You need to hear this…

When worthless companies catch the attention of retail traders and start surging to the upside, five-star put-trading opportunities can arise from the madness.

After all, I’ve made a large part of my $4 million+ fortune by trading patterns such as these…

So, when a certain setup appeared on my watchlist on Friday morning, I couldn’t resist slapping a few contracts on.

If you wanna know all the details about my newest trade…

Keep reading and I’ll break down what led me to buy puts on this particular stock (and how I plan on playing it)…

An Early History of NKLA Stock

For anyone unfamiliar, Nikola Corporation (NASDAQ: NKLA) is an American electric vehicle (EV) manufacturer known for developing hydrogen fuel cell trucks … and being outed as a fraud.

The company was founded in 2015 by Trevor Milton, and it gained significant attention shortly after going public through a reverse merger with a special purpose acquisition company (SPAC) in June 2020.

Here’s a brief timeline of events, laying out the early days of NKLA stock…

June 2020: Nikola’s stock begins trading on the NASDAQ under the ticker symbol NKLA after merging with VectoIQ Acquisition Corp, a SPAC. This method allowed the company to go public without the traditional initial public offering (IPO) process.

Shortly after going public, Nikola’s stock experiences a significant surge in value, with the stock reaching a high of $65.90 on June 19, 2020.

September 2020: Hindenburg Research, a short-selling research firm, publishes a scathing short report accusing Nikola of fraud and exaggerating its technological capabilities. The report raises concerns about the accuracy of the company’s statements and triggers a major decline in NKLA’s stock price. By September, NKLA is trading in the $30s.

Trevor Milton Resignation: In the wake of the Hindenburg report, Trevor Milton resigns as the company’s executive chairman in September 2020, adding further uncertainty and negative sentiment surrounding the stock.

Ongoing Developments: After the initial controversies, the company continues to face scrutiny and legal challenges regarding its statements and actions. This, coupled with the broader volatility in the EV sector and market sentiment, continues to impact NKLA’s stock performance.

Over the following two years, NKLA loses 98% of its market value, eventually hitting a low of $0.54 on June 6, 2023…

Now, this is where things get interesting…

NKLA Squeezes Off the Bottom

You’ve probably noticed a certain phenomenon in stocks that are facing corporate headwinds, short reports, or even potential bankruptcy…

Sometimes, traders try to rally these names off the bottom in an attempt to create a rip-roaring short squeeze.

We’ve seen this so many times in recent history…

Think about the crazy upside surges in GameStop Corp. (NYSE: GME), AMC Entertainment Holdings Inc. (NYSE: AMC), Carvana Inc. (NYSE: CVNA), Bed Bath & Beyond Inc. (OTCMKTS: BBBYQ), Revlon Inc. … the list goes on.

Well, this is exactly what’s happening with NKLA currently. Short-squeeze hopeful longs planted a flag at $0.59 and started buying shares hand-over-fist.

And sure enough, they’ve made some serious waves…

At the time of writing, the stock is up 350%+ in less than six weeks … a 5x multiple from its June lows!

