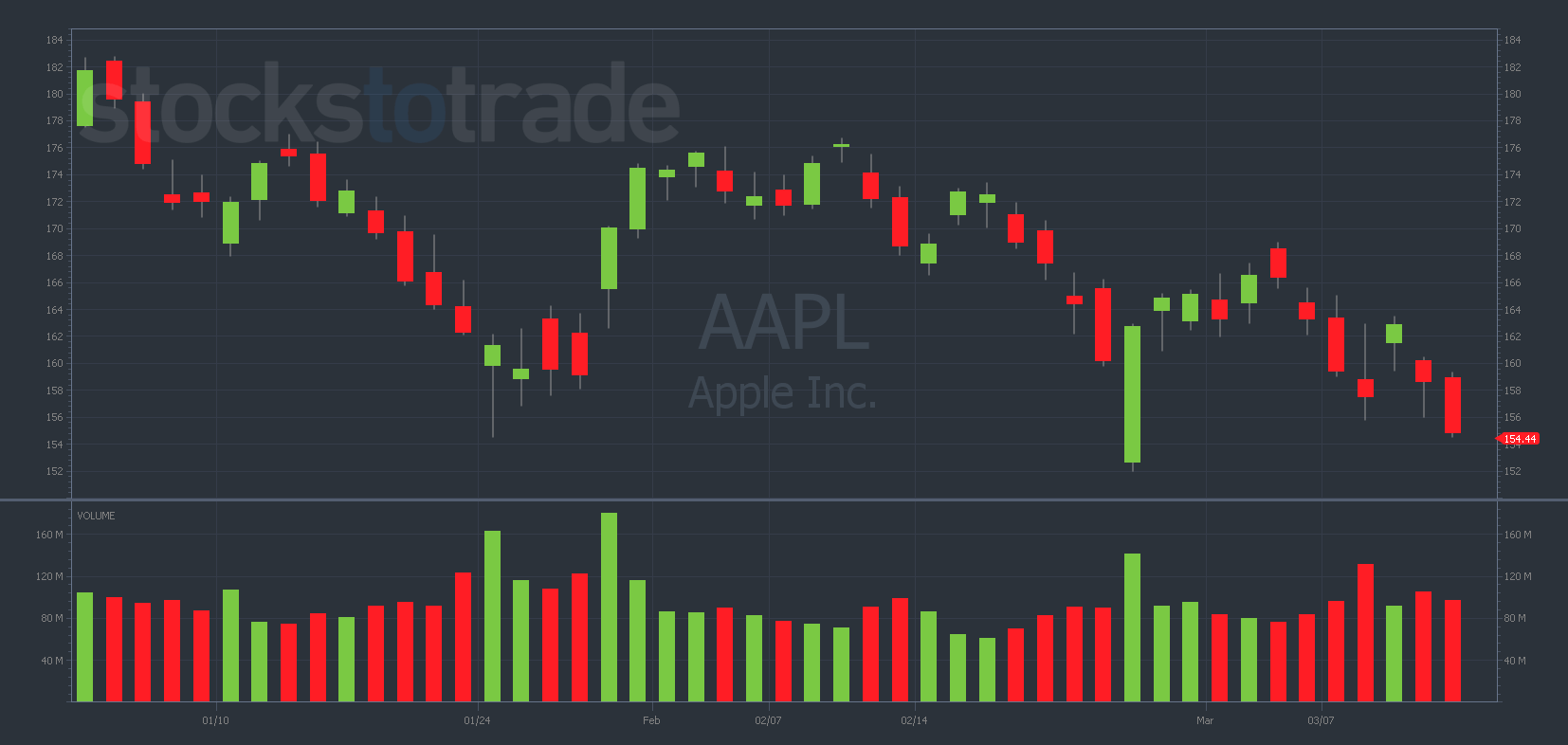

Apple Inc. (NASDAQ: AAPL)

AAPL is breaking key support at $160 and could be on the verge of a fade back to $140.

I may consider buying AAPL puts this week if it fails to bounce (and hold) the $155 zone.

