I was very satisfied with my trading last week.

I didn’t “throw darts” or play guessing games…

Instead, I stuck to my rules, identified some solid risk/reward setups, and nailed them.

Today, I’ll show you exactly how I made two killer trades on some familiar charts — my thoughts going into the trades, my choice of strike price and expiration date, and how I nailed my entries and exits.

Keep reading to see my full trade breakdowns…

Coinbase Global Inc. (NYSE: COIN)

On Wednesday, August 23, I executed a long call trade on COIN.

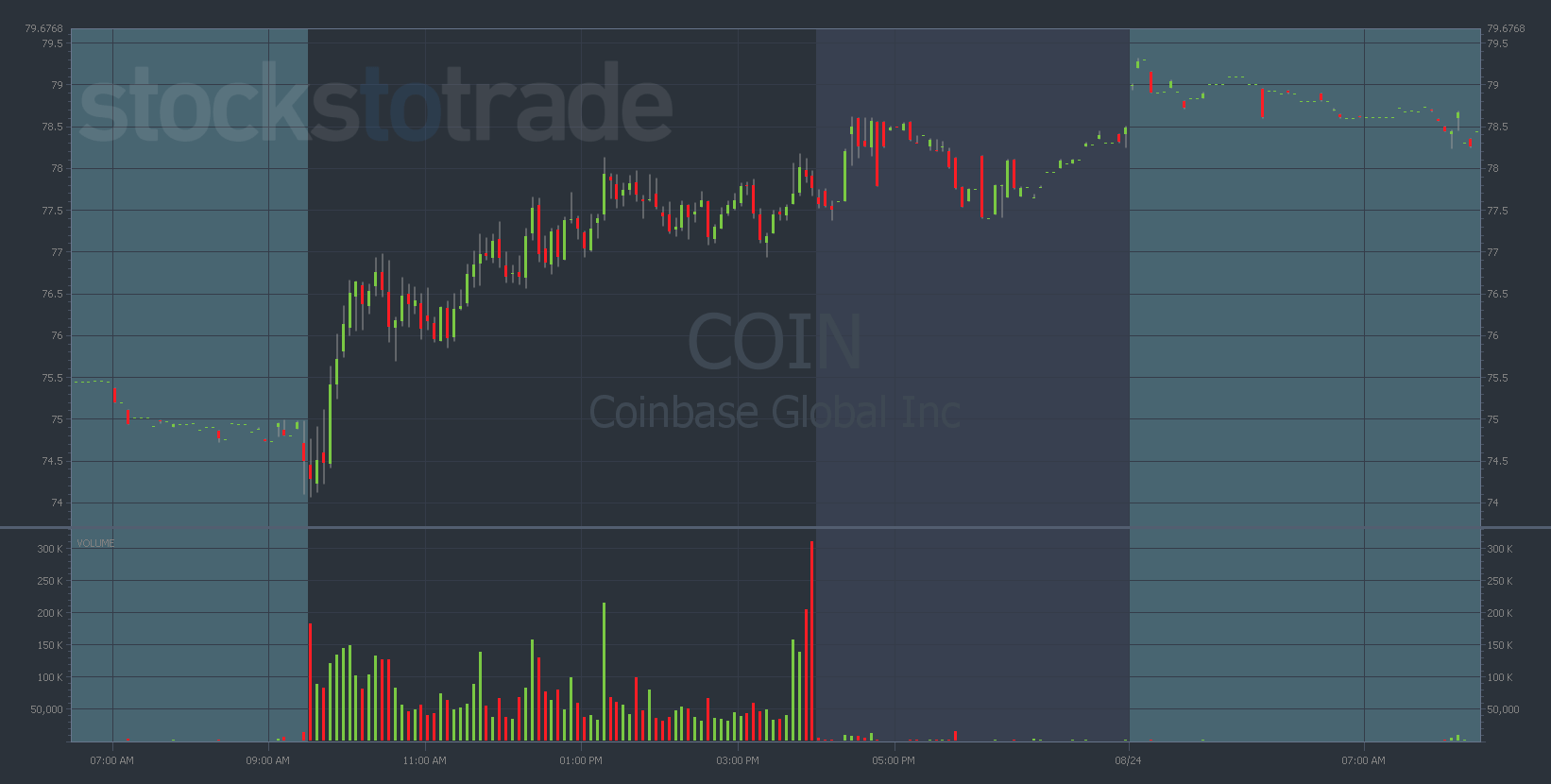

COIN 5-minute chart from August 23 — courtesy of StocksToTrade.com

My thesis going into this trade was extremely simple…

Bitcoin (BTC) and two related crypto stocks — Riot Blockchain Inc. (NASDAQ: RIOT) and Marathon Digital Holdings Inc. (NASDAQ: MARA) — had surged on the day.

