This needs your attention…

As the market surges and a certain basket of stocks leads the way, there’s a theme emerging from the current rip-roaring bull market…

SPOILER ALERT: It’s all about cutting-edge technology.

Artificial intelligence (AI) and crypto stocks are the most popular trades in the world right now, leaving other names in the dust.

But with many high-flying tech stocks nearing potential resistance levels … there are special considerations every trader should be aware of.

Bulls should be cautious about letting long positions run, while bears must be perfect with their timing on shorts.

With that in mind, keep reading to see me break down a few charts I’ve been watching and explain how to approach the potentially juicy setups within them…

2 Artificial Intelligence Stocks to Watch

In recent months, there’s been a remarkable surge in the popularity of AI.

With the rise of language models, like ChatGPT, AI is everywhere. It’s the new hottest niche.

And whenever a new hot corner of the market emerges, it usually brings volume and volatility with it … two of my favorite attributes for trading.

Considering this, let’s look at a couple of AI stock charts catching my attention right now…

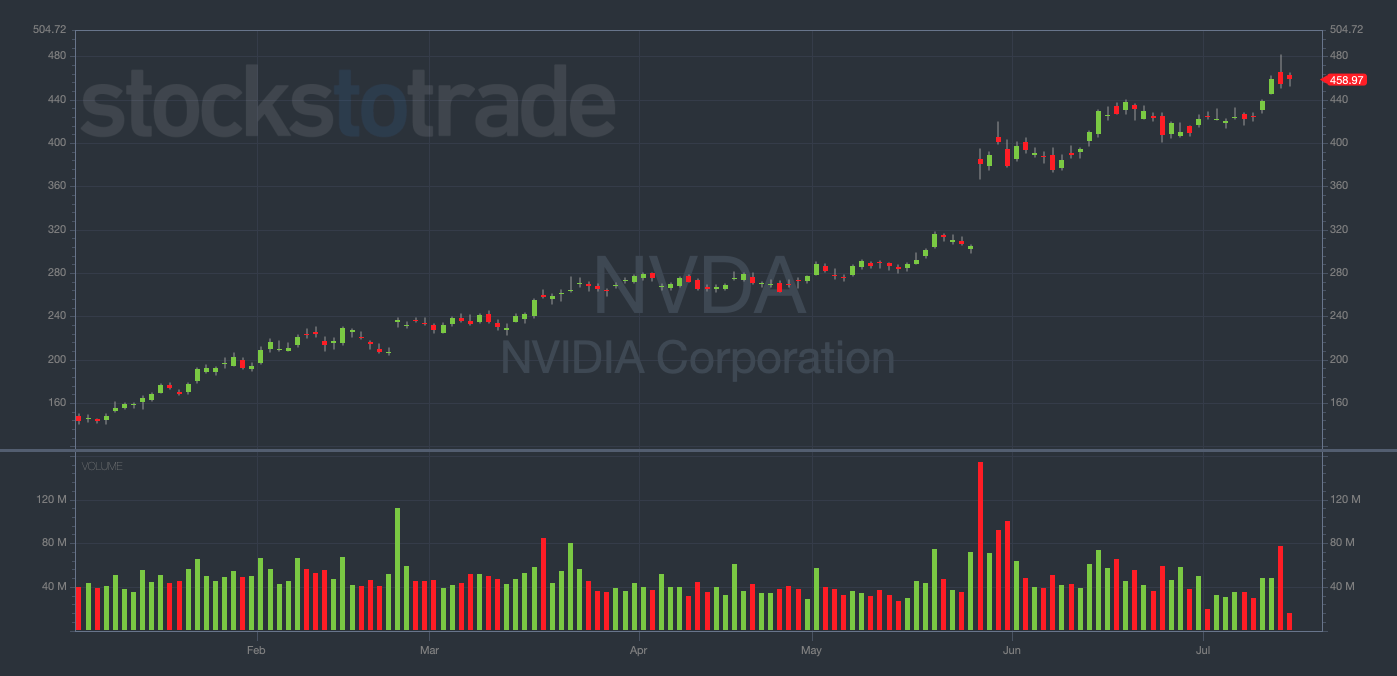

Nvidia Corporation (NASDAQ: NVDA)

NVDA YTD daily chart — courtesy of StocksToTrade.com

There’s no stock I’ve discussed more this year than NVDA, and for good reason…

NVDA has been the strongest mega-cap tech stock of the year, riding the tailwinds of AI hype to all-time highs and a $1 trillion+ market cap.

