It’s a new month, Evolvers!

And with a new month comes new considerations for traders…

You may have heard market pundits discussing the ‘September Effect’ — a period of historically weak stock market returns seen during the first month of fall.

There’s a lot of speculation about what causes the September Effect…

Popular theories include post-vacation indecision, stock sales to pay for back-to-school supplies, and year-end tax-loss selling as likely causes of an overall September market slump.

Regardless of the cause, the effect itself is hard to ignore…

September is the only calendar month with a negative Dow Jones return over the last 100 years.

Let that sink in…

Once again, knowing your history is vital to success in the stock market.

So, how can you trade effectively through the September Effect?

Keep reading and I’ll explain my thoughts…

Why Does the September Effect Occur?

The September Effect is a phenomenon in which stocks usually have historically negative returns throughout the month.

And the effect is especially palpable when it’s coming off a strong summer for the stock market, like this year…

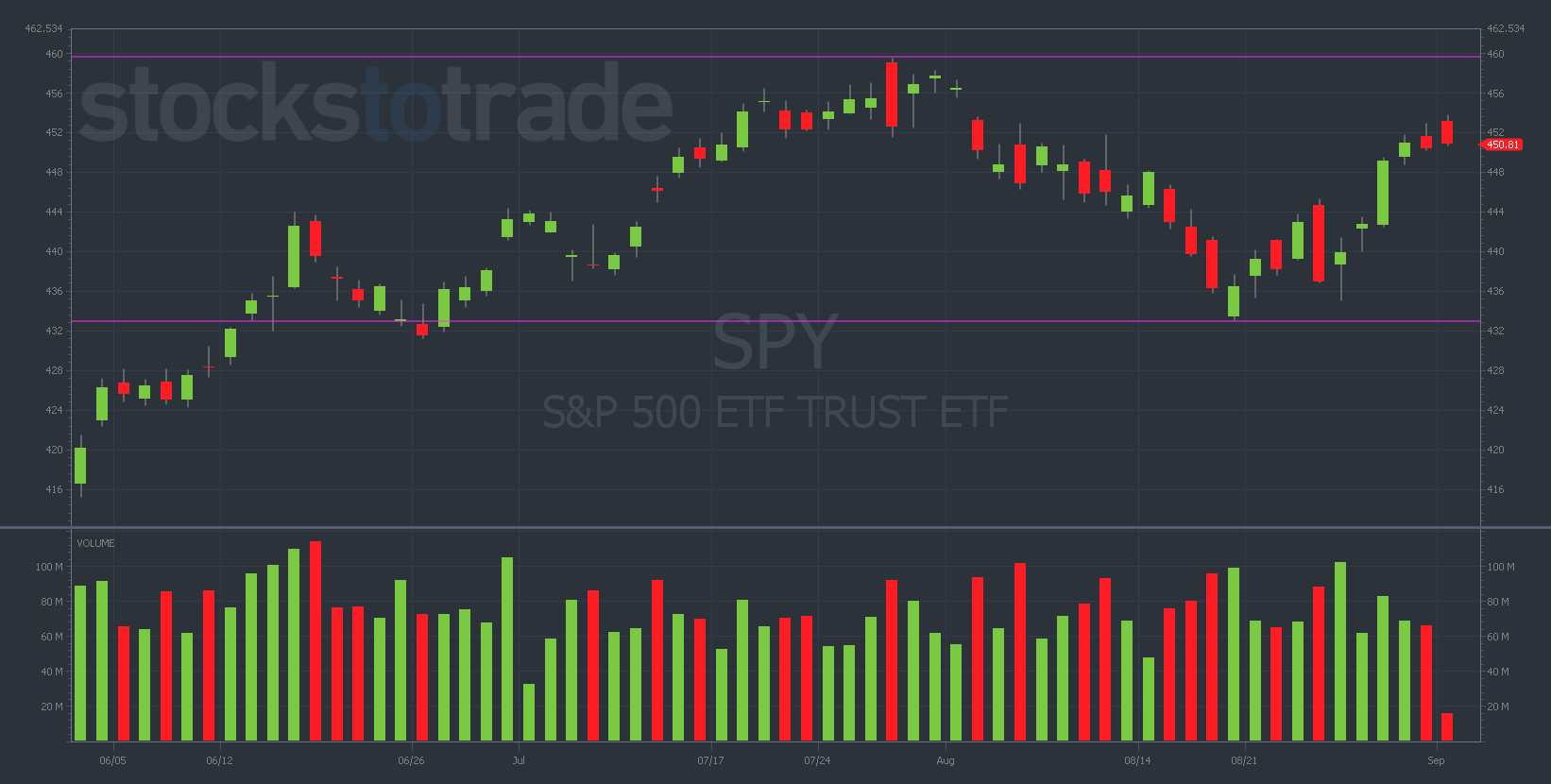

In the past three months, the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) is up nearly 8% from $416 at the beginning of June to its current share price of $450.80…

SPY 3-month daily chart — courtesy of StocksToTrade.com

This is setting up the possibility for a double-top pattern on the SPY chart…

If the SPY keeps moving upwards but can’t break its previous high from July 27 ($459.44), this will be an extremely bearish signal that could play into the September Effect.

In general, the fact that the major indexes have been strong for the past three months plays into the September Effect.

There’s plenty of downside on the charts and a lot of overextended individual names in the market.

Bottom line: September is usually a bad month for stocks, and history has a way of repeating itself in the stock market.

That said, the market is strong overall. Don’t buy a spattering of puts just because the calendar changes.

Let’s think about it…

Here are some important factors to consider about the September Effect:

Historical Evidence: The average performance of the Dow Jones Industrial Average (DJIA) and the S&P 500 during September has historically been weaker than for other months, although it’s worth noting that this isn’t true for every single year.

Psychological Factors: Some suggest that traders may be more pessimistic after the summer months, leading to more selling than buying. There might also be a self-fulfilling prophecy at play, where investors expect September to be bad, so they sell, causing it to actually be bad.