COIN, however, was lagging behind its peers. This is something to take note of…

Whenever an entire sector is blasting off, but one important stock in the group is “late to the party,” it’s time to be on high alert for a potential sympathy play.

What’s a sympathy play?

This is when you buy a stock in the same sector as another stock that’s making a big move in an attempt to catch a delayed reaction.

Here’s a hypothetical example…

- Imagine there are three major airlines: AirFlyer, SkyJet, and CloudWings.

- One day, SkyJet announces they’ve found a way to cut fuel costs by 20% without sacrificing safety, using a new technology.

- Traders might think: “If SkyJet can save on fuel, maybe AirFlyer and CloudWings will use this technology too and also save money.”

- Because of that thought, SkyJet’s stock might go up due to their announcement. But, the stocks for AirFlyer and CloudWings might also rise, even though there’s no direct news about them adopting the technology yet.

- Traders buying stocks of AirFlyer and CloudWings, hoping they’ll follow SkyJet’s example and save on fuel, is an example of a sympathy play.

So, in this case, the good news for one airline boosts confidence for other airlines in the same sector, leading traders to buy their stocks.

This was my exact thesis behind buying COIN calls after watching BTC, RIOT, and MARA soar.

Even without a major piece of news, these stocks were up between 5-10% at the open, while COIN was up just 1%.

I figured COIN was simply dragging behind the pack. I thought that it would likely catch up and make a bullish move to the upside.

Sure enough, I was right…

I bought COIN 8/25/2023 $76 Calls on Wednesday morning for $2.06, when COIN was trading around $75…

By that afternoon, COIN was trading up 5%, reaching an intraday high of $78.24.

I sold my calls in the mid-afternoon for $3.05 — a gain of 48% in less than four hours!

Once again, I never would’ve nailed this trade had I not identified the sympathy play very early in the morning.

DON’T MISS OUT: Whenever you see a stock in a red-hot sector lagging behind its colleagues, consider the opportunity for a sympathy trade.

Nvidia Corporation (NASDAQ: NVDA)

After my COIN trade, my confidence was restored and I felt like I was firing on all cylinders…

This led me perfectly into my next trade on NVDA the following day, Thursday, August 24…

