Knowing when to exit a winning trade is one of the most delicate balancing acts in the stock market…

More than half of the battle is finding these excellent setups and entering at the right price point.

But if you don’t exit the trade correctly, all of the work you did to research the play will have been for nothing.

This is especially true if you’re trading weekly options, where a green trade can go red in mere minutes (or even seconds).

And as the market surged at the end of last week, with the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) up more than 3% in five trading days, I got a lot of questions in my Discord server about when (and how) to offload plays that are soaring…

With that in mind, let’s compare the pros and cons of holding runners vs. booking profits quickly…

Keep reading and I’ll show you how to choose which move is right for you…

Facing a Tough Decision

Many of the questions I get from newbie traders revolve around mitigating losses and improving performance.

But once you get a bit more experience, you’ll eventually find yourself in the following situation…

You’ve entered an options trade, there’s a week left until your expiration date, and the contracts are up considerably from where you bought them.

And then, you’re faced with a tough decision…

Do you hold the runner or book profits quickly?

Well, the truth is, there’s no one correct answer for every potential setup, but there are certain things to look for that can potentially help you make this call…

Crucial Considerations for Exiting Trades

If you’re in the green and trying to determine where to sell, consider the following…

You don’t have to sell all of your contracts at once

If you follow my trading alerts, you’ll notice that I often offload portions of my initial position as I’m exiting the trade

As opposed to simply selling all of my contracts at once, this allows me to take some risk off the table and lock up safe profits while still having some skin in the game.

I made this exact move on my Tesla Inc. (NASDAQ: TSLA) trade from last week, selling half on Thursday and the other half on Friday morning.

So, don’t think you have to enter and exit the entirety of your position at one time. If you aren’t already, start considering a batch approach to selling your contracts.

Up 100%? Sell half of your position…

If you’re up 100% on an options trade, and you see more upside on the chart, you can sell half of your position to make the remainder of the trade risk-free.

From there, you’re ‘playing with house money’ because you’ve locked up your initial investment and now you’re simply letting your profits run.

This can make the second half of the trade — and your ultimate exit — much less stressful.

Plus, you’ll still have some risk-free exposure if the stock continues in your direction over the following days.

Always know your price target (and your risk level)

You should always have a price target where you plan to exit … before you enter the trade!

I like to have a target for the share price as well as for the options premium.

For example, I’ll write in my trading journal “I’m aiming for Stock XYZ to hit $95, or to hold the contracts I’m trading from $1.20 to $2.50ish.”

I also include my “risk zone” — a price at which I’ll sell if the trade starts going against me.

For example, on my recent TSLA trade, my alert email read: “Adding $TSLA calls for $160+ using $157 as risk.”

This means that I’m aiming for $160+, but if the stock hits $157, I’ll cut the losses and move on.

The Bottom Line

For experienced traders, holding runners can be incredibly profitable.

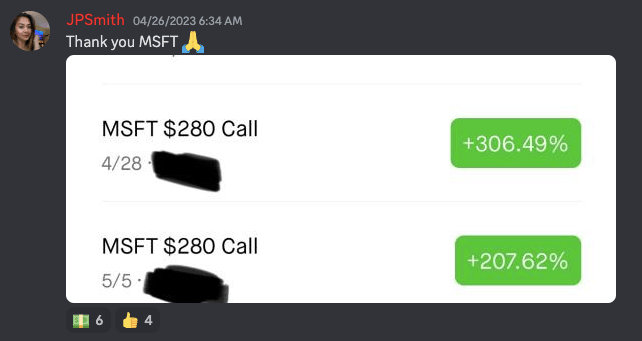

Just look at what one of my top students, Jenny Smith, posted in my Discord server on Wednesday, April 26…

She sold part of her position that day but kept a small amount of ‘house money’ on the table.

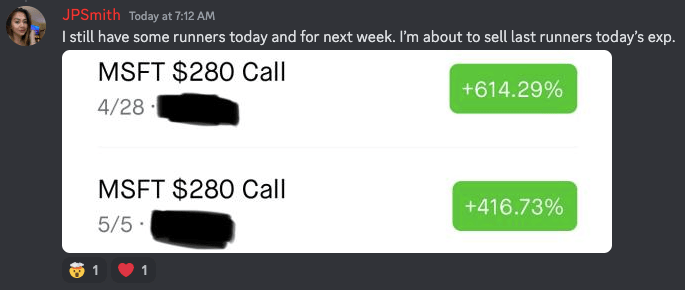

Then, by Friday, April 28, her positions looked like this…

This is a perfect example of how offloading your contacts in chunks can potentially lead to further profits.

And again, by locking up your initial investment early, you’re only risking your profits from there on out.

That said, I say this practice should be reserved for experienced traders for a good reason…

For the vast majority of traders, it’s gonna be best to sell all of your contracts once they’re deep in the green.

After all, you can’t lose money by booking profits quickly … you can only miss out on theoretical gains.

But if you truly believe the stock is set to hit a certain price target, consider employing the strategies I’ve laid out today to exit your trade like a pro.

Final Thoughts

Holding runners vs. booking profits quickly is a difficult call for traders to make.

Most of you should do the latter, but if you’re a bit more experienced and the stock hasn’t hit your price target, try the former (on a very strong runner).

Ultimately, only you can make these decisions, and a lot of it comes down to the individual specifics of the trade you’re in.