To put things in perspective, NVDA is up 222% YTD. This is almost unheard of for a company of its size and prestige.

NVDA is almost like an ETF for this entire crypto/AI theme we’re seeing right now. It’s the most important chart in the world.

I’ve been waiting for the perfect put-buying opportunity, but it’s been difficult to time when the dips happen so quickly.

There was a decent shorting opportunity last Friday in the $470s, but now, I think we need to wait for a test near the $500 level.

$500 is a hugely important psychological round number. As traders set this as their new price target, they may also start selling portions of their position near this level.

Keep an eye out near $500 for potential put-buying opportunities in NVDA.

But don’t jump the gun. Be patient. Remember, the trend is your friend.

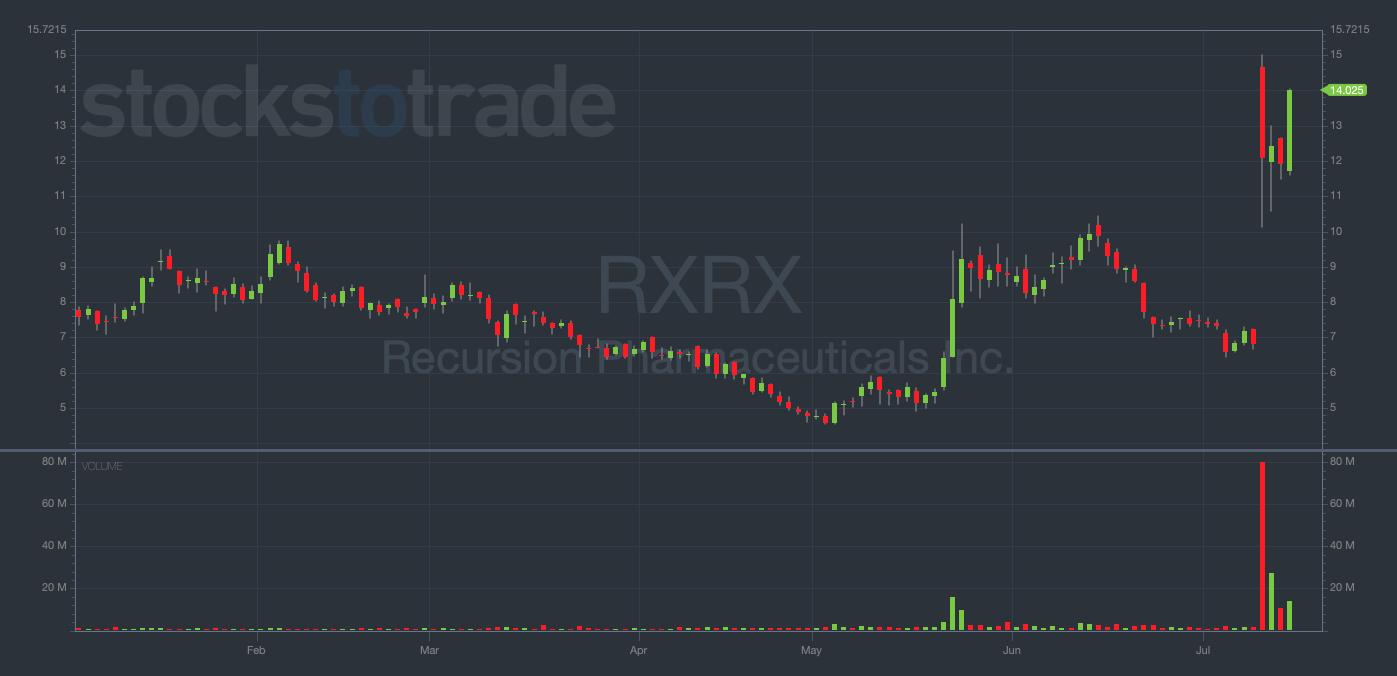

Recursion Pharmaceuticals Inc. (NASDAQ: RXRX)

Speaking of NVDA, there’s another stock benefitting from the company’s recent strength … RXRX.