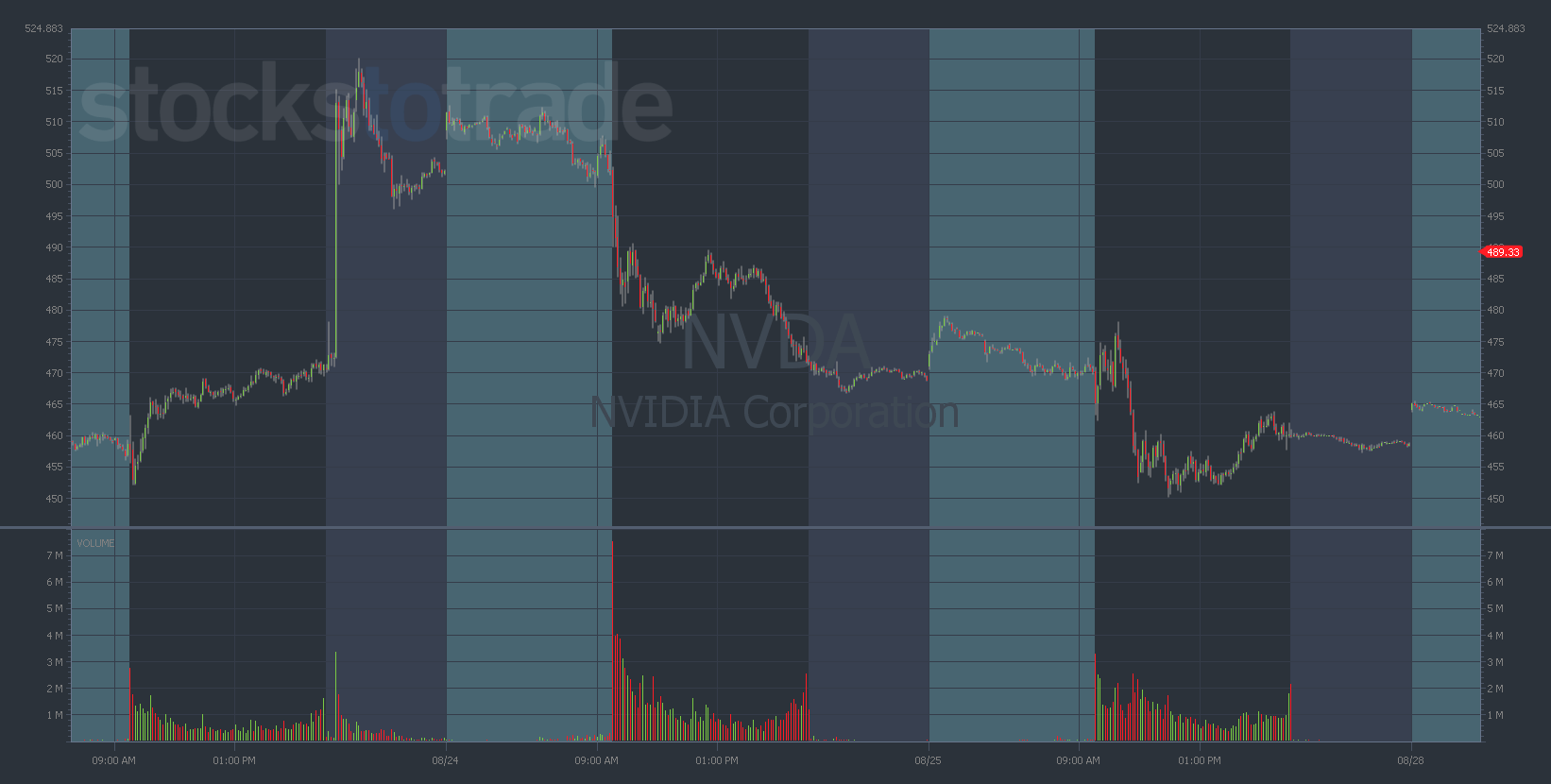

NVDA 5-minute chart from August 23-25 — courtesy of StocksToTrade.com

But while my COIN trade had little to do with technical indicators or charting, my NVDA trade was quite the opposite.

My thesis behind the NVDA trade was a combination of external catalysts and technical analysis.

Let me explain…

The prior afternoon, on August 23, NVDA delivered its much-anticipated earnings earnings report.

And the market reaction to the report was telling…

While the numbers were solid and the stock was green during after hours, the bullish move was considerably weaker than the one we saw immediately following NVDA’s May earnings print (when the stock surged 25%).

This hinted at something crucial — the bullish momentum was losing steam, even after the company beat earnings expectations.

Additionally, there was another bearish indicator bubbling up — NVDA’s failure to stay above the all-important $500 level.

I’ve said it before and I’ll say it again — when a stock struggles to hold a critical round-number resistance level, it’s time to think about buying puts.

So, that’s exactly what I did, buying NVDA 9/15/2023 $450 Puts for $8.40.

Notice that I purchased contracts expiring in September. At the time I bought them, they had three weeks left until expiration.

I wanted to give myself some wiggle room on this trade, although it turned out I didn’t need it…

In less than two hours, NVDA had traded down from its open at $502 to an intraday low of $74.24.

I could’ve sold all of my contracts here, but I decided to hold my position…

This turned out to be a great decision. On Friday, NVDA traded down to $451, where I sold my puts for $15.41 — a gain of 83% in less than 24 hours!

This trade was all about understanding momentum cycles and nailing technical analysis…

- I never would’ve had the confidence to make this trade if I hadn’t been studying the NVDA chart all year. I know this chart like the back of my hand.

- This earnings report was a huge test for NVDA, the most overextended chart on the planet. And I could feel the momentum waning following the print.

- $500 — a massive round number, and NVDA failed to blast off beyond it. A clear put-buying opportunity. This is exactly why I’m constantly preaching the importance of round-number resistance levels.

But I wouldn’t know anything about round number resistance levels or technical analysis if I hadn’t started my trading journey in the right place…

Are You Ready To Take The Next Step?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!