Key Takeaways

- See more of the INSANE trades that helped me 13x(!) my small account in just over a month!

- The top 3 factors that are critical to growing my small account…

- Plus, my buddy Tim Bohen’s strategy could change your trading forever. Learn how for FREE when you sign up for this event on January 26 at 8 p.m. Eastern!

On Tuesday, I went over two hugely important trades for my small-account challenge. But that was just the beginning…

This year, the small-account progress has astounded me — in a little over a month, I’ve taken the account from $10,000 to $134,671!

With that in mind, let’s break down two more mind-blowing trades that have helped me grow this account to such a staggering value.

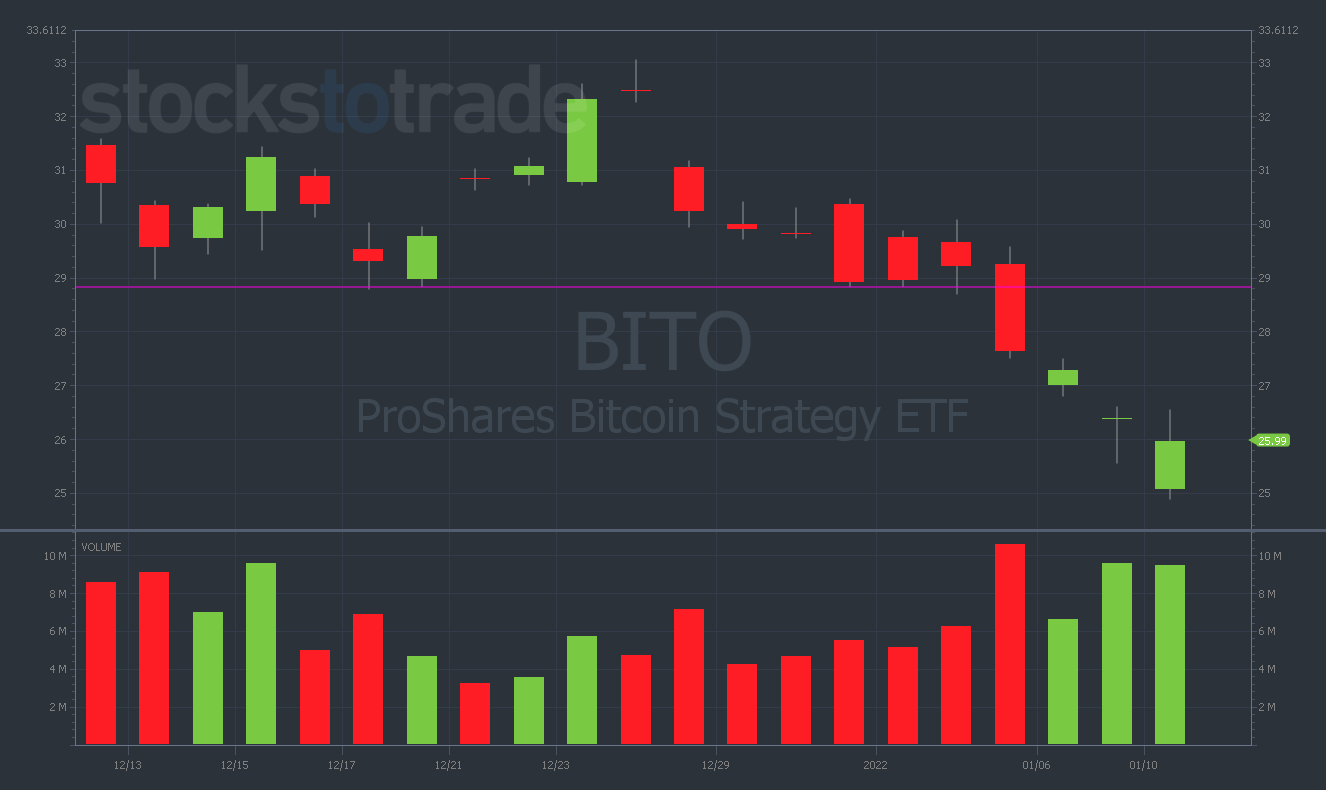

ProShares Bitcoin Strategy ETF (NYSE: BITO) 1/14/2022 $29 Puts (+$38,773)

As I mentioned in part I, BITO is an ETF that attempts to track the bitcoin (BTC) chart exactly. But unlike BTC, BITO is optionable — making it perfect for my trading strategy.

