I’ve been saying for weeks that the current market is mostly news-driven.

The Russia-Ukraine conflict, Federal Reserve action, high-profile stock splits — it has all dominated financial headlines and sent huge waves through the stock market.

This week, a new attention-grabbing headline has taken the market by storm.

You guessed it … I’m talking about Elon Musk’s surprise purchase of a 9.2% stake in Twitter Inc. (NASDAQ: TWTR).

After the news of Musk’s stake hit the wires, TWTR surged as much as 30% on Monday.

Today, Musk announced he’s taking a board seat, but the stock’s only up an additional 3% following the news.

I’m seeing strong justifications on both sides of this trade. In other words, I understand why options traders would buy calls AND why they might buy puts.

So, what’s the better trade — buying calls or puts on TWTR? Let’s break it down…

The Case for TWTR Calls

In a recent webinar following a regrettable Tesla Inc. (NASDAQ: TSLA) trade, a student gave me a piece of sage advice — ‘NEVER bet against Papa Elon!’

I’ve said it before and I’ll say it again … Nearly every trader who’s ever tried to short an Elon Musk company has failed miserably (me included).

It’s hard to deny that the guy has a somewhat magical aura around him…

Retail traders worship at his altar of memes. He can move the markets with a single tweet. And as of today – he’s once again the richest person on the planet with a net worth of $270 billion!

Bottom line: It’s difficult to bet against Musk with confidence.

Want to be alerted to hot trade ideas before anywhere else?

Check out the alert for DWAC on October 21st:

This is a tool you’ll want in your trading toolbox.

Take it from me … I’ve attempted to buy puts on TSLA several times with little to no success.

So, if you can’t beat ‘em, join ‘em … right?!

I have to say, if I was to trade TWTR based on this news — I’d lean toward buying calls.

I’ve learned my lesson when it comes to betting against Papa Elon.

That said, if you know me, you know I much prefer a juicy short setup over a speculative calls play.

And when I look at TWTR through a different pair of lenses, I can see a lot of arguments for buying puts at these levels…

The Case for TWTR Puts

I know, I know … Betting against Elon is a fool’s errand.

But you must look at every angle of a potential winning setup before deciding if (or when) to pull the trigger.

