Happy Friday, Evolvers!

This needs your attention…

Nearly every question I got this week was about one stock…

This name has completely taken over the market and arguably provided a once-in-a-lifetime earnings play opportunity.

Some Evolvers crushed this trade while others are disappointed they missed it.

So, in today’s Q&A, we’ll focus on a certain tech stock that’s rocking the stock market.

Keep reading and I’ll answer your questions…

“I’m really disappointed about missing NVDA earnings calls. How can I recover from missed opportunities moving forward?”

Let’s talk about NVDA…

Last week, someone asked me if I thought it would be “chasing” to buy calls prior to the earnings report.

I said yes…

Now, did NVDA’s incredible numbers change my mind about this?

The answer is no. Just because a stock goes up doesn’t mean the setup leading into it was five stars.

Listen…

Hindsight is 20/20. Now that we’ve seen the earnings print, it’s easy to say “That was so obvious!”

But in reality, no one knew what was going to happen. And the risk/reward going long into NVDA earnings was undesirable…

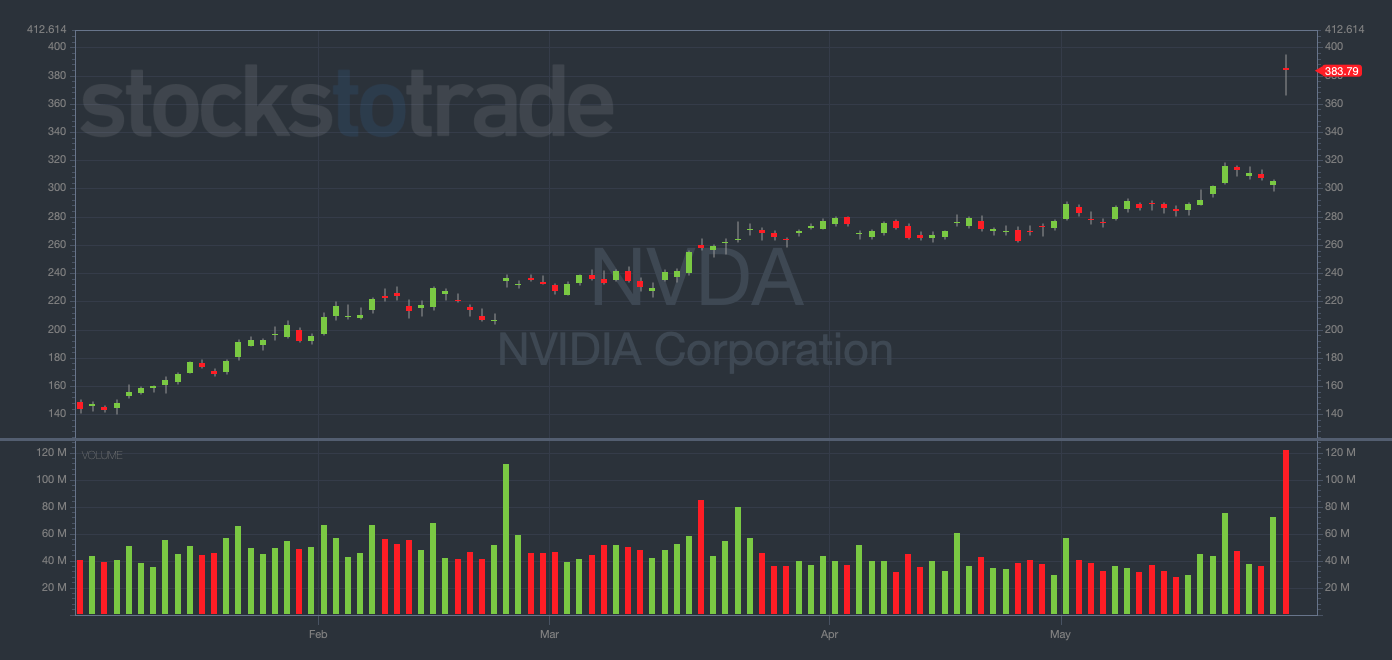

The stock was already up 120% in 2023 — 10% on the week — before the 20%+ earnings surge!

NOTE: Just as you shouldn’t chase my trade alerts … you shouldn’t blindly take my advice, either.

At the end of the day, trading is an individual sport. If you truly have conviction in a setup that I’m not seeing, don’t let me stop you.

You must do your own due diligence, technical analysis, and research. I’m here to help guide you, not to babysit every trade you make.

Now, look at the chart…

NVDA YTD daily chart — courtesy of StocksToTrade.com

(WARNING: If you follow my trade alerts, you’ve probably noticed I almost never buy options prior to earnings reports. Attempting to guess the outcome of an earnings report is gambling, not trading!)

Had NVDA not knocked it out of the park — nearly doubling analysts’ earnings estimates — the stock probably would’ve gotten destroyed yesterday.

But ultimately, the feelings you’re having come down to the fear of missing out (FOMO).

You see NVDA ripping and other traders profiting. Then, your emotions take over…

Or, you’ll see the play working after your setup happened and it’ll sting that you’re not in it.

I get it. I’ve been there many times before.

