You need to hear this…

A recent series of trades I put on one particular stock are great examples of a vital concept in the stock market…

I want every Evolver to understand and internalize this idea. If you can do so effectively, you’ll be a better trader for it.

Why? Because flexibility and adaptability are two of the greatest strengths a trader can possess.

Whether you prefer buying calls or puts, being able to navigate both sides of the momentum cycle is vital.

With that in mind, keep reading and I’ll show you how I played both sides of the chart on one of the craziest stocks in the market right now.

Recapping My NKLA Puts Trade

Recently, I wrote in detail about my puts play on Nikola Corporation (NASDAQ: NKLA)…

In case you missed it, my main thesis was this…

The stock was being rallied up in a purely speculative gamma squeeze. There was no fundamental reason for NKLA to be up 350% in a few weeks.

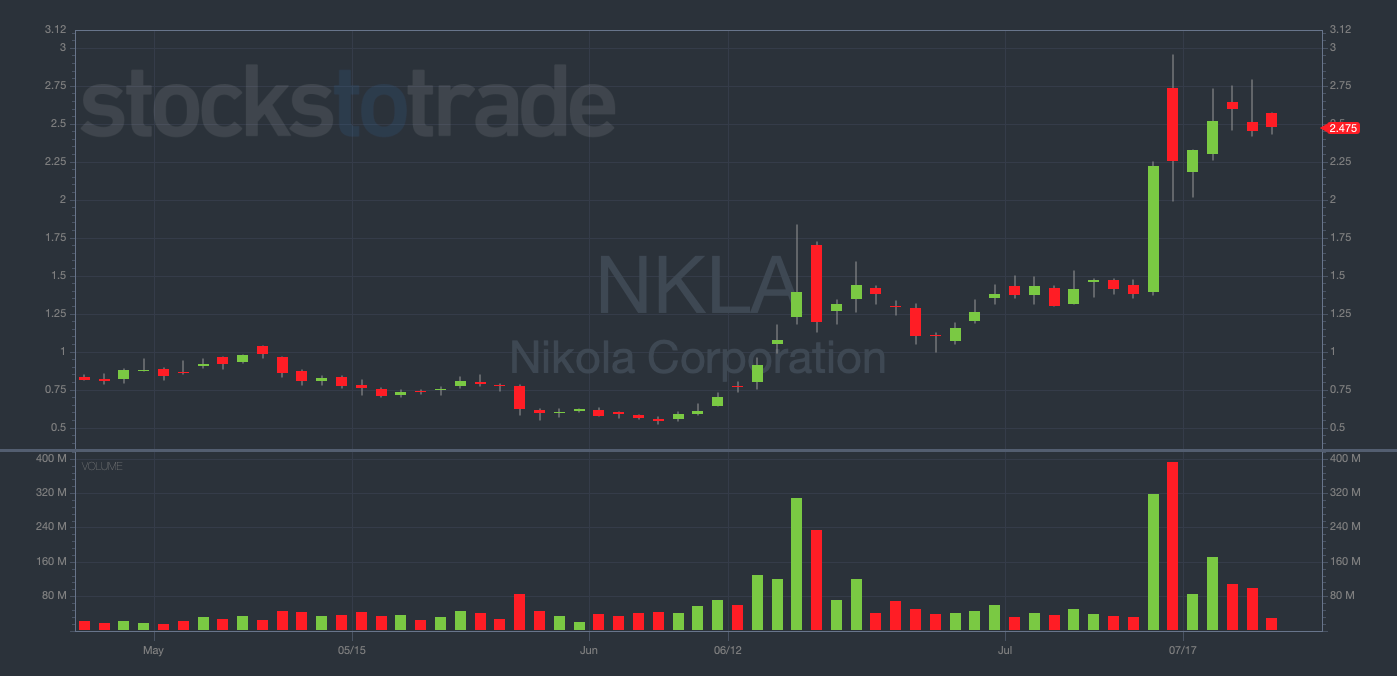

Take a look at the chart from July 24…

NKLA 3-month daily chart from July 24 — courtesy of StocksToTrade.com

Notice that the top was at $2.97 … a mere 3 cents before a big round number at $3.

Once the chart started to show signs of weakness near the all-important round-number level at $3, I used that technical indicator as a signal to buy puts.

Unfortunately for me, I was actually moving into a new house that day. I had so many distractions going on that I couldn’t babysit the trade appropriately. I was forced to exit the trade early.

So, I personally didn’t nail the puts trade as perfectly as I should’ve. But that doesn’t mean my alert wasn’t on point, or that this isn’t a great example of a prime put-trading opportunity.

For all intents and purposes, this was a fantastic setup.

And, in fact, this puts play was just the beginning of my recent moves on NKLA…

Why I Bought NKLA Calls

Listen…

If you can time the rally by buying calls early and selling them into strength, then follow through by buying puts near the blow-off top — that’s a nearly perfect trade.

And the inverse play can be just as profitable…

If you can buy puts near the top of a run, then profit off of a bounce at a near-term bottom, you can potentially make enormous gains overnight.