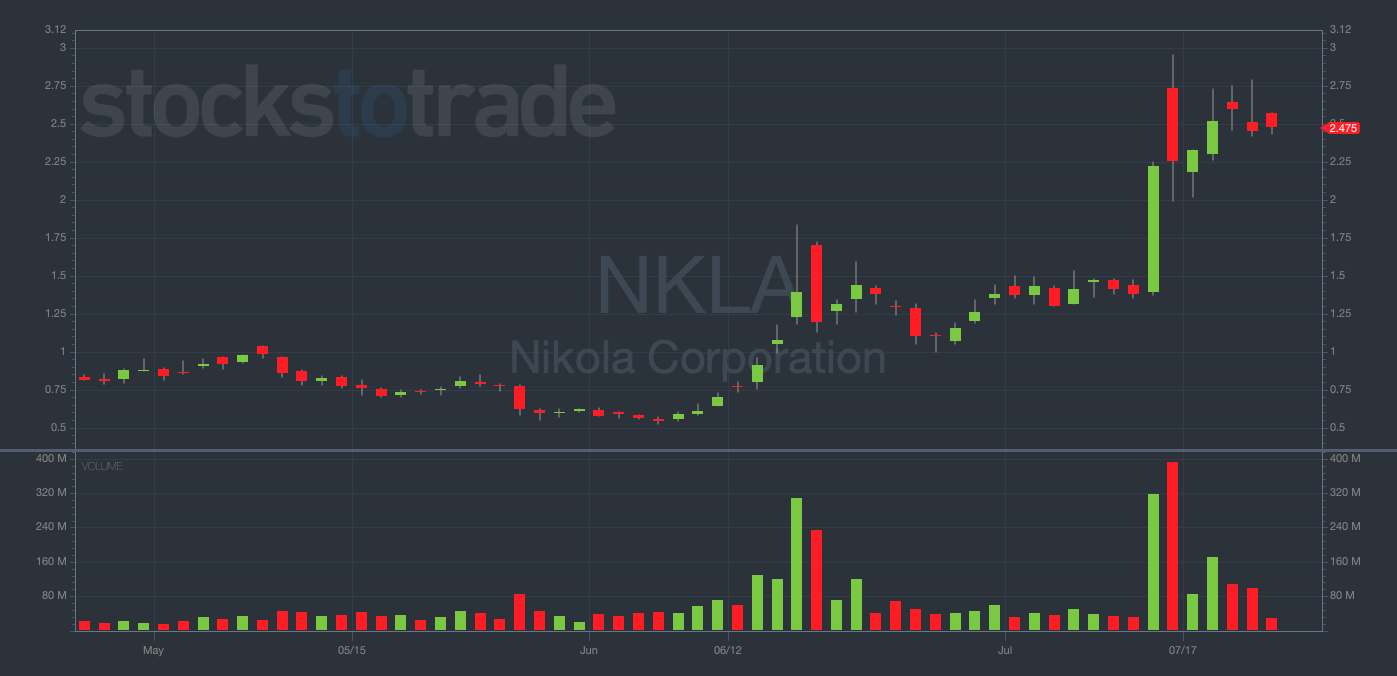

Take a look at the chart…

NKLA 3-month daily chart — courtesy of StocksToTrade.com

Notice that the top is at $2.97 … a mere 3 cents before a big round number at $3.

In my view, this isn’t a coincidence. I’ve said it before and I’ll say it again…

When a momentum stock starts to back off just before an important psychological price level, it’s time to think about buying puts.

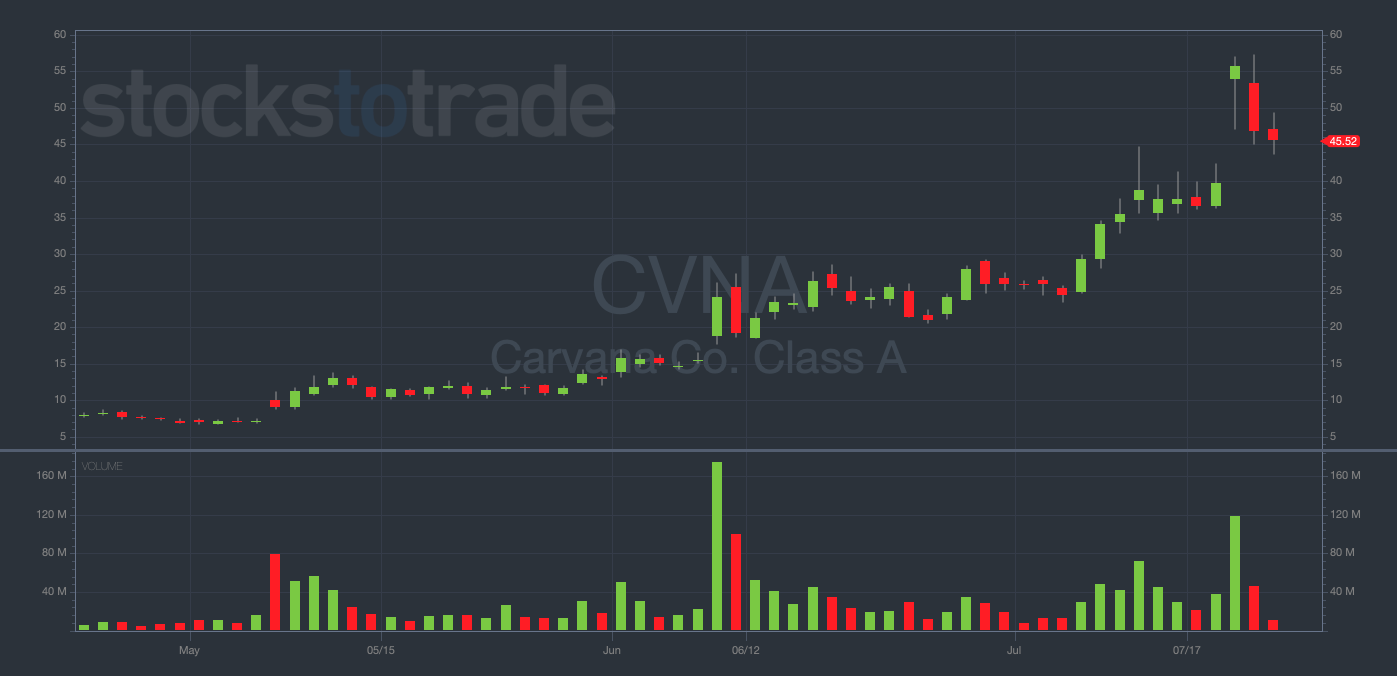

Additionally, I’m noticing major similarities between the NKLA and CVNA charts right now…

CVNA 3-month daily chart — courtesy of StocksToTrade.com

Notice the similarities? See how CVNA had a big red candle immediately following its double top at $57?!

Well, I’m betting that a similar move is in store for NKLA.

On Friday, I bought NKLA 7/28/2023 $3 Puts for $0.72. I’m looking for a downside move to under $2.

This company is completely worthless and the stock is only surging because of retail trader momentum…

Once that momentum stalls out — which I think is happening currently — this stock will inevitably do what every other short squeeze does at the end.

It’ll fall right back to where it began.

And my fingers are crossed that my timing is on point this time!

Final Thoughts

While I think this is a promising setup, I need to remind you NOT TO CHASE!

Whatever you do, don’t blindly follow me into this trade.

Do your own research and only enter the play if it fits your strategy perfectly.