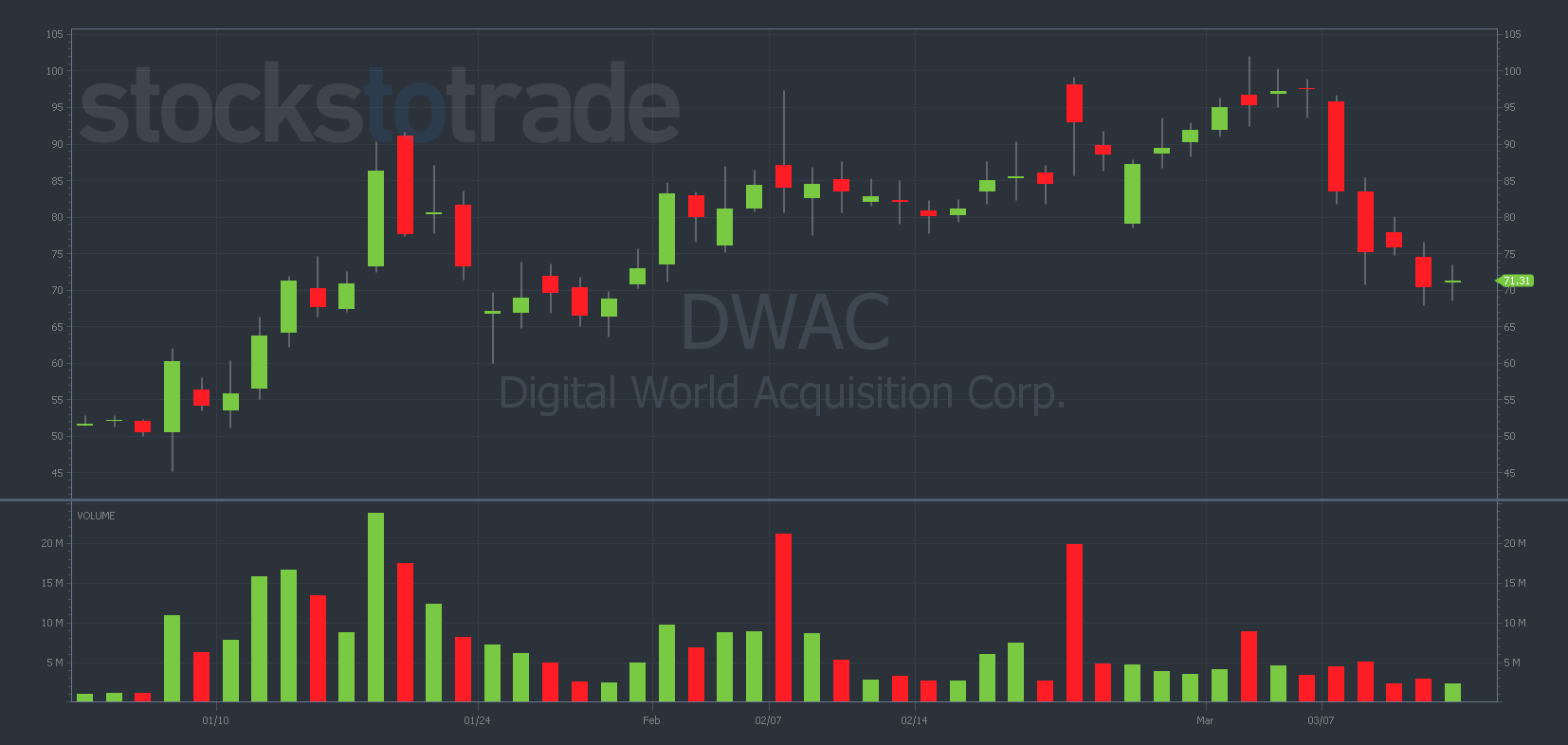

Digital World Acquisition Corp. (NASDAQ: DWAC)

Since we last talked about DWAC, the stock has crashed 20% off its highs. What a shocker!

Now I think the “Trump SPAC” could be on the verge of a total unwind back to $50.

I won’t chase the puts after this big move down. I’ll only consider them if the stock bounces back to resistance in the $80+ area.

