On Monday, I included the United States Natural Gas Fund (NYSE: UNG) in my weekly watchlist.

I kept a close eye on the chart for a potential reversal — and felt it was going to happen sooner rather than later.

UNG has gone nowhere but up for over a month. And we all know what happens to stocks that fly so high, so quickly…

On Tuesday, the reversal I was waiting for occurred as UNG dumped as much as 10% in a brutal first red day.

Meanwhile, UNG 4/22/2022 $25 puts surged more than 300% at the open, leaving the opportunity for weekly options traders to reap enormous profits.

If you missed this trade, don’t sweat it. I didn’t trade UNG either. Quite frankly, the options chain wasn’t liquid enough on Monday to fully entice me. Plus, I’m still on vacation!

The setup checked a lot of my boxes, but not all of them. I recently wrote about the value of learning from other traders. Well, I learned about trading checklists from my buddy Tim Bohen.

And speaking of Bohen, he’s hosting the 2 p.m. Cash Appointments Summit tomorrow, April 21, at 8 p.m. Eastern. He’ll reveal the unusual pattern that’s letting him walk away with $1,000 or more in LESS THAN AN HOUR! Click here to reserve your spot now!

Now that you’ve reserved your spot, let’s go over what I was seeing in the UNG chart on Monday.

Who knows? If you pay attention, maybe you can buy puts on the next overextended momentum chart before it dumps 10%…

Oil Stocks’ Wild Ride

In early March, I drew a line in the sand and decided it was time to short oil stocks. I was right.

A few days later, the bearish indicators I’d seen were proven correct as much of the energy sector tanked into oblivion.

But the downtrend was short-lived. The sustained nature of the Russia-Ukraine conflict has prevented any major crash in the energy sector from taking place yet.

[VIDEO] A Rare Live Interview With Two Millionaire Traders...

To trade options, you DON’T NEED:

❌ A big account…

❌ To stare at your computer all day every day…

❌ A stockbroker…

Because there’s a way to trade stocks (from home) without struggling through the unnecessary risk and hassle most newbies go through…

To get started…

Click here to watch a rare interview between these two millionaire stock traders

For the most part, oil stocks have been shaking off their momentary dips and ripping higher for the entirety of 2022.

That said, remember that sectors move in cycles. Even the most bullish of momentum charts have to reverse at some point…

The key to trading my puts strategy is identifying when exactly the reversal will happen. Timing is everything!

Bottom line: Nailing the downside is all about being able to see a blow-off top when it’s happening right in front of your face.

And at the start of this week, I started to see some of the same indicators in UNG that I saw in the broader energy sector back in March…

How to Spot a Blow-Off Top

On Monday, the UNG chart was exhibiting two crucial blow-off top indicators that I simply couldn’t ignore. Let’s break them down…

Indicator #1: Over-the-Top Price Action

Blow-off tops all start the same way — with insanely bullish price action. These moves usually look unassuming at first, bubbling up on modest volume…

A few days later, the share price will be surging unstoppably. And unobservant traders will wonder how they missed the boat.

