Happy Friday, Evolvers!

Right now, my trading is so bad that we might have to substitute the Inverse Jim Cramer Indicator for the Inverse Mark Croock Indicator!

All jokes aside, in times such as this, it’s important for me to determine exactly what I’m doing wrong…

After careful self-reflection, I noticed that I’ve been spot-on about the direction of my recent plays … but completely off on the timing.

WARNING: Timing is everything!

Going into next week, I’ll be much more conservative with my options trades. And when I do put one on, I’ll keep it on a short leash … paying close attention to my timing.

But enough small talk. It’s Friday, so that means it’s time for our Q&A.

Keep reading and I’ll answer your questions…

“What’s your thesis behind $AI puts for next week?

Before getting into this, I have to stress something once again…

Whatever you do, DON’T CHASE MY ALERTS!

If you’re going to enter this trade, do so because you genuinely believe in the setup. Don’t simply take it from me…

Now that we have that out of the way, my thoughts on C3.ai Inc (NYSE: AI) are pretty simple…

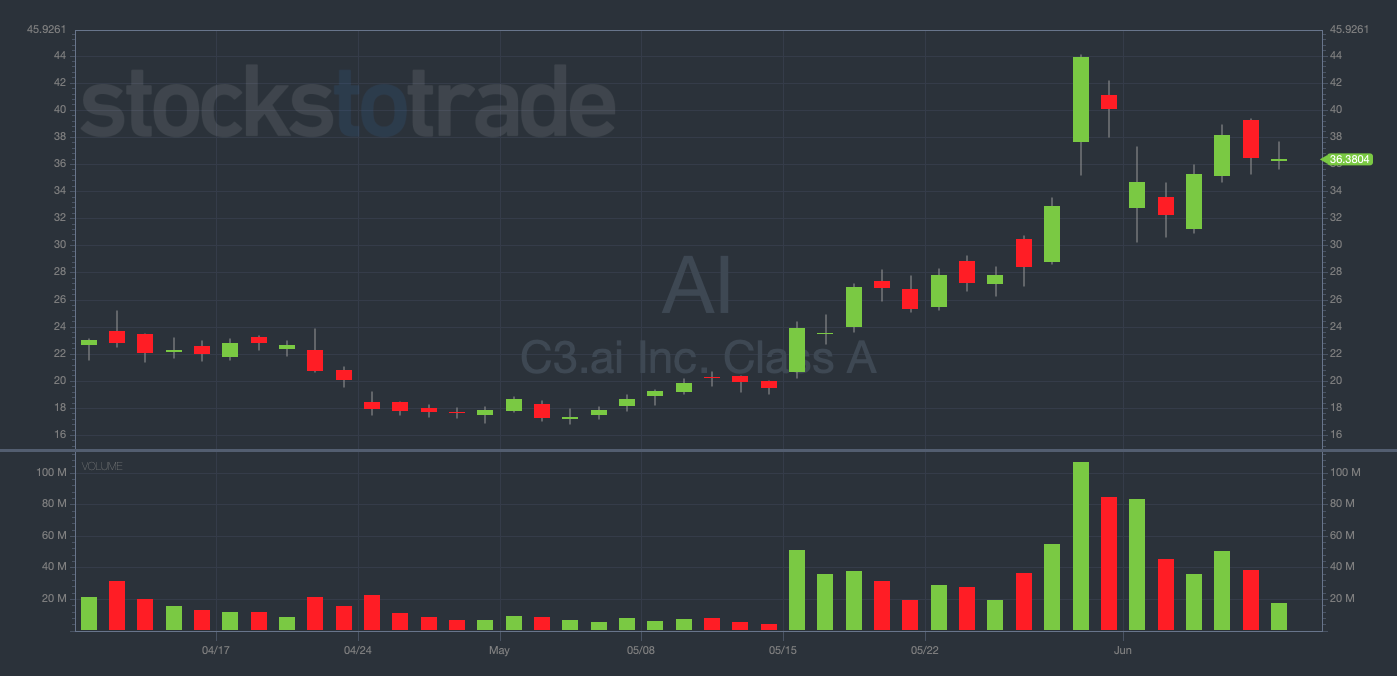

AI 2-month daily chart — courtesy of StocksToTrade.com

After reaching a near-term peak of $44 on May 30, AI hasn’t been able to make higher highs.

It got slammed down to $32, then tried to recover back to its highs, but failed at $39.40.

WARNING: These technical failures are very bearish indicators you should be paying attention to!

Seeing a big round-number rejection just before $40, coupled with the chart putting in lower highs, makes me think the chart is gonna get destroyed next week.

That’s why I bought 150 AI 6/16/23 $30 Puts for $0.65…

If I’m finally correct about the timing of this play, I’ll look to sell part of this position near the $30 level.

Then, if it’s continuing to look bearish, I may hold a small number of contracts for a possible landslide to the mid-$20s.

Keep in mind that this is a small position for me. When I’m not trading my best, I don’t load the boat into speculative options trades.

This leads me to the next question…

“When you’re going through a rough patch in your trading, do you change the size of your positions?”

Yes. If you’ve been following my recent bad run of trades, you’ll notice I haven’t been trading big positions.

I have $4 million+ in my trading account, yet I put under $10,000 into my AI play…

Why? Because I don’t want to take an outsized risk when I’m underperforming.

This is common sense…

When you’re firing on all cylinders, crushing the majority of your trades … you should press your edge and trade aggressively.

But if you’re like me right now, struggling to turn any trade into a winning one … you should size down and trade conservatively.

Smaller positions can give you more leeway to make mistakes (especially if you’re trading a small account).

In other words, if you size down, you won’t blow your account up on one trade.

The most important thing is that you go on to trade another day. NEVER risk more than you’re willing to lose.

REMEMBER: You can always add to a winner (which is much easier than cutting a loser).

I can’t tell you how many traders I’ve seen blow their entire careers on a few poorly-sized trades.

Don’t become one of these cautionary tales. Be very deliberate with your position sizing and you’ll be a better trader for it.

Final Thoughts

Have a great weekend, Evolvers!

I’ll be spending a lot of time going over my trades, determining my faults, and adjusting my plans for next week.

And I suggest you do the same!