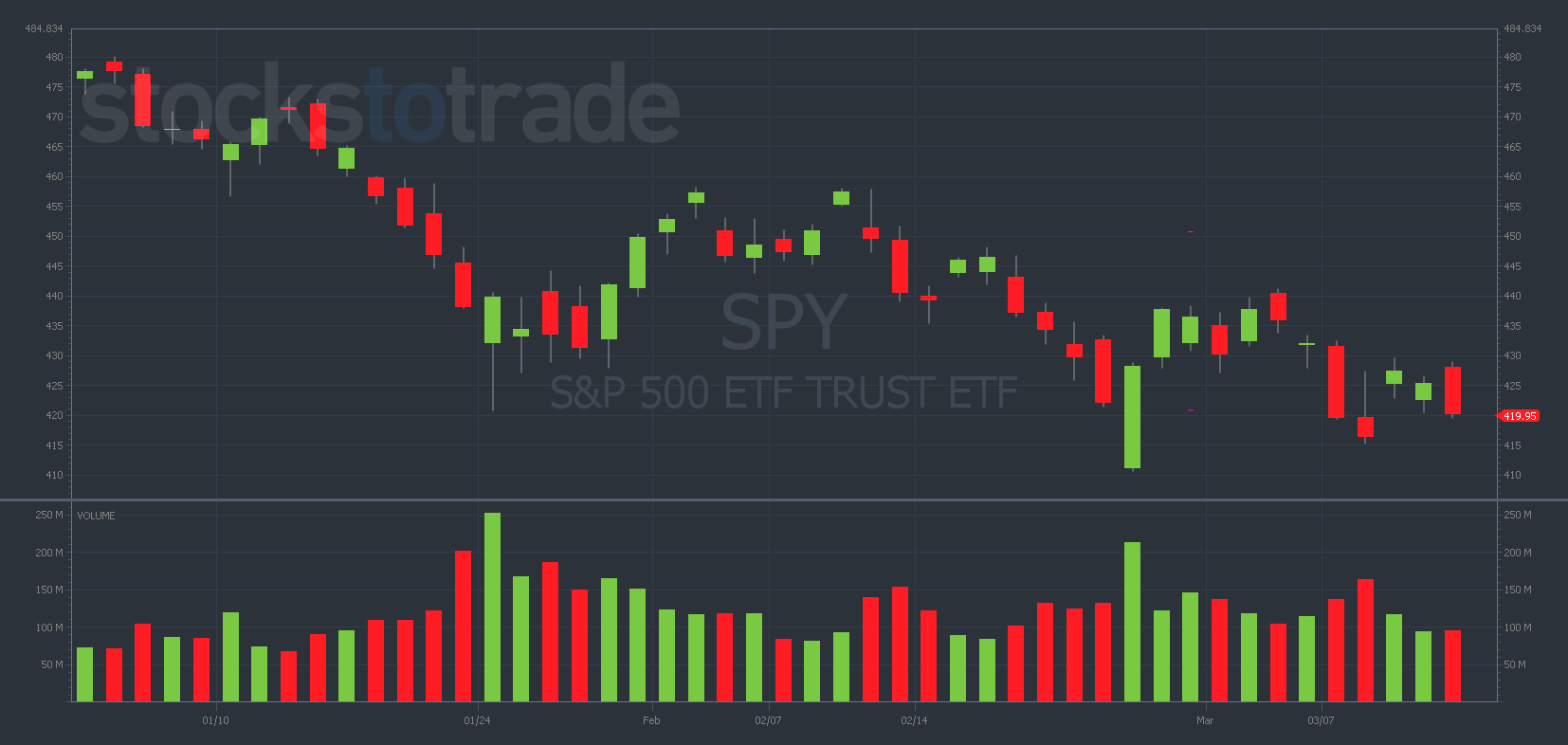

The Major Indexes

The major indexes — SPDR S&P 500 ETF Trust (NYSE: SPY), Invesco QQQ Trust (NASDAQ: QQQ), and SPDR Dow Jones Industrial Average ETF Trust (NYSE: DIA) — are all in danger territory from both a technical and fundamental standpoint.

Once again, the U.S. Federal Reserve (which has a meeting this week) holds the fate of the indexes in its hands.

I’m predicting a quarter-point increase in interest rates. So I guess we’ll have to wait and see if such a move has been “priced in” to the markets yet or not…

I don’t plan on trading the indexes, but I’ll keep a close eye on all of these charts this week. They determine how every other stock in the market reacts.

Final Thoughts

This week, my focus is on discipline. I shouldn’t have doubled down on CVX — and now I’m determined to make up for it.

Oil stocks remain my favorite potential puts plays in the market. The energy sector is still way above its averages (meaning there’s likely plenty of downside around the corner).

Keep your eyes on these stocks — but don’t force any bad trades!