But you can’t let these feelings overcome your discipline. Don’t let FOMO cause you to chase the upside or enter a trade too late.

Bottom line: You must value a setup fitting into your strategy over what other traders are doing.

“Would you consider playing puts on NVDA? If so, when?”

Now that NVDA’s earnings are behind us and the stock has surged another 20%, you’re on the right track to be thinking about put-buying opportunities…

I’ve been waiting for the downside on NVDA for weeks now.

But we need to stay patient…

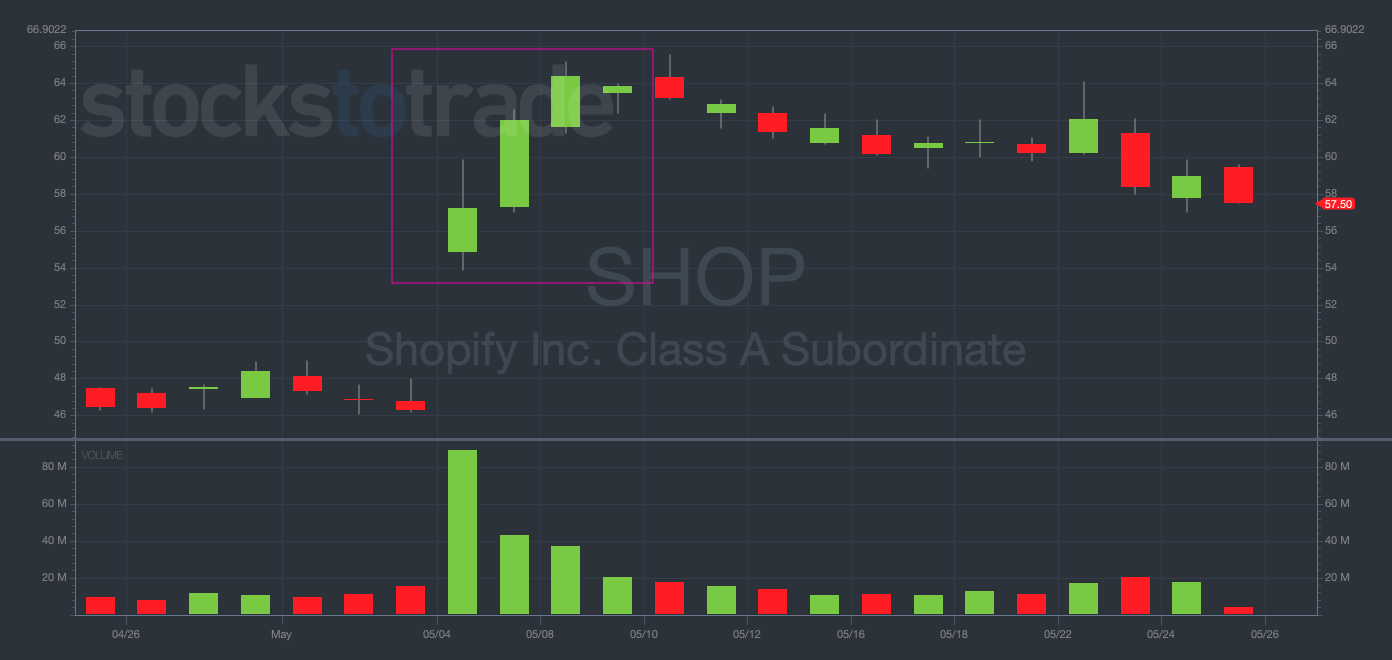

Look at what happened with Shopify Inc. (NYSE: SHOP) following its recent killer earnings report…

SHOP 1-month daily chart — courtesy of StocksToTrade.com

… the stock soared for four more days before topping out just shy of $65!

NVDA could make a similar move — or trade sideways for days or weeks — causing your puts to get wrecked.

I’m watching the psychologically-important $400 level for topping signals. If NVDA struggles near $400, that could potentially be a solid entry for put contracts.

After all, NVDA was already overextended before this earnings surge. And at this point, the company’s valuation is living in an absolute fantasy land…

At the time of writing, NVDA has a market cap worth $946 billion. This makes it the sixth highest-valued corporation on the planet, even above Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK.B)!

That said, remember that the trend is your friend. Don’t try to be a hero and prematurely short a stock that’s ripping on momentous volume.

Instead, look for confirmation of a blow-off top before considering puts. Here are the signs I watch out for:

- The stock is up 30%+ in a few weeks (or less). (NVDA is up 41% in the past month!)

- The average daily trading volume is 2-5x normal levels. (NVDA traded 120 million shares yesterday vs. an average of about 50 million per day!)

- The price action and volume fail to crack a crucial resistance level. (This is the one piece of the puzzle we don’t have yet. I’m waiting patiently for this signal!)

Bottom line: Watch for these indicators and wait for the momentum to turn. Only then should you think about buying NVDA puts.

Final Thoughts

Have a great weekend, Evolvers!

I’ve been a bit too speculative recently. I’ve taken a few losses, but I’ve also missed some good opportunities.

With that in mind, I’m taking this weekend to step back and review my trading. And I suggest you do the same.