Tax Reasons: In the U.S., individuals who need to make mandatory withdrawals from tax-advantaged accounts like IRAs might choose to do so in September, thus increasing selling activity.

Fund Rebalancing: Mutual funds, whose fiscal year often ends in October, might sell underperforming assets in September to improve the appearance of their year-end reports.

Global Perspective: While the September Effect is often discussed in the context of U.S. stock markets, there have been observations of similar trends in other global markets.

So, how can you fold all of these considerations into your strategy to trade September like a pro?

Let’s get to what you’re all waiting for…

How to Trade Around the September Effect

Should Evolvers change their game plan to fit the September Effect?

How can we trade around this typically volatile month to best capitalize on its unique opportunities?

These are two questions I get annually around this time of the year. Here are my thoughts…

First, remember that we’re traders, not investors.

And as traders, we should approach each month, each week, and each day individually.

In those terms, I wouldn’t change your overall trading mindset or game plan just because the calendar flipped from August to September.

That said, you need to be aware of the unique nature of September market sentiment and trade accordingly.

How can you do this exactly?

My advice is to be greedier with your winners (booking profits quickly) and more merciless about cutting losers immediately.

If you’re up big on unrealized gains, take the money and run. (Hit the home run, don’t try for a grand slam.)

On the other hand … If your position is bleeding out and you’re holding and hoping, cut the loss immediately and move on to the next trade.

I’ve been trading for years and experienced over a dozen September trading periods.

I’ve learned it’s important to be aware of the September Effect — but don’t let it change your entire strategy.

Expect the best, prepare for the worst, and have a solid plan for anything the market throws at you.

And speaking of being prepared for anything in the market…

Are You Ready To Take The Next Step?

Here’s the truth … I wouldn’t be a multi-millionaire if I hadn’t joined Tim Sykes’ Trading Challenge so many years ago.

And I want you armed with all of the tools necessary for success in the stock market.

So, if you’re passionate and dedicated, ready to take on anything the market throws at you, then I’ve got something for you…

My mentor, Tim Sykes, has helped traders learn to succeed for years. More than 30 of them (including me) are now millionaires.

Are you ready to take your trading game to the next level? Do you have what it takes to face the Trading Challenge?

Let’s find out…

CLICK HERE TO SIGN UP TODAY FOR ONE OF OUR FREE, LIVE TRAINING CLASSES!

I’m excited to see you there!