It’s time to cap off another insane week of market volatility with a Friday Q&A!

I’ll do a more in-depth breakdown next week … but I feel that I should mention how much this market’s starting to feel like the 2020 pandemic selloff.

During that period, the major indexes alternated up and down 2-4% day after day … for weeks.

Sound familiar?

Many dip-buyers fell for the bull trap on Wednesday, only to be annihilated on Thursday in the biggest single-day market rout since early 2020.

If you aren’t ready for the market to be surging one day and tanking the next, you’re ill-equipped for the current price action.

WARNING: Prepare for more head-spinning volatility in the near future.

I’ve said that I think the overall market’s headed lower this year, and I’m not seeing anything to make me change that thesis.

This sort of volatility can be a dream for professional scalpers. But it can also be a nightmare for anyone trying to learn how to trade at their own pace.

On that thought, our first question…

“This volatility is killing me. How can I trade with confidence when the market’s so choppy?”

First of all, know that you aren’t alone. From what I’m hearing, a lot of traders are getting wrecked in this tape.

The crazy volatility we’re seeing offers incredible setups for experienced traders … But it also comes with unique challenges for newbies.

REMEMBER: Volatility is a double-edged sword for options traders. The price swings can lead to huge % gains in contracts, but high implied volatility (IV) can potentially stunt some of those profits.

This price action makes it tough to buy breakouts. Even the most experienced traders can lose their cool during a failed bounce or surprise rally.

That’s the thing with this rollercoaster market…

A chart you’re tracking could be moving in the right direction … But if the overall market’s whipsawing back and forth, that can lead you to doubt your plan.

That said, it’s possible to win big in this market if you trade a consistent strategy with discipline…

Just look at my top student, Jenny Smith, who’s been absolutely CRUSHING IT through all of the volatility:

When you swing & scalp… 1700% $AMZN $SHOP $GOOGL #TSLA #OptionsTrading pic.twitter.com/aTux7M587g

— Jenny Smith (@jpsmith5804) May 2, 2022

Ultimately, I can’t tell you what to do. You have to figure out what works for you, just as Jenny did.

But I’ll give you a few pieces of advice for navigating this whipsaw price action…

- Keep your position sizes small. Don’t get too aggressive on either side of the move.

- Pay close attention to the news. In this news-driven market, it’s all about the headlines. Give yourself an edge with this tool.

- Get in and out of your winning trades QUICKLY! Don’t hold out for your most profitable price targets. If you’re decently green on a trade — take the money and run before it reverses on you.

- Cut your losses IMMEDIATELY! Remember Tim Sykes’ #1 rule. Don’t wait for a setup to turn around in your favor — there’s no room for bag holding losing trades in this environment.

“Which do you prefer to trade — the market open or close?”

I love trading the market open and close — the two most volatile periods of the trading day. But I approach the two very differently…

As the opening bell rings each morning, traders are excited. The entire market has been anxiously waiting all night — everyone’s ready to go.

While you may think this exuberance could lead to bullish setups, I often find the opposite to be true.

On overextended stocks, the first 30 minutes of trading can bring HUGE opening flushes.

But when it comes to the price action leading into the closing bell, I approach my trading differently…

Most of you know I have a negative bias. I focus on buying puts and rarely go long these days.

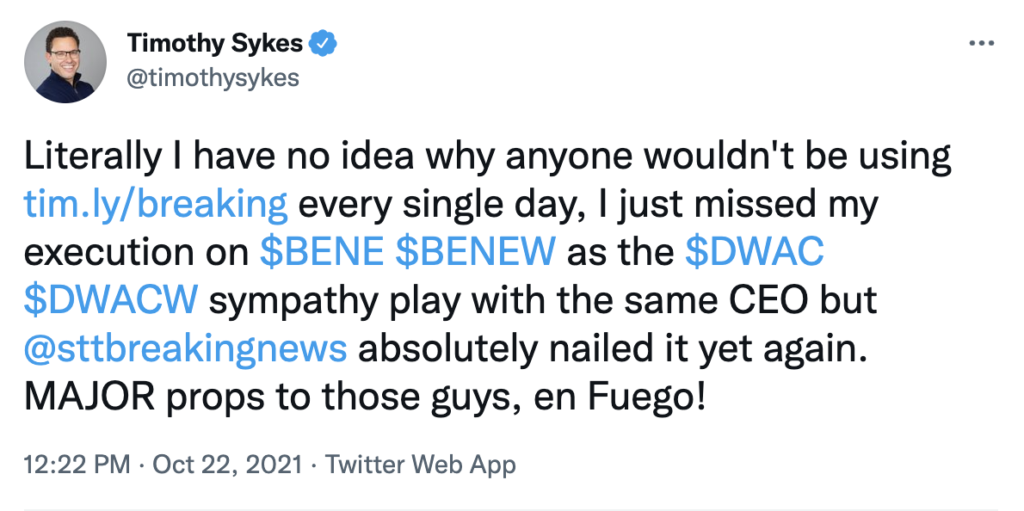

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

But when I do go long, it’s usually into the closing bell.

So … why do I like to go long into the close?

After the morning exuberance settles, the energy around the close feels different. As the closing bell draws near, traders rush to get all their orders in…

They’re rapidly positioning themselves for the following day, which can lead to rushed buying or last-minute short-squeezing.

Bottom line: I love to trade both power hours. I lean towards trading puts in the morning and calls in the afternoon.

Final Thoughts

Crazy week, Evolvers! Thanks again for the questions.

This market’s not for the faint of heart. Be selective with your setups.

Stay disciplined out there and study hard this weekend!