RXRX YTD daily chart — courtesy of StocksToTrade.com

NVDA recently invested $50 million into this biotech company, creating one of the best catalysts I’ve seen all year!

I’m looking to re-enter calls on RXRX at some point this week, hopefully on a dip, as I believe we could see a breakout back to $14+.

But first, I’d like to see some consolidation in the high $11s to low $12s.

That would be setting up a beautiful base for a continued surge.

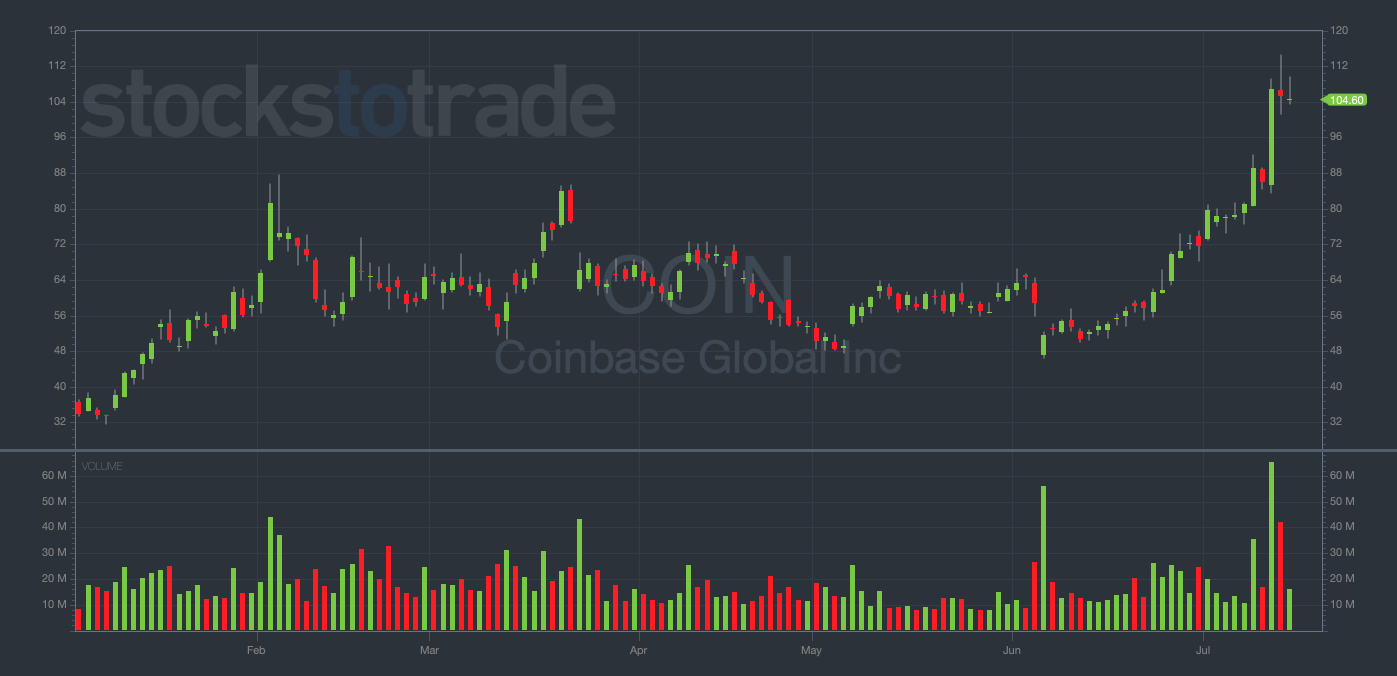

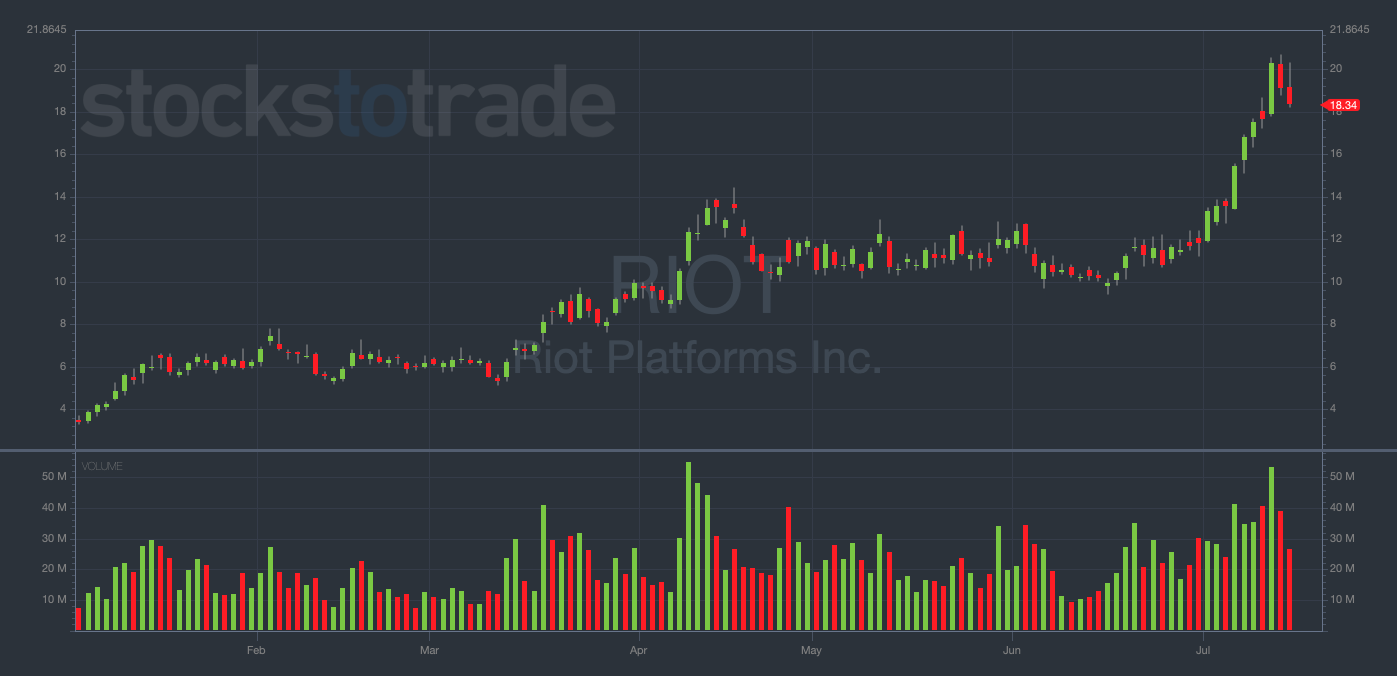

3 Cryptocurrency Stocks to Watch

Now, I’d like you to take a look at these three charts…

COIN YTD daily chart — courtesy of StocksToTrade.com

RIOT YTD daily chart — courtesy of StocksToTrade.com

