Have you ever missed a juicy trading opportunity that could’ve netted you huge profits?

Of course, you have. Anyone who’s ever traded the stock market has dealt with this unfortunate problem at one point or another.

And for me, one of these points was last Friday, when I identified (then failed to pull the trigger on) two excellent setups.

Today, I’ll break down what I was seeing in these charts and why I missed their epic moves.

If you wanna stop missing winning trades … it’s time to pay attention.

Keep reading and I’ll show you what I mean…

Shopify Inc. (NYSE: SHOP)

The first setup I was looking at on Friday was a post-earnings play on SHOP.

The hugely popular point-of-sale e-commerce platform reported stellar Q1 numbers on Thursday afternoon, with total revenue and gross profit increasing by 25% and 12%, respectively.

Furthermore, right before the earnings print, the company announced plans to sell its logistics unit to supply chain technology company Flexport (a move the market clearly liked).

SHOP was already up 15%+ before the open on Friday. I knew I wanted to buy calls, but I was looking for an entry price between $51 and $52…

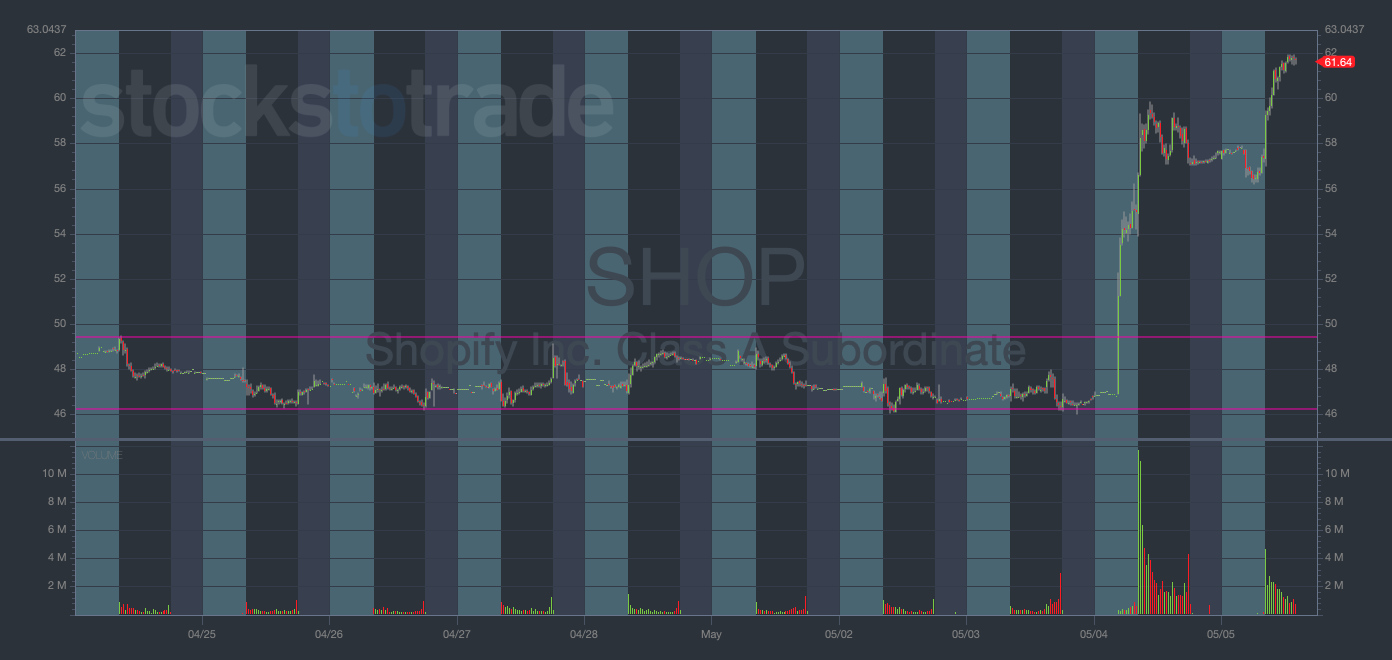

SHOP 10-day 15-minute chart — courtesy of StocksToTrade.com

I thought if I was patient, there might be a mid-morning dip that I could load calls into…

Unfortunately, the dip to the low-$50s never came. SHOP absolutely blasted off from the open, surging another 7.8% intraday.

Am I disappointed that I missed this move? Sure. But I don’t regret having the discipline to stick to my desired entry level.

As I’ve mentioned before, I always have a specific price I’d like to enter at. If the stock doesn’t reach that price, I don’t buy the contracts.

This discipline pays off the vast majority of the time. It prevents me from chasing trades that have already made the move without me…

But every once in a while, a setup like this comes along, where even if I had strayed from my entry price … I still would’ve profited.

I may be exercising too much caution right now. Perhaps I need to get more aggressive…

But SHOP wasn’t the only setup I was looking at on Friday. A stock I’ve traded a ton in the past came back up on my radar as well…

Tesla Inc. (NASDAQ: TSLA)

Longtime Evolvers know that TSLA is one of my favorite stocks to watch.

