About two weeks ago, I started analyzing a few charts and one setup stuck out among the rest.

The charts that caught my eye are members of the only sector that’s seen any kind of sustained gains throughout 2022…

You guessed it, I’m talking about oil stocks.

I’ve had a strong sense of the energy sector since March when I perfectly called the top.

A few weeks ago, when I started to see similar topping signs to those I saw in March, I told Evolvers to watch the sector closely.

I told you all that I thought we were getting close to a potentially great trade opportunity in the sector…

Sure enough, this week we’ve seen the total destruction of oil stocks.

Furthermore, the options contracts on some of these tickers have exploded to the upside, once again proving the power of well-timed options trades on overcrowded sectors.

At this point, I think the best part of the move is over. I won’t be chasing and you shouldn’t either.

But I’d like to break down the specifics of why this setup was so excellent for my strategy.

That way, you can potentially find these five-star opportunities on your own in the future…

Why I Was Watching Oil Stocks Closely

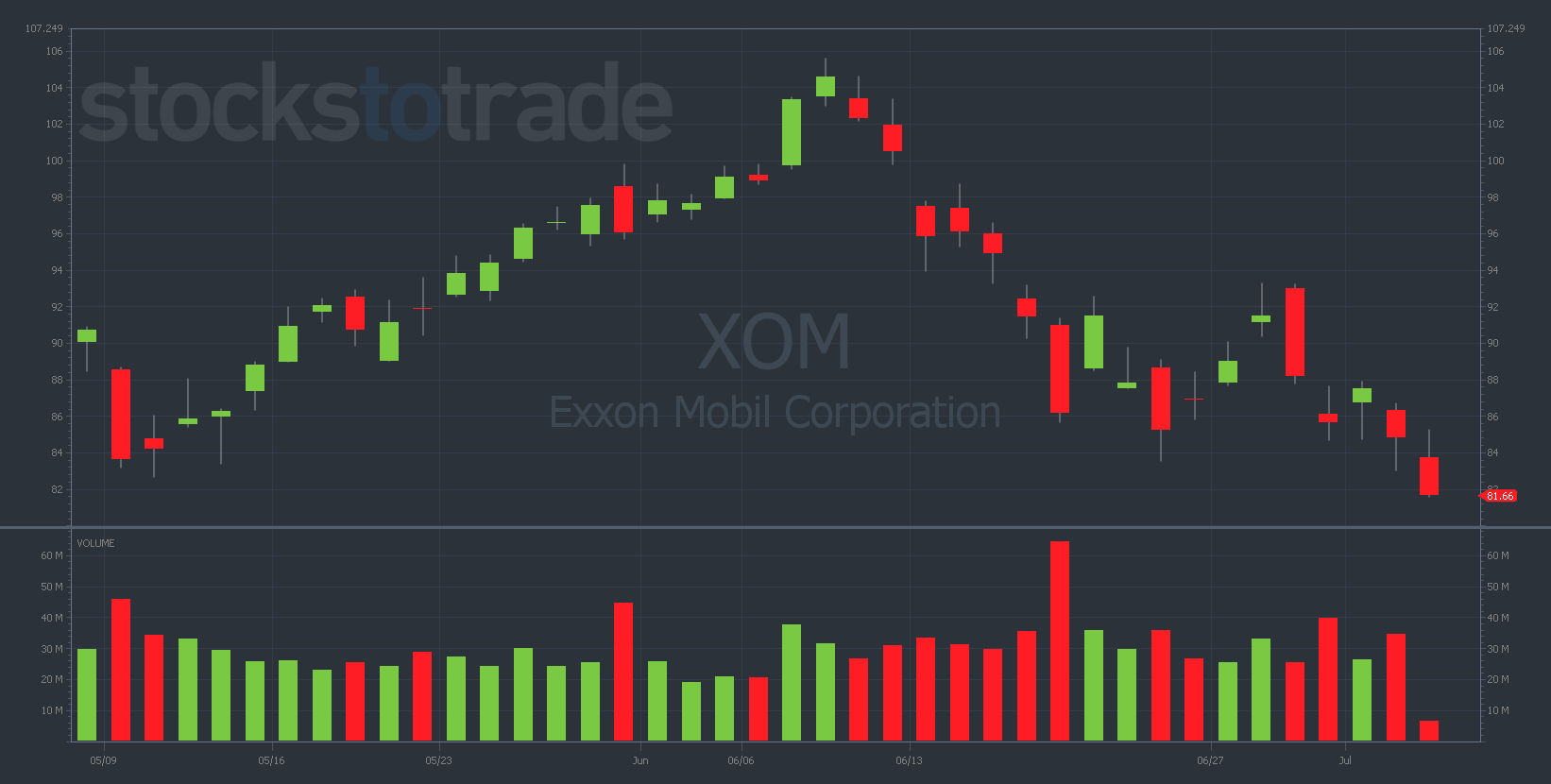

At the end of June, I found myself drawn to the setups in the energy sector — Exxon Mobil Corp. (NYSE: XOM) and United States Oil ETF (NYSE: USO) in particular.

I was starting to see many of the same topping signals that I saw in March when oil stocks hit a massive blow-off top. For example…

- Declining volume on green daily candles

- Round-number resistance ($100-$105 on XOM)

- Potentially negative headlines for the sector

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

These are the sorts of bearish indicators I want you to start looking for in your own trading. When multiple indicators line up together, it’s usually time to pay attention and get aggressive.

But I realize that some of you have other jobs, commitments, and concerns that might prevent you from staring at charts for multiple hours a day.

And the truth is that you don’t have to be a full-time trader to make money in the markets. My buddy Tim Bohen, the lead trader at StocksToTrade, just wrote an e-book about how you can have major success as a part-time trader. Click here to get your FREE copy of The Ultimate Guide To Part-Time Trading!

Even for full-time traders, making a call on a big trade like this can be tough. The bearish signals were screaming at me, but there were other factors to consider…

Examining the Charts

XOM and USO were already significantly off their highs by the time I was seriously considering trading them.

Additionally, news about the possibility of a ‘gas tax holiday’ or action related to the Keystone Pipeline created uncertainty I wasn’t entirely comfortable with.

Any oil trade in 2022 has been a news-driven setup, so you must be paying attention to the headlines if you plan to trade oil stocks. This was no different for me over the past two weeks.

I think I’ve proven that I have a spidey sense for momentum charts that are about to crack… and I was getting those feelings in a big way looking at the XOM and USO charts…

XOM 2-month daily chart — courtesy of StocksToTrade.com

Let’s break down just a few of the overall bearish indicators that were visible in the energy sector before this week’s major crash…

- Rising price and falling volume on the daily chart

- Nearing a perfect retracement from the pandemic lows to the previous highs

- The first red week finally happened

If you notice these indicators aligning on future setups, don’t sleep on them. I wasn’t patient enough with this setup and should’ve capitalized more.

A confluence of this many negative signals is rare and we must take advantage when the opportunities arise.

Final Thoughts

Is the best part of this downside move over? Most likely. Does that mean there’s no trade left in the energy sector? Not necessarily!

Keep an eye on oil stocks in the coming weeks. I’d love to see a bounce I can buy puts into, but I won’t be chasing at these levels.

I just want everyone to be on the lookout for the indicators I’ve laid out today in any sector that may get overheated in the future.