SPOILER ALERT: This is exactly what I did with NKLA last week…

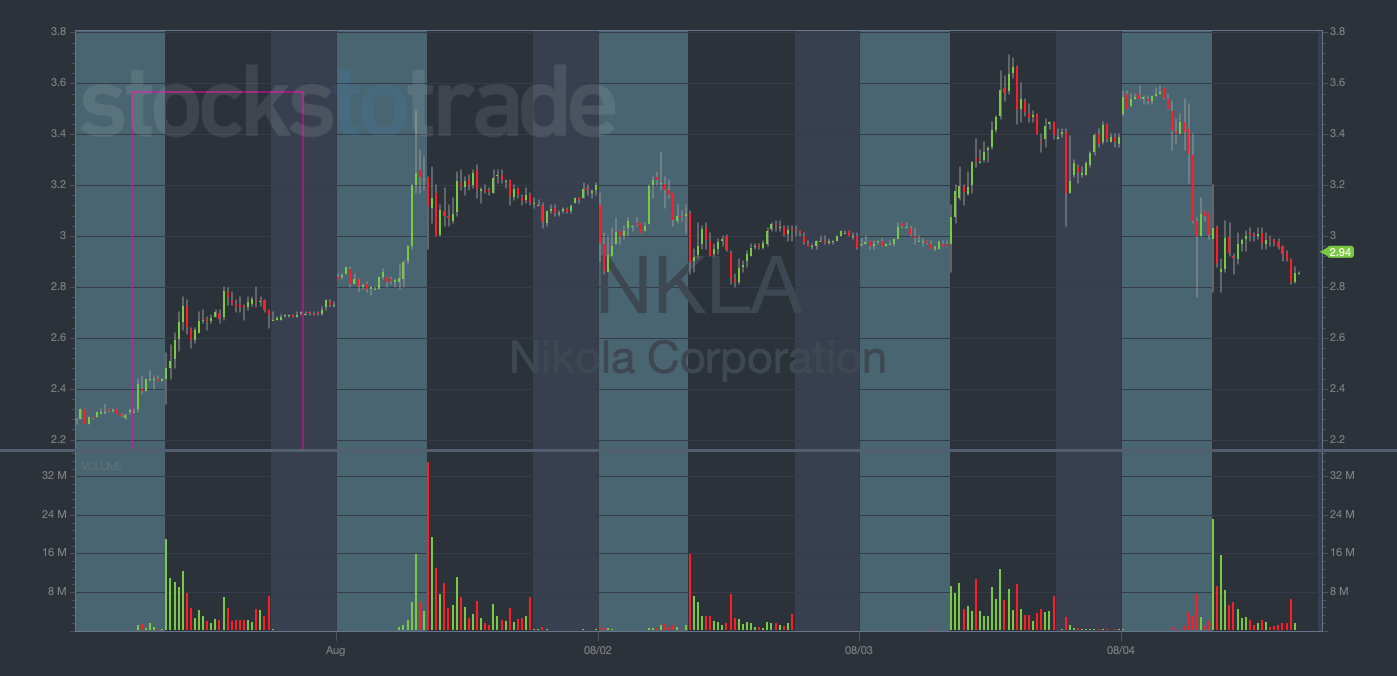

On Monday, July 31, NKLA was starting to show signs of a reversal to the upside…

Take a look at the chart (I drew a purple box around July 31)…

NKLA 5-day 15-minute chart — courtesy of StocksToTrade.com

So, just before the bell rang, I bought NKLA 8/4/2023 $3 Calls for $0.21.

These were incredibly cheap contracts, and I knew that any move above $3 the following day could potentially deliver triple-digit gains.

Sure enough, I was right…

NKLA gapped up on Tuesday, August 1, when I sold the calls for $0.47 — a profit of 126% in less than 24 hours!

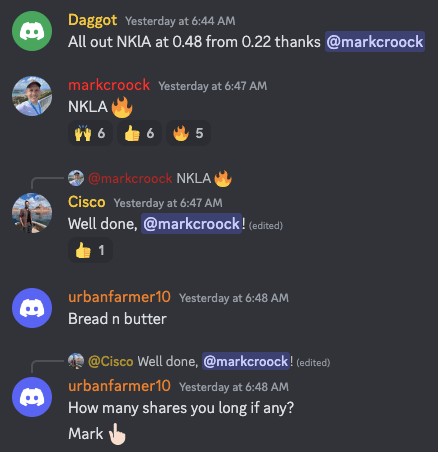

Better yet, a bunch of Evolvers in my Discord server shared their wins with me!

Congrats to anyone who banked on NKLA with me! Excellent work, let’s keep it up!

Why You Should Always Consider Both Calls and Puts

The lesson I want to stress in regard to these trades is simple — don’t sleep on the power of playing both sides of a chart!

One of the most valuable skills a trader can strive towards is the ability to nail both the upside and the downside of a chart.

I hear some traders say they ‘only buy puts on this stock’ or ‘only buy calls on that stock’ … but this is a dead wrong approach.

Don’t EVER fall in love with — or hold a grudge against — any particular stock.

I see this all the time with inexperienced newbies. They’ll have blinders on, only looking to trade calls or puts, failing to see the opportunities on the other side of the options chain.

But these inherent biases will do you a major disservice as a trader. You’ll only consider half of the possible setups on a chart.

Take my recent NKLA trades as inspiration to start seeing the opportunities on the upside and the downside.

Final Thoughts

To crush it as an options trader, you’ve gotta be flexible … ready to strike on both sides of the momentum cycle.

WARNING: Don’t be a perma-bull or perma-bear!

Sure, I’m a generally short-biased trader. But I’m just as willing to put a bullish trade on if the opportunity arises (as evidenced by my moves last week).

Having the ability and foresight to trade puts and calls — even on the same chart — is a crucial skill you must develop if you wanna have a long and successful career in the options market.