The volatile EV company is always making big technical moves and often provides juicy trading opportunities in the process…

I saw one of these opportunities on Friday. As TSLA hovered around support near $160, I thought a dip could bring about a beautiful entry for a breakout through the $164 area.

So, how did I choose $160 and $164 as my key levels? By looking at TSLA’s trading range over the past five days…

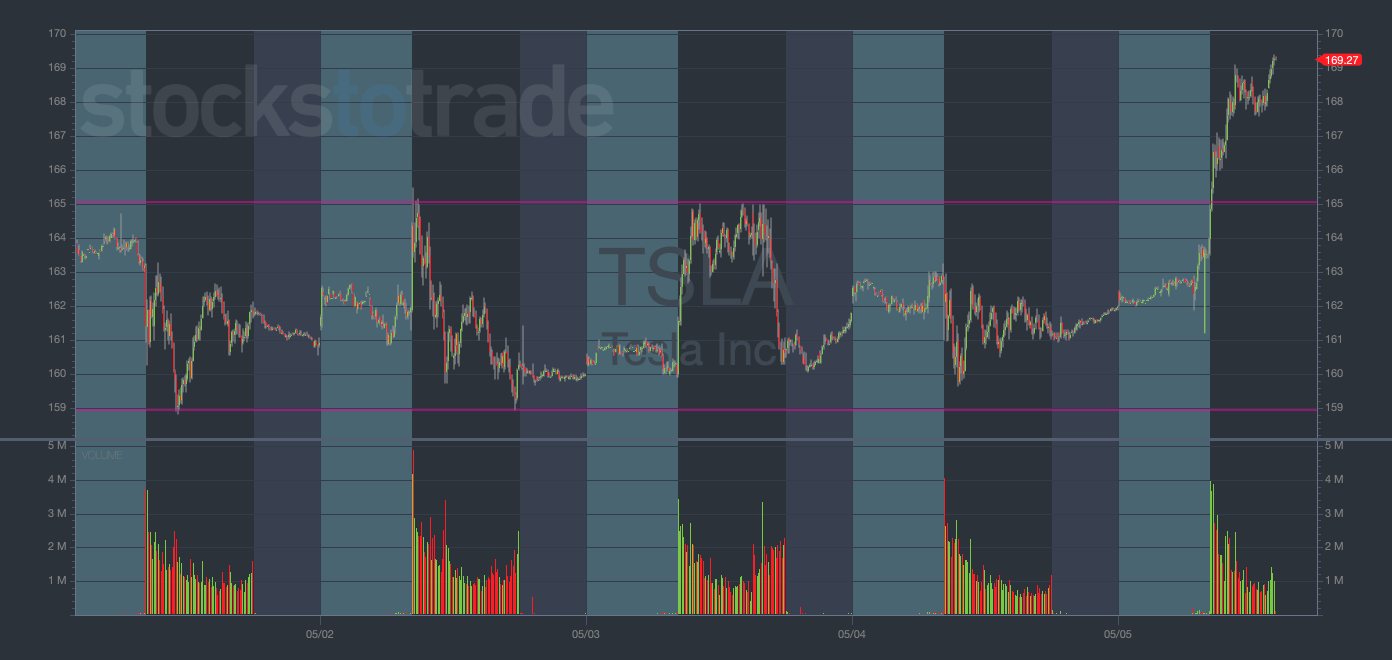

Just look at this chart … the range couldn’t be more clear:

TSLA 5-day 5-minute chart — courtesy of StocksToTrade.com

The stock has bounced off $160 and gotten rejected at $165 multiple times in the past few days. These are textbook support and resistance levels.

But just like SHOP, TSLA never gave me the morning dip I was looking for…

After opening at $162, the stock blasted through $164 (as predicted) to gain another 5%+ intraday, trading as high as $170.

Again, as disappointing as it is to see the move before it happens and still miss it … I can’t regret sticking to my price targets.

I wanted to get into TSLA closer to $160 than $162, and I just didn’t get the opportunity I was looking for near the open.

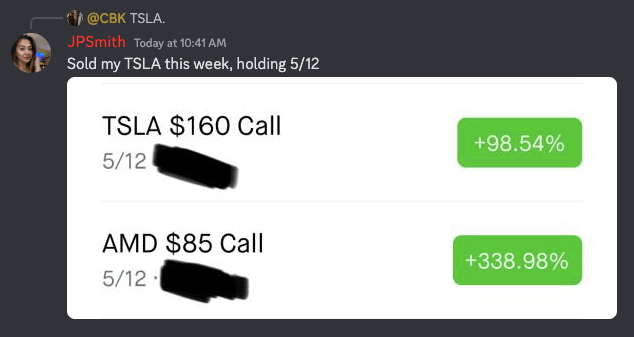

However, some Evolvers — like Jenny Smith — crushed their TSLA trades … and that’s an amazing consolation prize for me.

I love to see my students winning!

Final Thoughts

I’m probably being a bit too conservative with my trading at the moment.

I’ll consider getting more aggressive if I see similar setups next week.

But in general, erring on the side of caution is better than taking outsized risks.

Remember … it’s always better to miss a win than to take a loss!