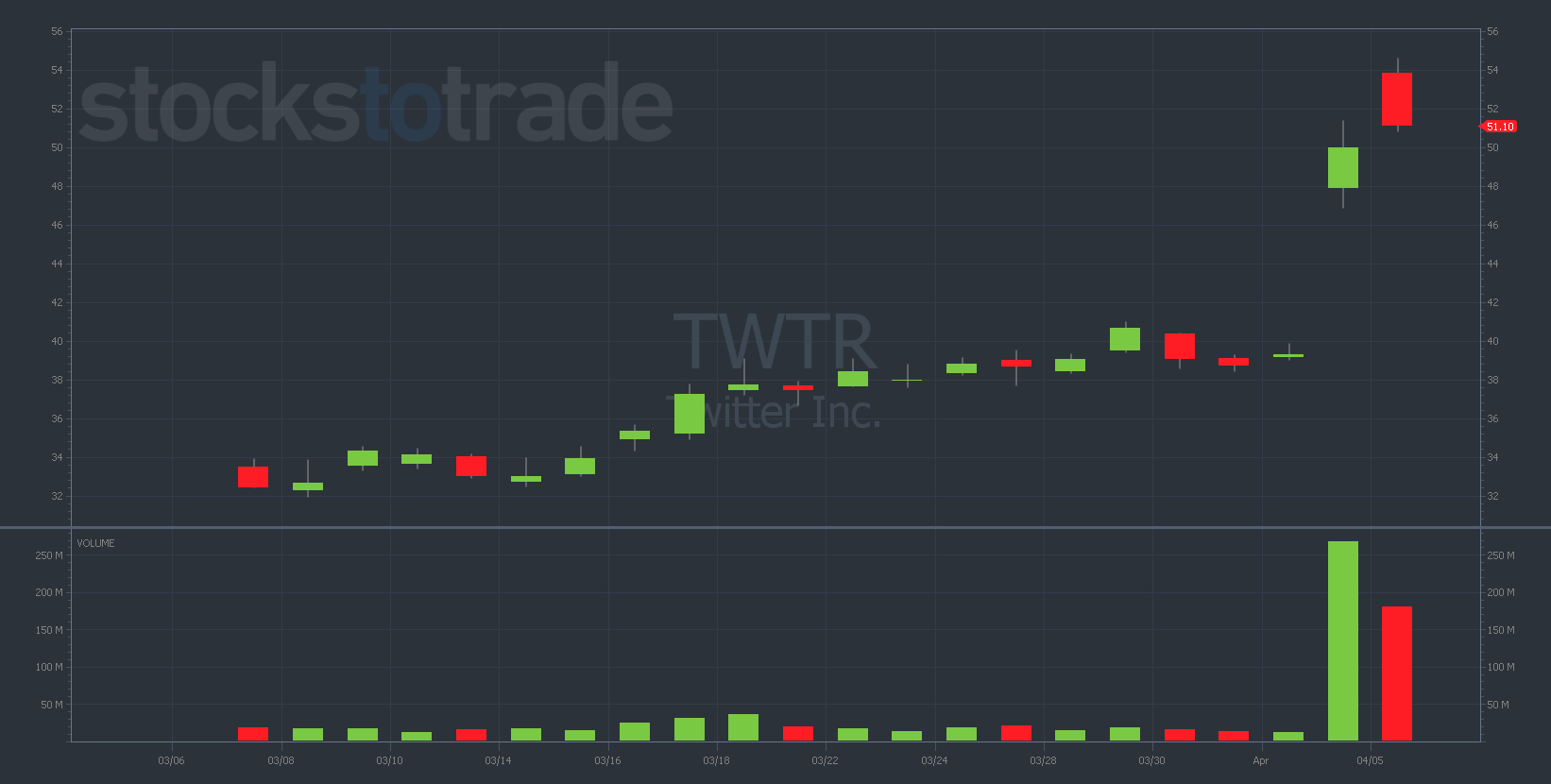

Challenge yourself to see both sides of the trade. Take a look at the TWTR chart…

The case for puts is pretty simple. Let’s look at the three bearish indicators I’m seeing on the chart…

- Up more than 30% in two days

This is a no-brainer bearish signal.

You have to believe that a large majority of the buyers over the last two days were exuberant retail traders looking to nail a quick swing.

These positions are usually racing toward the exits on any signs of weakness.

- Back below the 200-day moving average

TWTR’s 200-day moving average is sitting just above $52.

Interesting … Where’s the stock trading at the time of writing? $51.30!

When a chart exceeds a critical moving average level, this is bullish.

But when it quickly drops back below the average in less than a day, this is bearish.

WARNING: TWTR is also trading below the most important short-term averages (50-day moving average and VWAP) at the time of writing.

- Rising share price and falling trading volume

When a share price is rising, but the daily trading volume is declining — it’s usually time to get aggressive on the puts side.

For a chart to be truly bullish, you want to see the share price and the daily trading volume rising together, like graceful synchronized swimmers.

But if you see a divergence between share price and trading volume, this is usually a signal that the bull run is losing steam.

Final Thoughts

We’re still early in this TWTR surge, so anything can happen.

Musk is a force to be reckoned with. That said, it’s hard to ignore some of the bearish indicators I mentioned.

Tomorrow will be critical. If the volume continues to fall, I’d guess that the share price will open lower tomorrow.

But TWTR could just as easily buck all the bearish indicators and surge another 10% tomorrow…

Remember: It’s a dangerous game to bet against Elon Musk!

That’s why I’m staying on the sidelines for now. It could go either way…

But I wanted to show you how I look at all of the angles of a potentially two-sided trade. My hope is that you can approach these kinds of setups objectively in the future.