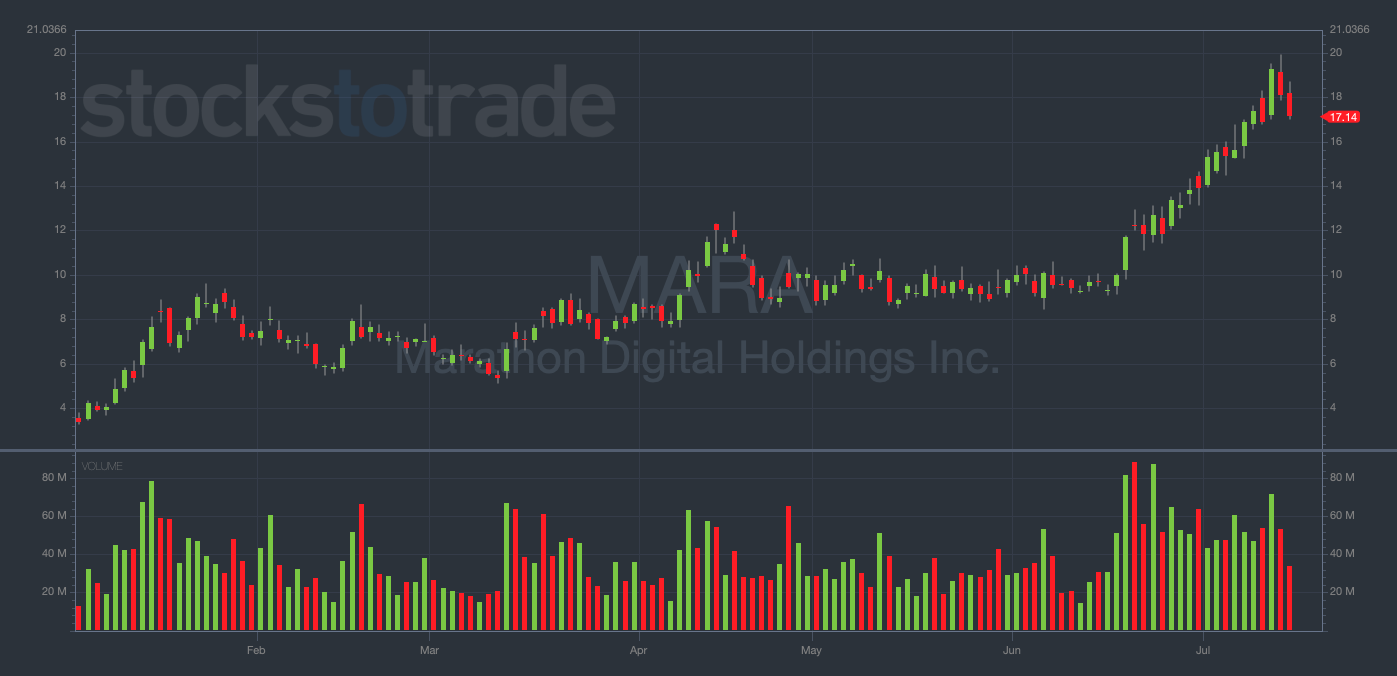

MARA YTD daily chart — courtesy of StocksToTrade.com

… Do they look similar to you?

They should. As usual, crypto stocks have been trading in sympathy with one another, which can lead to some interesting trading opportunities if you keep your eyes peeled.

Watch these three charts closely. If you see one lagging behind the others’ moves, that could be a prime opportunity to enter a sympathy trade (when you buy a stock that’s lagging behind its peers, expecting it to catch up).

Additionally, crypto stocks could become a leading indicator for the health of this overall AI/crypto theme in the markets.

If crypto starts to tank, AI stocks could follow suit shortly thereafter. And if AI stocks start entering downtrends, look out below on crypto.

And as I look at the MARA chart, for example, it looks as if the multi-week uptrend may be finally breaking…

I think these two sectors (AI and crypto) are closely related to the current market theme.

By watching both like a hawk, you can potentially find sympathy plays and five-star setups that other traders are missing.

Final Thoughts

Continuing with yesterday’s theme of focusing on former runners in hot sectors… crypto and AI are the charts to be watching right now.

Volume, volatility, and catalysts … both niches contain all three.

Don’t overcomplicate things. Trade the stocks providing the most upside (and downside) and give yourself the best possible chance to bag huge gains.