Last week, I broke down why I bought puts on the Dow Jones index — betting that there’s more downside left in this brutal market correction.

But by Thursday, the insane volatility in the markets was chipping away at the value of my DIA puts. I needed a hedge … quickly!

Let’s go over exactly why I hedged my bet — what caused me to sell too early — and how you might avoid similar situations in the future.

Trade Notes

For anyone who missed the details … last Wednesday, I bought SPDR Dow Jones Industrial Average ETF (DIA) 2/18/2022 $330 puts for $5.20.

By Thursday afternoon, traders everywhere were waiting for one thing and one thing only — Apple earnings.

This volatile earnings print created an ideal hedge opportunity for any big put position (like mine).

So what did I do? I took a gamble by buying Apple Inc. (NASDAQ: AAPL) 1/28/2022 $165 calls as a hedge against my DIA puts.

Why I Chose AAPL Calls

WARNING: This sort of options hedge is a high-risk/high-reward setup that should be reserved for experienced traders only. Don’t try this at home!

With that out of the way, let’s go over the three main reasons I bought AAPL calls…

1. Picking a Market Leader

Why did I pick Apple? It’s simple — I was trying to hedge against Dow Jones index puts.

Apple is the index leader, not to mention the most valuable company on the planet with a market cap of $2.7 trillion.

So I was thinking that if the market rallied on Friday, AAPL needed to lead the way.

2. Monthly Puts vs. Weekly Calls

My DIA puts are monthly contracts that expire on February 18. I’ve still got three weeks to realize just under 5% downside.

When looking for a hedge, the AAPL weeklies were a standout choice. I knew I would close this hedge out within a day, so there was no reason to pick longer-dated contracts.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

3. Earnings Volatility

Heading into this trade, Apple was set to report Q4 2021 earnings on Thursday after the bell.

This call would reflect their holiday sales numbers, where Apple consistently crushes it year after year.

Because AAPL was heading into an earnings call, the implied volatility (IV) on weekly contracts was inflated way above normal levels.

Normally, I view high IV as a downside. But on this binary up-or-down hedge play, the elevated IV worked in my favor.

Why I Sold on Thursday

Ultimately, I didn’t nail this trade perfectly. But the AAPL hedge did help me exit the DIA position entirely. Let me explain…

On Thursday afternoon, my market outlook was changing. I wasn’t sure what to think.

My gut told me that the market was headed lower, but the price swings were getting too crazy to keep the risk/reward viable.

I used the AAPL call gains as an opportunity to exit my DIA puts right around breakeven. But this was a mistake…

Had I held the calls into Friday, I would’ve not only erased my put losses — but also made a huge percent gain on the calls.

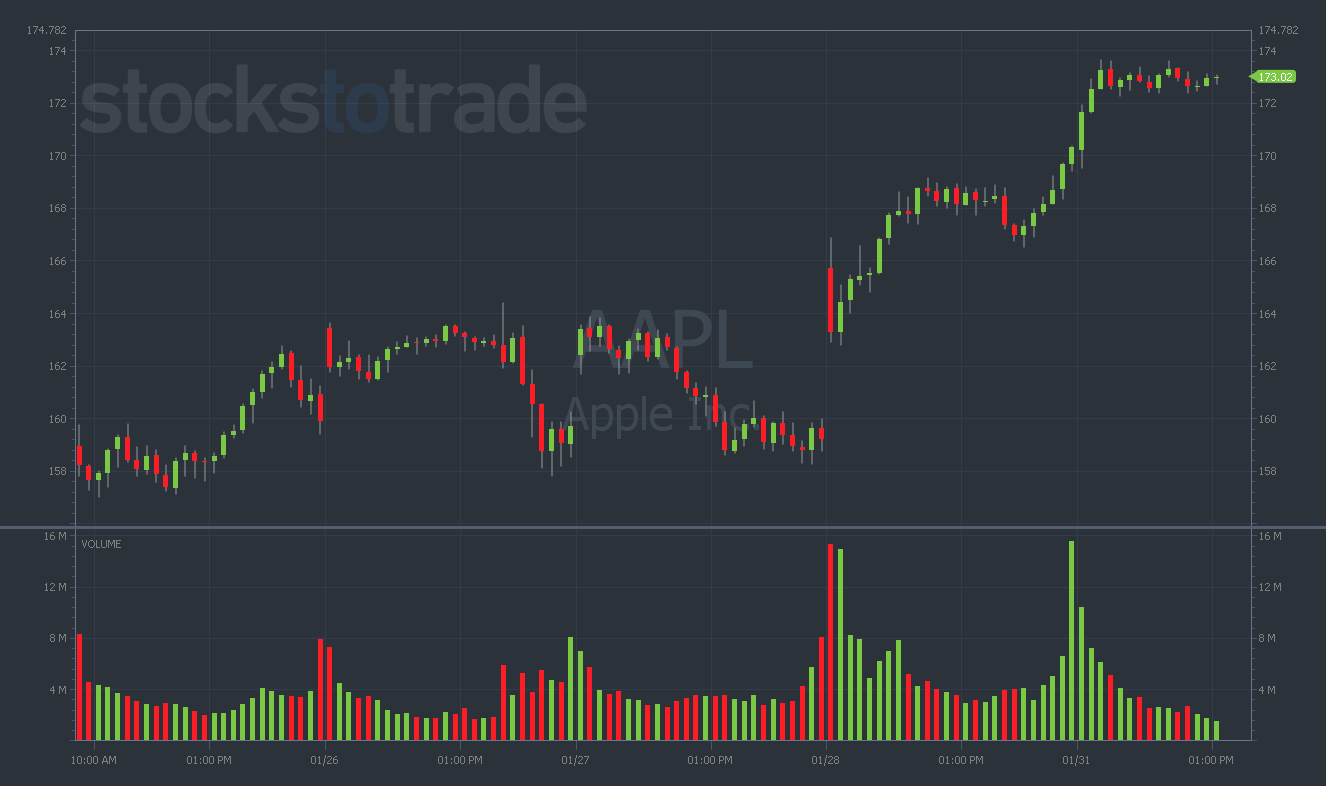

Take a look at the AAPL chart from the past five days:

Exiting the DIA position was the right call, but selling the AAPL calls on Thursday was a critical error. Just look at that ramp I missed!

The lesson? Don’t let near-term price action pull you out of an excellent mid-term setup.

Final Thoughts

Sure, I wish I’d held some calls. But overall, I don’t regret my moves on Thursday. Hindsight is 20/20.

This market’s crazy. And the volatility is making options trading very difficult (more on that later this week).

I took the opportunity I had to take a ton of risk off. Now it’s probably best to sit on the sidelines and wait for a clear trend to emerge.

Stay cautious out there, traders!