There’s one sector that’s catching my eye more than any other this week — cryptocurrency.

The two largest cryptocurrencies — Bitcoin (BTC) and Ethereum (ETH) — have rallied nearly 10% and 44% in the past month, respectively.

Unsurprisingly, crypto bulls have been attempting to push the momentum, leading to some intriguing setups and chart patterns.

That said, I’ve noticed that many traders — particularly those who focus on stocks and/or options — have no idea how to effectively play the crypto markets.

You may be wondering … how can you play the crypto surge if you aren’t already holding a goldmine of BTC or ETH?!

Keep reading and I’ll tell you why I’m watching crypto closely. Plus, I’ll show you how optionable crypto stocks can potentially lead to five-star trading setups.

My Big-Picture Thoughts on the Crypto Market

If you’ve been an Evolver for a while, you know I LOVE to trade hot sectors…

And in the past few weeks, the overall stock market has gotten bullish.

There’s been a significant shift in trading volume, volatility, and momentum. Every trader feels it.

Meme stocks that have been doing nothing for months — like Bed Bath & Beyond Inc. (NASDAQ: BBBY) and AMC Entertainment Holdings Inc. (NYSE: AMC) — are finally blasting off again.

Meanwhile, the major stock indexes have rallied off a solid base and seem to be holding strong for the time being.

But even more than meme stocks and ETFs, there’s one market that has historically taken the cake for volatility and momentum — the crypto market.

Cryptocurrencies have historically provided huge upside on bounces. Then, they occasionally offer incredible put-buying opportunities when the stocks near resistance.

Let’s look at the big picture…

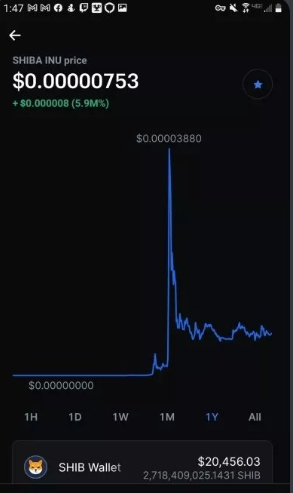

It’s no secret that cryptocurrencies have had a rough 2022 so far.

But in the past month, the tide seems to be turning to the upside. Everyone’s talking about it.

For stock and options traders, like me, the idea of trading crypto can be overwhelming.

Certain coins require traders to set up unfamiliar foreign brokerage accounts to buy them. But you don’t have to do this to trade crypto volatility.

Sometimes traders miss great crypto setups simply because they have no idea how to trade them.

There are better ways to play crypto. You just need to understand how options work.

Learn a Different Approach to Trading

Matthew Monaco — one of Tim Sykes’ millionaire students — is a trader who loves to look for anything and everything hot in the market. Crypto’s a great example.

Growing A Small Trading Account? Check this Out

When multi-millionaire trader Mark Croock first started trading, he was an overworked and underpaid accountant…

So he knows what it’s like to start small while wanting to massively grow your wealth as quickly as possible.

That’s why he just recorded a step-by-step training that reveals what he believes is the best options trading method for someone trading with a small account.

Matt catches big moves in coins and stocks. He’s made nearly $2 million … But how exactly does he do it?

Well, you have your chance to find out Tomorrow, August 9 at 1 p.m. Eastern as Matt hosts his brand-new ‘$5k Trades’ webinar!

Click here to reserve your spot before it’s too late!

Now, back to my thoughts on trading crypto…

Why I Trade Crypto Options

My favorite way to play crypto setups is by trading options on crypto-related stocks.

In fact, I can’t imagine trading a juicy crypto setup any other way…

Here are some of the benefits of trading options on crypto stocks:

- Defined risk — options allow you to bet against crypto without risking your entire account…

- Massive upside — the percent moves in crypto stocks can be parabolic (which often makes the options even juicier)…

- Easy to trade — you can trade options on many crypto-related stocks directly from your normal brokerage account, avoiding the need to set up another trading account…

My Weekly Crypto Watchlist

Now that you see why crypto options can be incredibly fun to trade, which crypto stocks should you be watching this week?

I’m following these three tickers — all names I’ve traded before — for potentially big moves this week:

- Marathon Digital Holdings Inc. (NASDAQ: MARA)

- Coinbase Global Inc. (NASDAQ: COIN)

- Riot Blockchain Inc. (NASDAQ: RIOT)

Final Thoughts

I always recommend trading hot sectors, and the cryptocurrency market checks all my boxes this week…

So if you aren’t a crypto trading expert, don’t simply ignore the entire market.

Instead, consider trading options on crypto-related stocks (like those I mentioned above).

These kinds of setups are PERFECT for my momentum trading strategy.

If we can recognize hot sectors and watch for any catalysts that cause multiple stocks to move — that’s how we can catch the truly ideal setups.