After yesterday’s Fed decision to hike interest rates another 75 basis points, I planned to sit on the sidelines until a clear market trend emerged.

But my game plan was interrupted when a five-star setup on Tesla Inc. (NASDAQ: TSLA) appeared right before my eyes.

I simply couldn’t ignore one specific technical indicator that gave me a strong conviction in TSLA’s immediate downside (more on that later)…

Most of the time, you should stick to your trading plan. Changing up your strategy too much can lead to serious confusion for less experienced traders.

But occasionally, if an ideal pattern or setup shows up that’s too good to ignore, you’ve gotta be ready to switch your plans up.

My most impressive trading student, the incredible Jenny Smith, has excelled because she understands when to press her edge and when to sit on the sidelines.

(If you wanna learn more about Jenny’s meteoric rise as a trader, click here.)

Great traders (like Jenny) are nimble and flexible. They know when to stay out of trades and when to get into them, when to stick to their game plan and when to adjust it.

With that in mind, keep reading to see my full trade breakdown of my overnight TSLA puts play…

TSLA’s Brutally Bearish Indicator

As I mentioned in my last letter, I wasn’t planning on making any trades yesterday. (My plan remained the same until I saw this chart…)

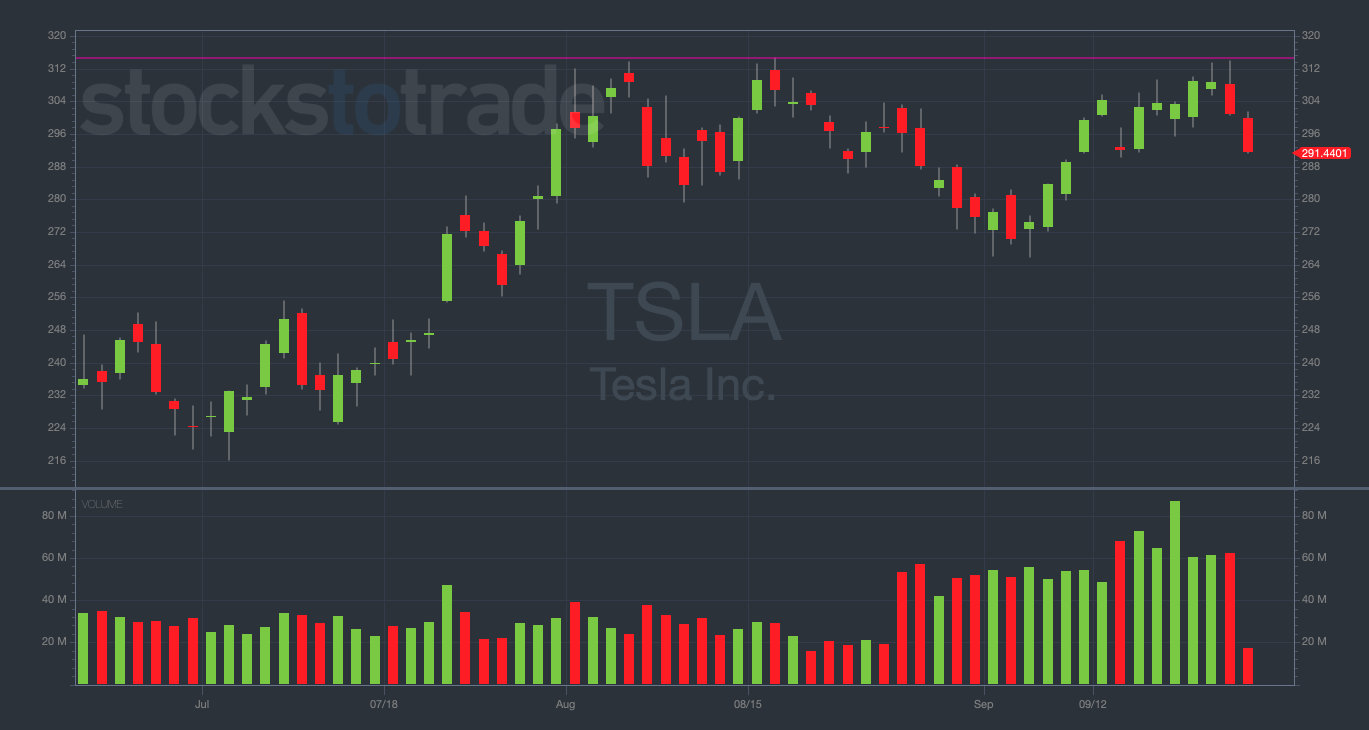

TSLA 3-month daily chart — courtesy of StocksToTrade.com

At first glance, what do you notice about this chart?

Can you see the quadruple top forming right below the $315 level? (I drew a purple line on the chart to notate this.)

If you’re not sure what I’m talking about, it’s time to pay attention…

Double, triple, and quadruple tops occur when a stock gets rejected at the same price level two, three, or four times, respectively.

These multiple tops are extremely bearish indicators that very often lead to near-term downside in the underlying stock.

This is even more notable when it happens multiple times in a short period, which is exactly what I saw in the TSLA chart yesterday.

On four separate days over the past three months, TSLA has attempted to crack the $315 level and failed miserably.

If I see a double top on a volatile momentum stock, I’m intrigued.

But if I see a quadruple top, I’m on red alert for a potential puts play.

Look at the days when TSLA struggled at $315 previously. Up to this point, the stock has tanked every single time in the days following these failed key-level cracks.

Once again, I trusted recent history and made a bet that TSLA would dump after failing at $315.

And sure enough, I was right…

How I Traded TSLA Puts

On Wednesday afternoon, near the close of the trading day, I bought TSLA 9/23/2022 $305 Puts for $3.20.

I made this trade as soon as I noticed TSLA’s huge rejection at $315, the established quadruple top level.

I was expecting a big morning dump today, so I readied myself to sell near the open.

TSLA opened lower this morning, so I stuck to my game plan and sold my contracts in the first minute of trading for $6.70, a gain of 109%.

Unfortunately, I didn’t maximize this trade. Had I held on just an hour longer, I could’ve potentially turned this into a 200%+ winner and made an extra $10,000+!

Why Elon Musk is Probably Laughing Right Now

These days it seems like everybody wants to take their shot at Elon Musk.

And yet – Tim Bohen thinks he’s gotta be laughing his ass off right now.

Why?

Because of what he’s predicting could happen on or around October 21st.

You’ll see what he means when you watch this video.

(In case you haven’t noticed, I’m a perfectionist. I wanna squeeze every possible dollar out of the trades I make…)

That said, I’m not beating myself up over a 109% win.

We’ve gotta remember that in a market as unpredictable as this one, it’s crucial to book profits quickly.

Sell your contracts before the profits evaporate and don’t be upset if the contracts gain value after you sell them.

Furthermore, remember that winning chart patterns trump everything else. Don’t be afraid to adjust your game plan if a five-star setup is too good to ignore.

Final Thoughts

My TSLA trade was another solid win based on clearly bearish technical signals.

And it felt even better considering I’ve made some mistakes trading this stock in the past. I finally redeemed myself.

The moral of the story? A win is a win. Congrats to anyone who got in quickly and banked on this play with me!