After playing BITO $34 puts in late December (and doubling the account in the process), I patiently waited for another opportunity to trade it.

Leading up to this trade, I watched the BTC chart closely.

Specifically, I tracked the critical support level at $45,000. This support on BTC lined up with the $29 level on the BITO chart.

I knew that if these levels broke, the charts could collapse much further. See the chart below…

Can you guess what happened next?

On January 5, as I was recording a video lesson, I saw the key support levels crack on both charts.

I immediately bought BITO 1/14/2022 $29 puts. I entered this position aggressively (and with size) — risking over 70% of the entire account on this one trade.

CAUTION: Don’t try this at home! I’m taking crazy risks in this account as an experiment. No Evolver should ever risk this much of their account on one trade!

That being said, as a professional trader, you need to know when it’s time to get aggressive.

I’d had massive success trading this exact setup — on this exact ticker — just one week before.

So when those key levels cracked, buying BITO puts was a no-brainer for me.

And because I’d just traded a similar setup, I had the strong conviction I needed to enter the position with (nearly) everything I had in the small account.

On top of entering the trade with size, I also held the position longer than usual. Let me explain…

My first BITO trade in the account, on December 3 and 4, was an example of a time when holding the puts overnight paid off handsomely.

I remembered that going into this second trade. In other words, my previous experience trading BITO led me to hold the $29 puts over the weekend. This was ultimately a great decision.

BITO opened almost 10% lower on Monday, and I sold my puts for a gain of $38,773!

