Let me paint a picture for you…

You’re in the lobby (or the top floor) of a 30-story building, with the choice of taking the stairs or the elevator all the way back up (or down)…

What do you do? I’d bet you’d choose the elevator every time.

Well, this is exactly why I prefer to buy puts over calls.

I’ve said it before and I’ll say it again … Stocks take the stairs up and the elevator down.

But I’ve noticed there’s still a stigma around put trading and that some traders have an irrational fear of buying them.

Why am I bringing this up? That’s easy…

I’ve made a huge part of my $4 million+ fortune by trading put options. I don’t want Evolvers to misunderstand the potential of using put options for shorting overextended charts.

And at the time of writing, I’m still holding 8/11/2023 $445 Puts on Nvidia Corporation (NASDAQ: NVDA)…

Keep reading and I’ll show you why going short (by buying puts) is something you should look forward to as opposed to fear.

Defined Risk

My mentor Tim Sykes has been warning traders about the risks of shorting stocks for years. And he’s right to do so.

I agree with Sykes. Shorting common shares is just too risky…

In fact, the risk is infinite, because stocks have no limit on how high they can go (theoretically).

Remember the historic GameStop Corp. (NYSE: GME) gamma squeeze of January 2021? Make no mistake … the only reason that stock ever traded to $500+ was because of this exact concept.

So, steering clear of shorting common shares is recommended…

And that’s why I love trading options, specifically put contracts — because I’m able to define my risk.

By trading puts, I’ll never lose more than my principal investment in the position. I can sleep like a baby holding puts (as long as my kids don’t wake me up in the middle of the night!)

This is so important to understand. I think some traders, especially those newer to options, are under the false impression that buying puts is inherently riskier than buying calls. But that’s not accurate…

Bottom Line: Puts are the simplest way to bet against a stock without risking a margin call or blowing up your entire account.

And I want every Evolver to get that, loud and clear!

Potentially Huge Gains

Remember how I was saying that stocks take the stairs up and the elevator down?

Just pull up the daily chart for any crazy momentum stock to see a picture-perfect illustration of this concept.

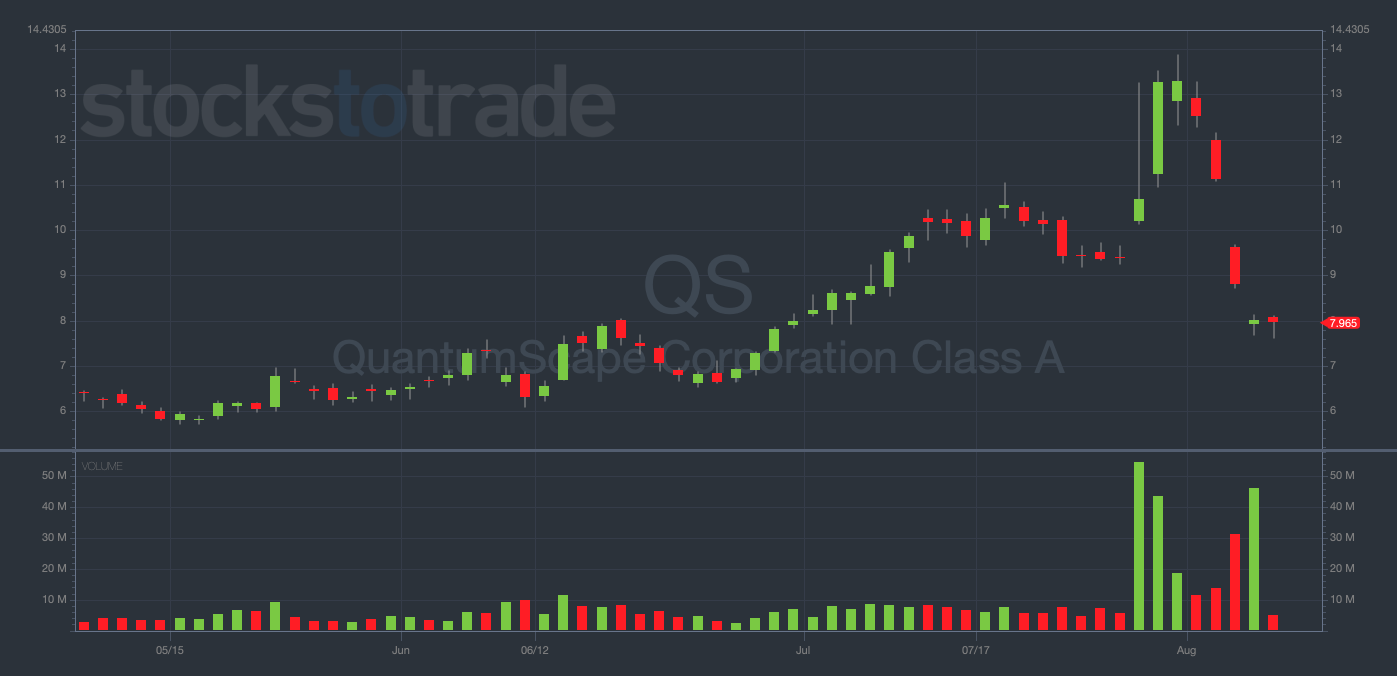

Here’s a recent example, Quantumscape Corp. (NYSE: QS)…

QS 3-month daily chart — courtesy of StocksToTrade.com

See how long it would’ve taken you to make serious gains had you attempted to catch the upside and bought calls toward the beginning of this momentum run?

You would’ve been holding those contracts for several months to reach maximum gains…

But if you had focused on your timing and bought put contracts near the top, you could’ve potentially made a small fortune in just a few days.

Nearly 50% of the value of the stock was wiped out in five trading days. These are exactly the kinds of massive breakdowns I look to take advantage of.

Think about this…

If you had shorted the shares instead of trading puts, you would’ve had a maximum gain of 43%

But with puts, the pricing relationship is completely different. The contracts can 10-20x in a huge crash while a common-share short is stuck tracking the borrowed stock to the cent.

I don’t know of many other strategies that can consistently deliver such massive returns.

That’s why I trade the way I do and why I want you to open your mind to trading puts (if you aren’t already).

Final Thoughts

Listen…

if you’re not capitalizing on the downside of charts, you’re leaving money on the table…

Much of my $4 million+ in career trading profits have come from put contracts. In my opinion, puts are superior to shorting shares in nearly every way.

So, if you’re one of these people who doesn’t like to go short by buying puts … get over it!

And realize this … having the ability to trade both sides of a chart is a superpower.