When I first started trading, I didn’t know what to look for.

The market was new to me. Sometimes it seemed like stocks moved at random.

But one fateful day I discovered Tim Sykes’ Trading Challenge, and the rest is history…

I knew I could trust Sykes because he shares all his trades on Profit.ly. He focuses on teaching the tools you need to succeed instead of hyping pumps.

WARNING: There are a ton of faceless Twitter profiles claiming to be brilliant trading mentors. Be EXTREMELY careful of the fake gurus or ‘furus.’ Don’t blindly follow trading advice from anyone who hasn’t proven their skills to you.

Unlike these clowns, Sykes was a verified veteran in an industry I was just beginning to understand. And there were certain rules I needed to learn from him to stay safe…

If Sykes hadn’t taken me under his wing, who knows what I would be doing right now. And now, I hope I can provide the same sort of guidance for you.

In that spirit, I’d like to give you a bit of a trading cheat code, if you will.

It took me years to learn these lessons from Sykes … But today, I’m gonna reveal to you the three most important things he’s taught me…

Know Your History

One of the first principles Sykes taught me was this — know your history.

Even though the stock market is filled with numbers, Sykes says he views himself as more of a history teacher than a math teacher.

The stock market isn’t a perfect science. This is so important, yet so many traders miss the historical context of their trades.

No matter what stock you’re trading, you should learn everything you possibly can about its history. Pay close attention to the following historical metrics:

- Prior price action in the chart

- The company’s earnings history

- Major catalysts in the past

Know how the stock has reacted throughout history. Then you can form a strong plan for what may happen soon.

Furthermore, understanding how the broader stock market has reacted to certain periods throughout history can potentially help you prepare for future moves in the major indexes.

For example, if you didn’t know that tech stocks generally struggle as interest rates rise, you might’ve traded this year’s price action completely wrong.

Bottom line: know your history!

Focus on the Best Setups ONLY

Sykes has taught me many important lessons. But there’s one, in particular, that has changed my entire life…

Focus on the best setups ONLY!

A lot of newbies get caught up chasing anything that’s spiking. Sykes was able to help me understand why stocks spike and when those spikes are predictable.

I now use the same principles to understand why stocks crash and how to predict the timing of said crashes.

You can’t predict every move that a stock will make. That would be superhuman and impossible. Not to mention it would be exhausting.

Want to be alerted to hot trade ideas before anywhere else?

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the Stock Market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for DWAC on October 21st:

This is a tool you’ll want in your trading toolbox.

But you can narrow the patterns you trade down to a very selective list. If the setup doesn’t check your boxes, don’t even think about trading it.

One of my favorite DVDs that Tim made was “PennyStocking Framework.” His experience and knowledge helped me learn basic patterns and setups that I now apply to the options market as well.

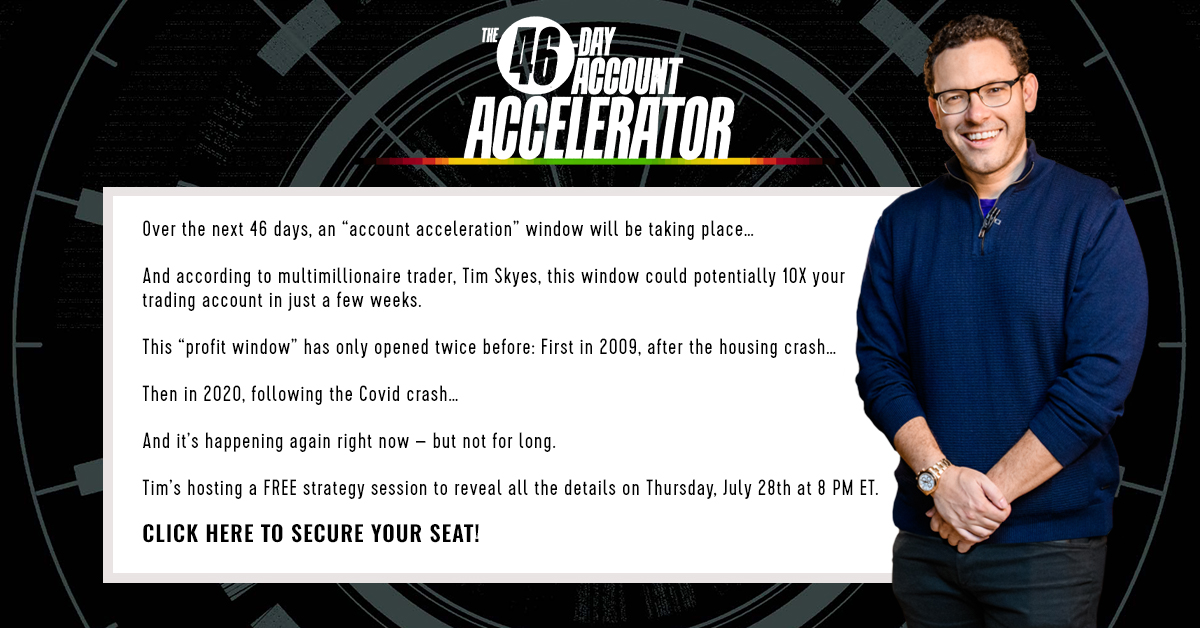

Even better … Tomorrow at 8 p.m. Eastern, Sykes is taking a different challenge on — The 46-Day Account Accelerator.

Sykes will be doing a trade-by-trade walk-through of previous ‘profit windows’ … proving that it’s possible to repeatedly 10x your trading account during these short periods of time. Click here to sign up before it’s too late!

The great part about the stock market is that chart patterns tend to repeat over and over. And Sykes figured it out a long time ago. They’re still the same patterns all these years later.

Understanding this makes it easier to focus on the best setups. With experience, you’ll learn what works for you, and how to identify those patterns immediately just by glancing at them.

The right mentor makes all the difference. They point you in the right direction, then the rest of the work is up to you.

Check out what my top student Jenny has to say on the topic!

The First Red Day and First Green Day Patterns

Speaking of setups, some of my favorites that I’ve learned from Sykes are the first red day and first green day patterns…

The idea behind both of these patterns is the same…

When momentum stocks hit a big reversal — moving into their first red or green close in several days — incredible trading opportunities can arise.

I have a negative bias, so I tend to focus on the first red day. I target tops on overextended stocks. Then I wait for the inevitable dump.

The first red day is often the biggest single-day drop in a momentum chart. This can lead to juicy setups for short sellers like me.

On the first red day, I often day trade put contracts. When the right patterns come along, it’s important to strike while the iron is hot.

But I never would’ve grasped this concept if it wasn’t for Sykes showing it to me in the first place.

Final Thoughts

Without the right teacher, I could’ve stumbled down the wrong path. I was very lucky to find my mentor when I did.

Sykes has helped guide me to nearly $4 million in trading profits and taught me everything I know about the stock market in the process.

Now, I have the pleasure of being your trading mentor. And I don’t take that responsibility lightly…

I’m here to coach you through the unavoidable highs and lows of being a professional trader. If you’re reading this, you’re already ahead of the game.