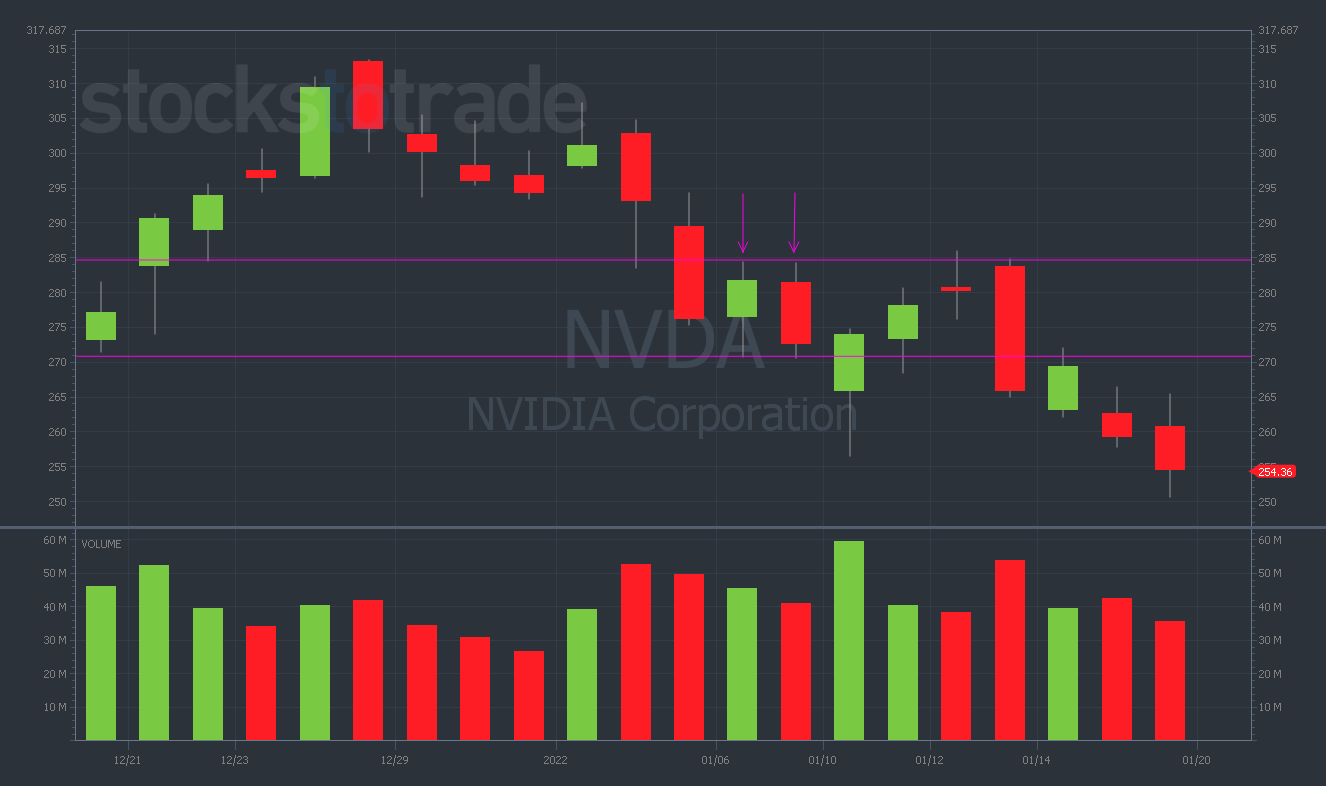

Nvidia Corporation (NASDAQ: NVDA) 1/14/2022 $250 Puts (+$48,280)

Just like the BITO setup, my next big trade — on my old friend NVDA — was inspired by the chart getting dangerously close to key support levels.

With NVDA, I was watching the $250 level. Why? Because it was almost exactly 30% off of the all-time high of $346.

And 30% is a standard correction for a hyped-up momentum stock (like NVDA).

When I noticed that a big round number — $250 — coincided with a 30% drop off of the highs, I decided this was as good a level as any to set as my price target.

January 6 and 7, when I was trading NVDA, were interesting days for the stock. Both days saw a rare occurrence — a simultaneous double top and double bottom.

The high on each day was $284 (double-top resistance), while the low on each day was $270 (double-bottom support). See the chart below…

Note: When a stock struggles to get above a certain price level on two separate days, that’s a double top. When a stock refuses to drop below a certain price level on two separate days, that’s a double bottom. These indicators mark levels of support and resistance, respectively. And when these levels show up on the chart two days in a row, that’s even more notable.

So, when the trading day of January 6 neared the close, I had a big decision to make…

Should I hold the puts overnight and patiently wait for a drop to $250? Or should I take profits and call it a day.

Ultimately, I decided on holding the puts overnight. Once again, my recent success holding BITO overnight helped me find the confidence to keep these puts in my account for an extra day.

And good thing I did. On January 7, NVDA had a gap-down open to $265, eventually reaching a low of $256. Close enough!

I sold my puts near the bottom for a gain of $48,280 — capping off another incredible trade for the small account!

My Top 3 Lessons From the Small-Account Challenge

Why do I trade a small account every year? I do it to challenge myself — and to evolve as a trader.

Trading the small account reminds me to focus on three of the most important lessons I’ve ever learned in the stock market…

- Never trade more than you’re willing to lose.

This is always true — but the importance of sizing becomes more clear when you’re trading a small account.

I’m usually disciplined with my sizing, but the exercise of small-account trading forces me to be even more cautious and specific.

You need to know when to size up — and when to size down — when the setup you’re trading calls for it.

- Timing is everything.

As an options trader, one mistimed trade on weekly contracts could decimate my tiny account.

In my bigger account, I’m not afraid of losing the entire value, but the lesson applies just the same.

If you can trade options by connecting the right sizing with the right timing — you can potentially grow a small account to levels you’d never imagined.

- Trade only the best setups.

The true key to growing a small account quickly is to only trade the best setups. And it’s no coincidence that this is my #1 rule in my big account as well.

In the world of social media stock pumpers and scammers, it’s easy to get caught up in FOMO and let a subpar setup ruin your momentum.

Whatever you do — avoid this outcome at all costs. Be patient and ALWAYS let your best setups come to you.

Conclusion

Currently, my small account is sitting at a value of $134,671. Remember that it had only $10,000 in it just six weeks ago…

My small account journey is a lesson in the power of options trading. I never could have grown the account this quickly by trading common shares. Options can open the doors to unbelievable gains…

You’re probably wondering … how can you execute gains like this in your account?

Your account is probably much closer in value to my small account than my primary account. With that in mind, take the lessons I’ve learned throughout this process and try to apply them to your own trading strategy.