I’ve got one word for this market, Evolvers — brutal!

It seems like every time stocks try to rally, even a little bit, the bears come slamming them back to reality.

I’ve said it before and I’ll say it again — this market is news-driven. And there’s just not much good news for stocks right now…

Until we get a positive shift in the inflation headlines, Federal Reserve policy, or geopolitical tensions — stocks are vulnerable to further downside.

That said, it’s time to lighten the mood. I got a lot of fun questions from students this week.

So let’s celebrate this Friday with a little Q&A, shall we?

How do you pick your ‘key price levels’?

Identifying key price levels takes a bit of experience. But if you trade for a while, you’ll find it eventually comes as second nature.

When you’re first starting, it can be a weird concept to grasp. It might seem like professional traders pick these ‘key levels’ out of thin air.

I’ll be honest … I was lucky when I was first starting as a trader.

I found Tim Sykes’ Trading Challenge within my first few months of researching the stock market — and it completely changed my life.

Are You Missing Out On Epic Trades?

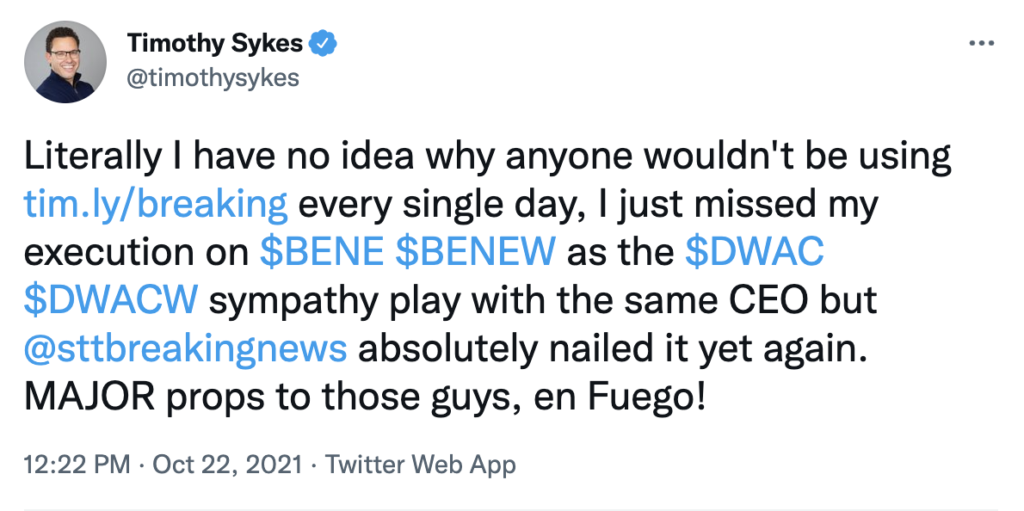

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

Tim Sykes encourages his students to use Breaking News Chat every day:

Sykes’ approach to trading is unique. By absorbing his knowledge like a sponge, I learned how to find key levels…

First, start by looking for levels on a long-term chart, like the daily or the weekly. I find it’s much easier to see the key levels on more zoomed-out charts.

From there, I look for three indicators when trying to pick the key levels on a chart…

- Prices that the stock has consistently bounced off of (support)…

- Prices that the stock has consistently been rejected at (resistance)…

- Channels between two prices that the stock trades within (ranges)…

I also wrote in detail about — and gave specific examples of — identifying key price levels here.

What’s your biggest trade of all time?

Back in February 2021, I traded Riot Blockchain Inc. (NASDAQ: RIOT) puts toward the end of the month — a textbook supernova reversal play.

Ahh … remember early 2021? Momentum plays were ripping, the bull market was still going strong, and crypto stocks were absolutely firing…

It was around that time that I started feeling like the cryptocurrency market was overextended.

And I knew that crypto stocks (like RIOT) would suffer greatly from any overall crypto market weakness. (Plus, crypto stocks are optionable, unlike the coins themselves.)

I won’t bore you with the entire trade again. But at one point I was down about $40,000!

Instead of cutting my losses in frustration, I decided to stick to my convictions and let the setup play out.

WARNING: Don’t try this at home. Always cut losses quickly!

But that time … I was right. The following day, RIOT went from about $56 down to $46 in the first 20 minutes of trading.

I sold the puts near my target price and profited just shy of $128,000.

To this day, it’s still the biggest gain on a single trade in my entire career!

My all-time biggest trade is an example of a time when sticking to my conviction paid off handsomely.

But ultimately, the real key to this trade was using technical indicators to time the blow-off top move.

What’s the biggest options trade in history?

I’m not sure if anyone knows the answer to this as many options trades happen behind a cloak of secrecy.

Oftentimes, traders can see a huge block trade on an options chain, but we have no idea who it is.

That said, I’ve researched this before, and the biggest single options trade I’ve heard of is the following…

In late 2018, a mysterious trader started getting attention online because of their huge block buys of cheap VIX calls.

This trader had a habit of buying massive batches of volatility insurance contracts for 50 cents. This earned them the internet nickname ‘50 Cent.’

Want to be alerted to hot trade ideas before anywhere else?

Check out the alert for DWAC on October 21st:

This is a tool you’ll want in your trading toolbox.

In April 2020, when the stock market crashed due to the pandemic, the world found out who ‘50 Cent’ was all along…

It turns out the huge VIX buyer was London-based hedge fund Ruffer Investment Management.

Ruffer had purchased an INSANE amount of volatility insurance from 2018 to 2020.

Take a look at the profits netted from each leg of the position:

- VIX calls — +$800 million

- Corporate bond puts — +$1.3 billion

- S&P 500 and Euro Stoxx puts — +$350 million

- Gold hedges — +$145 million

When all was said and done — Ruffer bagged approximately $2.6 billion in the pandemic selloff.

Pretty crazy, right?

I know that when we’re placing our bets, most of us don’t have the kind of money this fund had.

But this impressive spread trade is a great example of the power of options in the right market environment.

Final Thoughts

If you’re struggling to find a way to trade this head-spinning market — you aren’t alone.

My advice? Be patient, study hard, and wait patiently for ideal setups.

But most importantly … rest up and have a great weekend!