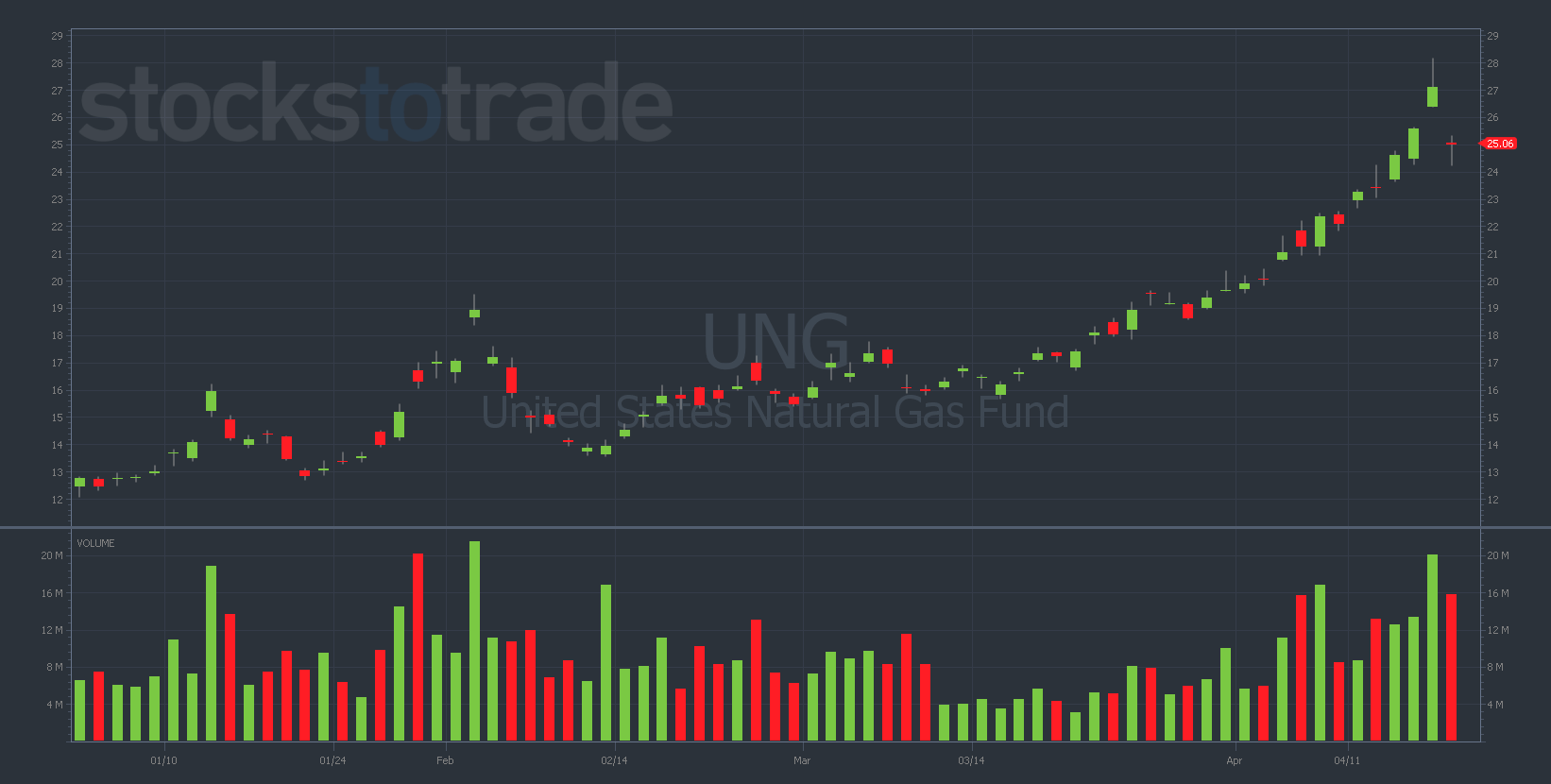

Look at the UNG chart for an excellent example of this brand of over exuberant price action.

Take note of the fact that UNG was green five days in a row prior to its blow-off top on Monday.

Whether a chart like UNG will eventually reverse isn’t a question of if, but when.

Indicator #2: Above-Average Trading Volume

Perfectly calling a blow-off top is far easier said than done … but it’s not impossible.

And I think there’s one particularly revealing indicator to track when searching for blow-off tops — trading volume.

Beyond an ever-increasing share price, you want to see extremely elevated trading volume leading into a blow-off top.

If you’re looking at a stock and notice that the shares have exchanged hands several times more than the average daily volume … this is a flashing red light.

Additionally, look at a daily or weekly chart and mark the all-time high-volume day…

When the current rally’s volume nears this previous level, a blow-off top could be right around the corner.

This is exactly what happened with UNG if you compare this week’s volume top to the chart in mid-February…

On February 22, UNG hit a top of $19.50 before crashing more than 30% in the following eight trading days. On that day, 21.6 million shares exchanged hands.

Watch This Exclusive Crypto Webinar NOW!

(With millionaire trader Matt Monaco)

If you want to see how a millionaire trader is dealing with the crypto boom…

Then you need to see this webinar.

Can you guess how many shares exchanged hands this Monday? Just over 20 million, and these were the two highest-volume days of the entire year for UNG.

Had you bookmarked that all-important volume level, you could’ve noticed that UNG was butting up against its year-to-date volume high.

And as traders, these are the kinds of signals you should look for to get the confirmation you need to pull the trigger.

Final Thoughts

As brutal as this first red day was for UNG, I think there could be plenty more downside in this trade. The chart is still incredibly overextended.

But I’m not chasing the downside here. I’ll wait to see some kind of bounce (and potentially a shift in the headlines) before I’ll consider buying UNG puts.

The lesson here is to keep your eyes peeled for the blow-off top indicators I’ve taught you about.

You never know when that five-star setup will present itself, checking all of your boxes.

And if you blink, you could miss it.